Sequans Sells 970 Bitcoins, Unsettling the Markets

In recent days, the crypto market has darkened. Bitcoin is falling slowly but surely, flirting with 100,000 dollars. Should this be seen as a temporary pullback or the onset of a prolonged collapse? In this uncertain climate, Sequans’ decision to liquidate nearly 1,000 bitcoins is causing a stir. This is not a small player: this listed company had massively invested in BTC in recent months. Today, it is selling a third of its holdings. Start of panic or simple tactical adjustment? The crypto community is holding its breath.

In brief

- Sequans sold 970 bitcoins to reduce its debt from 189 million to 94.5 million.

- The firm keeps 2,264 bitcoins in reserve, used as collateral on its current debt.

- Its ranking in Bitcoin Treasuries drops from 29th to 33rd place worldwide.

- Bitcoin’s price was around 102,000 dollars at the time of the announced transaction.

A massive bitcoin sale to ease pressing debt

The news came through a press release: Sequans sold 970 BTC, reducing its convertible debt from $189M to $94.5M. This move aims to improve its debt/net asset value (NAV) ratio, dropping from 55% to 39%. In a declining crypto market, this Sequans maneuver draws attention.

The timing is all the more striking as bitcoin was trading around $102,000 at the moment of sale, its lowest level in four months.

CEO Georges Karam seeks to reassure:

Our Bitcoin treasury strategy and our deep conviction in Bitcoin remain unchanged. This transaction was a tactical decision aimed at unlocking shareholder value given current market conditions.

Yet despite this rhetoric, the sale represents 30% of its BTC reserves. A significant reduction that lowers its position in the ranking of biggest corporate holders from 29th to 33rd place. Enough to make some crypto investors doubt the solidity of the “bitcoin-treasury” model.

The “bitcoin-treasury” model tested on an unstable crypto market

Since June 2025, Sequans embarked on a MicroStrategy-inspired strategy: financing bitcoin purchases through debt and capital raises. The plan was ambitious, targeting 100,000 BTC by 2030. In July, the company added 755 BTC through placements. But since then, the winds have shifted.

The crypto market has cooled, capital raises dried up, stock premiums are collapsing. Indebted companies like Sequans suffer acutely from this reverse leverage effect. When BTC falls, the value of their treasury plunges, as does their borrowing capacity. Difficult, in this context, to maintain the trajectory.

A simple phrase, but one that reflects a concern shared by many observers: when a pioneer of the crypto strategy liquidates its holdings, perhaps the squeeze is tightening.

Declared convictions, assumed concessions: Sequans adjusts course

Despite appearances, Sequans is not giving up on its strategy. The remaining balance of 2,264 BTC will still serve as collateral for its debt. But it must be recognized that the 100,000 BTC target now seems more distant. The sentiment remains confident, but the action is more nuanced.

The company mentions a desire to increase its flexibility, revive its share buyback program (ADS), and issue preferred shares. In short, shifting from offensive accumulation to cautious management.

On the stock market side, SQNS shares have plummeted, losing 56% of their value since summer. Crypto investors watch this with a mix of concern and pragmatism. Many wonder: is the bitcoin strategy viable if the market reverses sustainably? Or should one hold firm and strengthen positions when fear dominates?

In summary: 5 notable data points

- 970 BTC sold by Sequans in early November;

- 2,264 BTC kept, still used as collateral;

- Debt/NAV ratio dropped from 55% to 39%;

- Bitcoin Treasuries position: from rank 29 to 33;

- Bitcoin price at writing: $101,927

As for the future of bitcoin, opinions diverge. Some still see a rocket ready to take off to $150,000 by the end of 2025. Others, like CryptoQuant analysts, believe that a fall to $72,000 remains perfectly plausible. Between celestial promises and risks of collapse, the balance is thin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

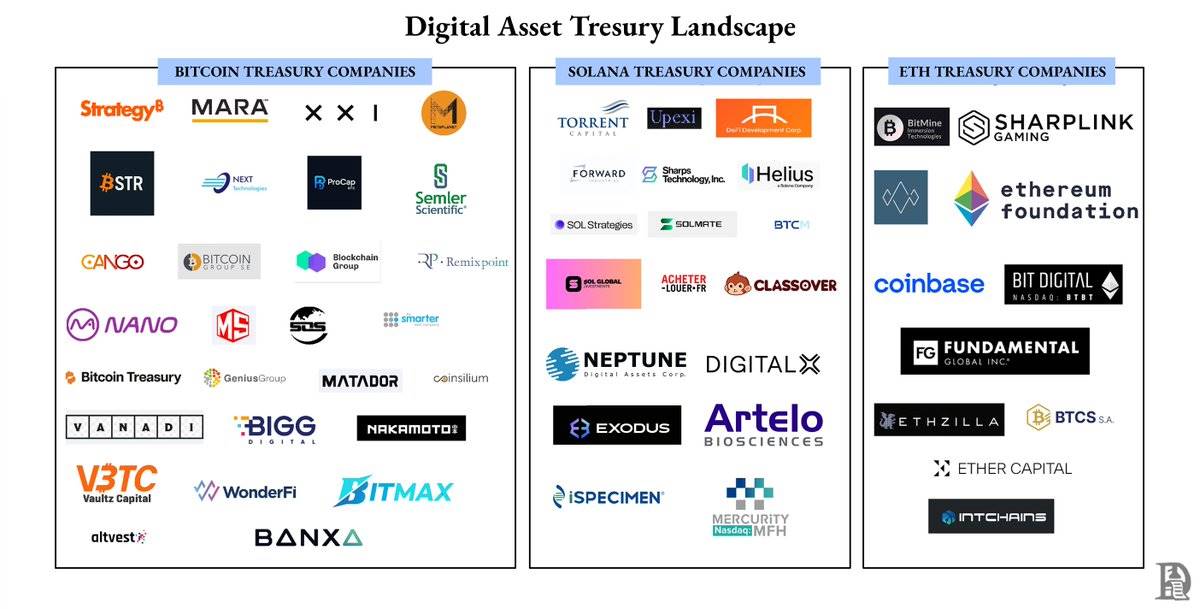

A bucket of cold water: Most Bitcoin treasury companies are facing doomsday

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

Dive into Altcoin Strategies that Shape the Market

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

Ripple and Mastercard Propel XRP to New Heights

In Brief XRP's price surged by 4.9%, reaching $2.35, driven by institutional trading. The XRP Ledger pilot by Ripple and Mastercard boosts XRP's market demand. Dogecoin maintains its trend with institutional support around $0.1620-$0.1670.

Cryptocurrency Analyst Highlights Recovery Hints in Key Altcoins

In Brief Analyst Ali Martinez identifies potential recovery signs in key altcoins. Martinez highlights critical support re-tests in SEI, PEPE, VET, ALGO, and AVAX. Technical indicators suggest possible trend shifts in these altcoins.