Not Epstein Files — Here’s Why Crypto Markets Are Flashing Green

The market’s rebound had nothing to do with Congress or the Epstein files—Saylor’s live optimism and Brunell’s long-term framing reignited crypto sentiment and sent charts back into the green.

Two totally unrelated storylines collided into one big question across Crypto Twitter: Why is the market turning green again?

Spoiler: It’s not because Congress is releasing the Epstein files — but that headline didn’t hurt the chaos.

House Votes 427–1 to Release Epstein Files: Market Reacts, but Not How You Think

In one of the most lopsided votes in modern history, the US House of Representatives voted 427–1 to force the Department of Justice to release the long-sealed Jeffrey Epstein files.

The bipartisan bill, co-sponsored by Rep. Thomas Massie and Rep. Ro Khanna, now heads to the Senate.

BREAKING: US House votes to release Epstein files

Rep. Marjorie Taylor Greene called it a “major victory for the survivors who’ve waited decades for the truth,” adding that she would personally read the names “on the House floor” if necessary.

However, despite the political shockwaves, the market wasn’t rallying due to congressional transparency.

That part of the story belongs to someone else.

Michael Saylor Declares the Dip ‘Normal,’ Says Bitcoin Will Hit New ATH Soon

While Washington was going nuclear over the Epstein files, Michael Saylor went live on Fox Business, telling the world what Bitcoin holders wanted to hear:

“This is normal… Bitcoin’s had 15 major drawdowns, and it’s always come back to a new all-time high,” he said.

And then the line everyone clipped and spread across X:

“The dip is temporary — Bitcoin will hit a new all-time high soon.”

Saylor doubled down with long-term math:

- Bitcoin has appreciated approximately 50% annually over the past five years.

- Strategy (his company) is “engineered to survive an 80–90% drawdown”

- BTC could grow 30% annually for the next 20 years

- And volatility will keep decreasing as Wall Street moves in

In classic Saylor form:

“If you want to save money forever without counterparty risk, Bitcoin is stronger than ever.”

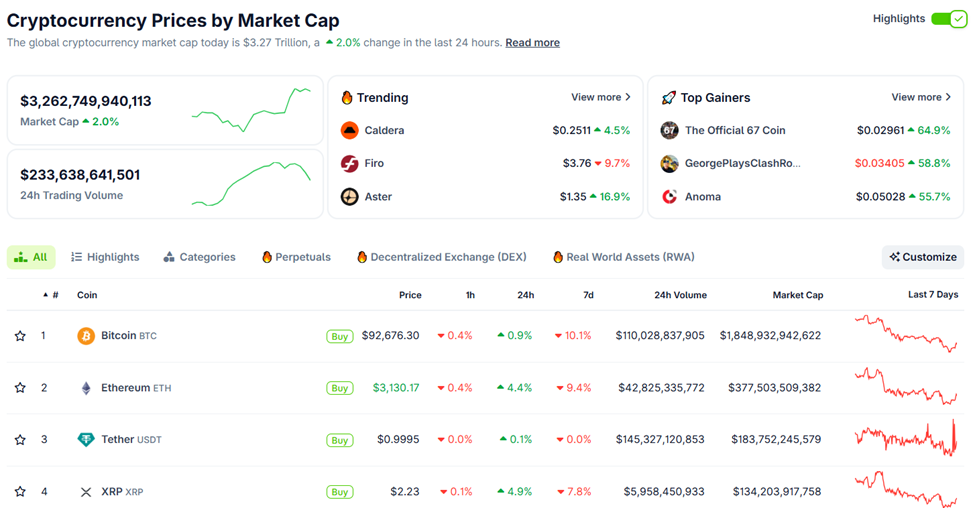

Markets seemed to agree, with charts flipping green and the total market cap rising by a modest 2%.

Crypto Market Cap Rises. Source:

Crypto Market Cap Rises. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Bet on Tariff Profits: Legal and Financial Obstacles Ahead

- Trump proposes using $3 trillion in projected tariff revenue to fund $2,000 dividends for U.S. households earning under $100,000. - Analysts question feasibility due to current $195B annual tariff collections and conflicting fiscal priorities like the One Big Beautiful Bill. - Supreme Court review of emergency tariff powers and Treasury warnings about double-counting funds add legal uncertainty to the plan. - Critics highlight inflation risks, political polarization over income thresholds, and economic f

Bitcoin Updates Today: Bitcoin Derivatives Aim for Greater Independence as Nasdaq Pursues $1 Million Growth

- Nasdaq seeks SEC approval to raise IBIT Bitcoin options limits from 250,000 to 1,000,000 contracts, aligning with major equities. - Market participants criticize current caps as restrictive, with IBIT now surpassing Deribit as the largest Bitcoin options market by open interest. - Nasdaq analysis claims 1M-contract limit poses minimal systemic risk (0.284% of total Bitcoin supply) while enabling institutional hedging strategies. - SEC's December 17 review deadline could catalyze 25-30% liquidity growth,

Cardano News Update: Worldwide ADA ETPs Experience Growth While U.S. Regulators Delay Approval

- Cardano (ADA) gains institutional traction as Europe/Asia launch ADA ETPs, while U.S. regulators delay ETF approvals amid government shutdown uncertainty. - Whale accumulation of 348M ADA tokens and $0.50 support level highlight market optimism, though technical indicators like the death cross raise bearish concerns. - Cardano's Wirex partnership introduces crypto cashback cards and DeFi/NFT growth, yet Ethereum maintains dominance in decentralized finance ecosystems. - Global regulatory divergence persi

Bitcoin Leverage Liquidation Patterns: Managing Risk Amidst Crypto Market Volatility

- 2025 crypto liquidation events exposed leverage risks, with $2B+ daily losses from Bitcoin’s volatility and thin liquidity. - Structural flaws like over-leveraged positions and inadequate buffers worsen cascading price declines during crashes. - Panic selling and herd behavior amplified losses, as seen in Ethereum and Solana’s $239M combined liquidations. - Experts urge diversified portfolios, automated tools, and liquidity-aware strategies to mitigate leverage-driven risks.