UK to unveil stablecoin regulation consultation on Nov. 10 to keep pace with US: report

Quick Take The Bank of England remains on track to publish a consultation on stablecoin regulation on Nov. 10, according to Bloomberg. The proposals are expected to include temporary caps on stablecoin holdings for both individuals and businesses.

The Bank of England is on track to unveil its regulatory regime for stablecoins to keep pace with the U.S., according to Bloomberg.

Bank of England Deputy Governor Sarah Breeden dismissed concerns that Britain is lagging behind the U.S. in setting up stablecoin oversight, saying that new stablecoin regulations will be operational "just as quickly as the U.S.," Bloomberg reported Wednesday.

Breeden confirmed that the central bank will release its much-anticipated consultation on stablecoin regulation on Nov. 10, according to Reuters . The proposed new rules will initially apply only to what the BOE deems "systemic" stablecoins — those likely to be widely used for payments — while other stablecoins will remain within the remit of the Financial Conduct Authority under a lighter regime, the report said.

According to Bloomberg, the forthcoming proposals will include temporary caps: up to £20,000 ($26,000) for individuals and £10 million for businesses. Breeden said the rationale for more stringent limits in the UK stems from the country's mortgage market being largely bank-based, making it more vulnerable to rapid shifts of deposits into stablecoins.

"Our aim is to make sure that our regime is up and running, just as quickly as the U.S.," Breeden said, according to Bloomberg.

The BOE's move comes as the UK faces mounting pressure to remain competitive with U.S. crypto regulations. Last month, the UK government announced plans to appoint a "digital markets champion" to lead efforts to modernize its wholesale financial markets through blockchain technology. The Financial Conduct Authority has also lifted its four-year retail ban on crypto exchange-traded notes, expanding availability beyond professional investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MegaETH announces token sale allocation strategy

Different allocation strategies for existing community members and long-term investors.

ADP employment data exceeds expectations, so why is the market falling instead of rising?

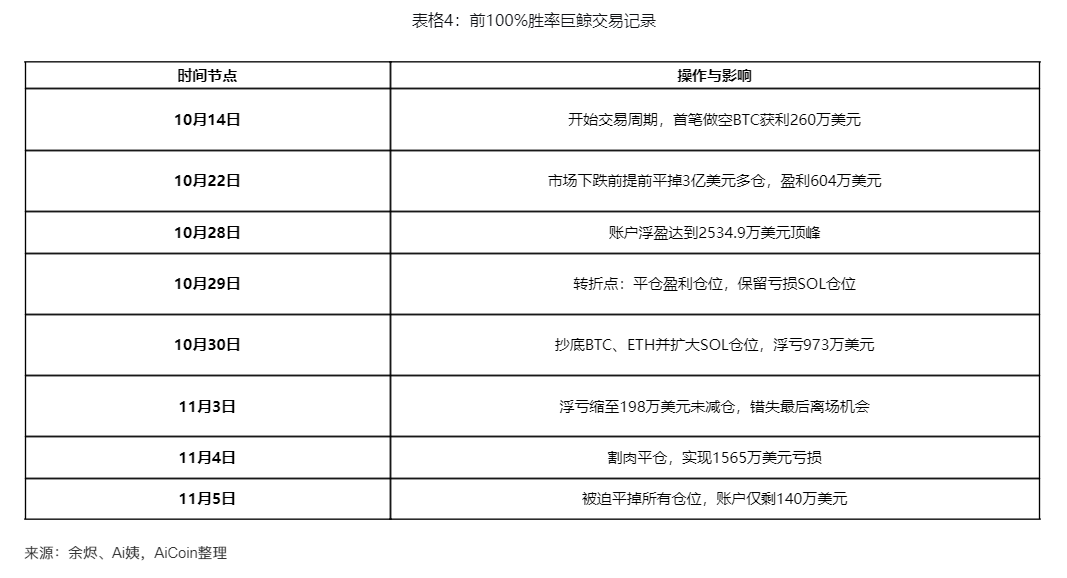

The Fall of the Hyperliquid Whale: A High-Leverage Feast Turns into a Capital Graveyard

Government Shutdown, Market Strike? The Plunge Behind Bitcoin's Crash