This Is How Aster Whales Can Save Price From Its First Bearish Crossover

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses. However, whale behavior suggests that a full breakdown may still be avoided if their support continues. Aster Whales Stand Firm Aster’s

Aster’s steady three-week uptrend has been abruptly interrupted as broader market conditions weakened, dragging the altcoin lower. The shift reflects rising bearish pressure across the crypto market, putting Aster at risk of deeper losses.

However, whale behavior suggests that a full breakdown may still be avoided if their support continues.

Aster Whales Stand Firm

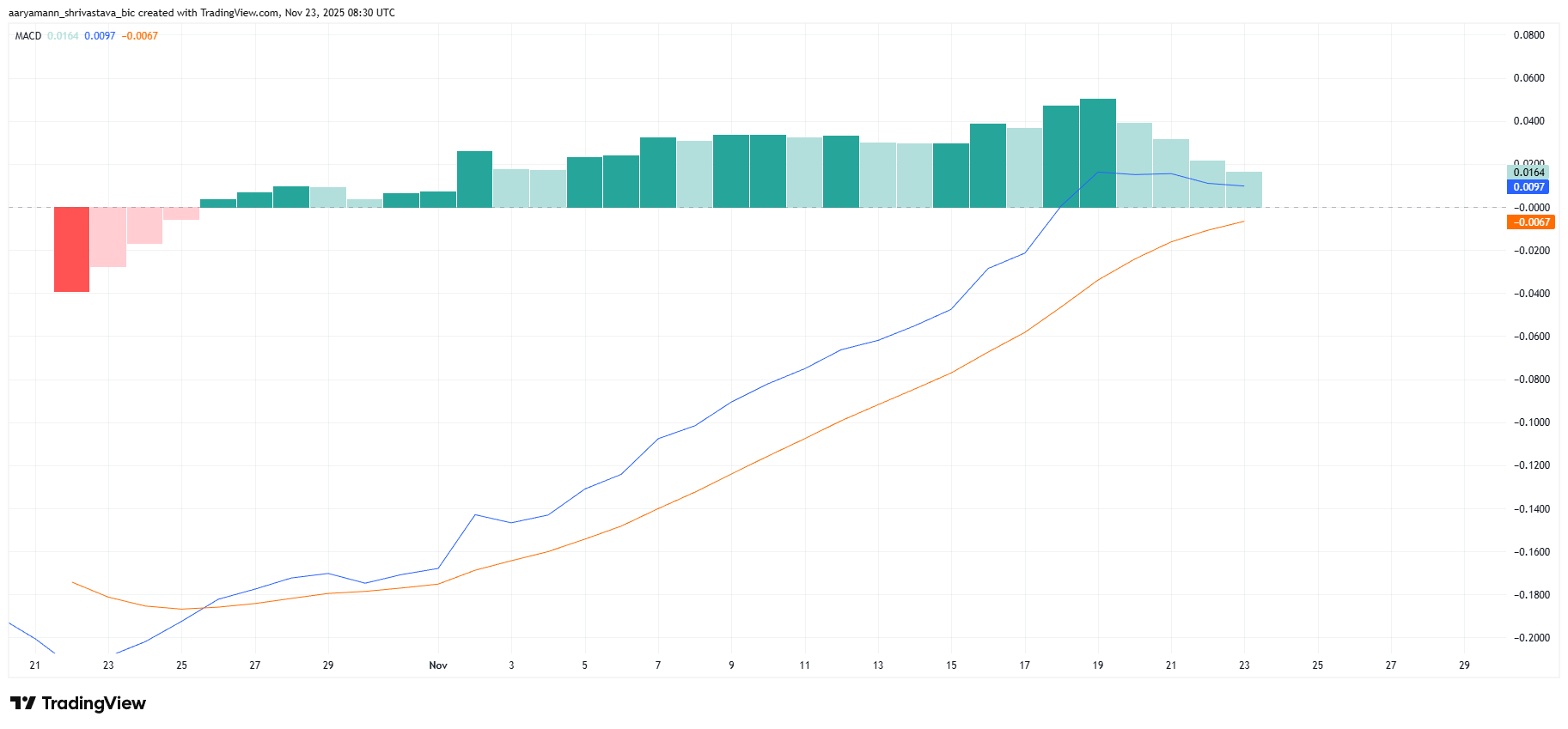

Aster’s MACD indicator is signaling a potential shift in momentum.

For the first time, the altcoin is nearing a bearish crossover as the signal line edges closer to moving above the MACD line. This alignment typically marks a transition from bullish to bearish momentum and raises caution among traders.

The histogram reinforces this warning with shrinking bars that indicate fading bullish strength.

As momentum recedes, investor sentiment may shift, making Aster more vulnerable to additional declines. The potential crossover could be Aster’s first major momentum reversal since the uptrend began.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER MACD. Source:

ASTER MACD. Source:

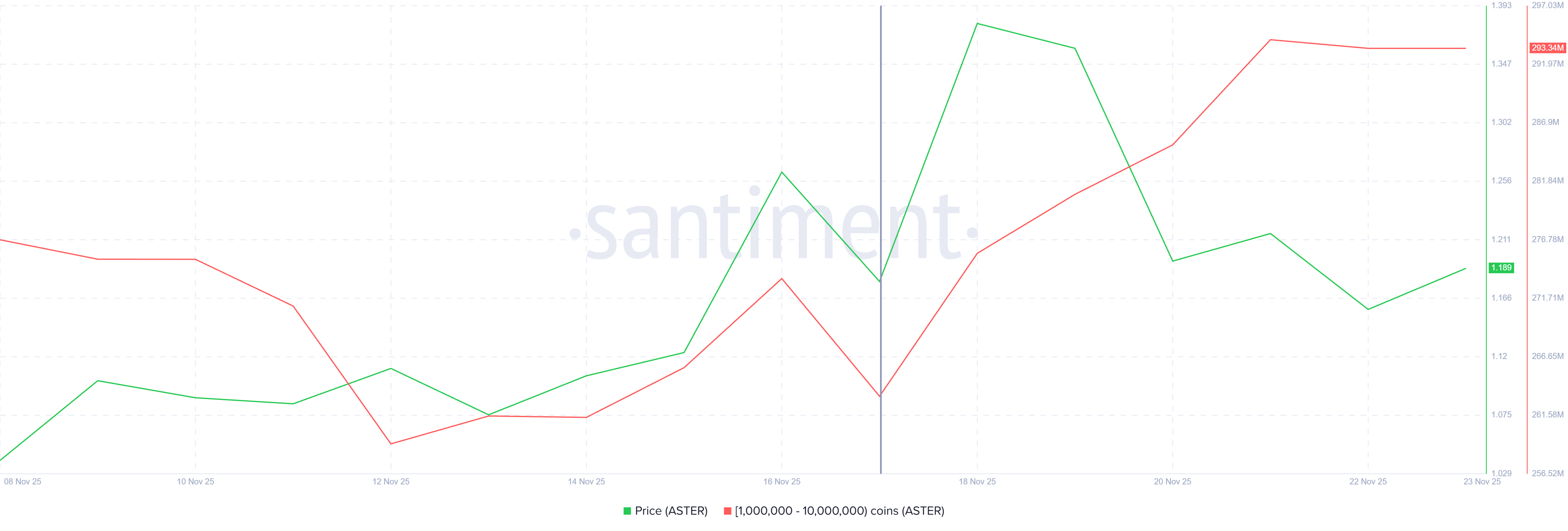

Despite weakening indicators, whale activity has remained surprisingly supportive. Over the past week, addresses holding between 1 million and 10 million ASTER accumulated 30 million tokens, worth more than $35 million. This consistent buying helped stabilize price action during earlier volatility.

Although whale accumulation has paused, these holders have not shifted to selling. Their willingness to hold despite market turbulence provides a critical cushion against sharper losses.

If whales maintain their positions, Aster may avoid a deeper decline, even if market conditions deteriorate further.

Aster Whale Holding. Source:

Aster Whale Holding. Source:

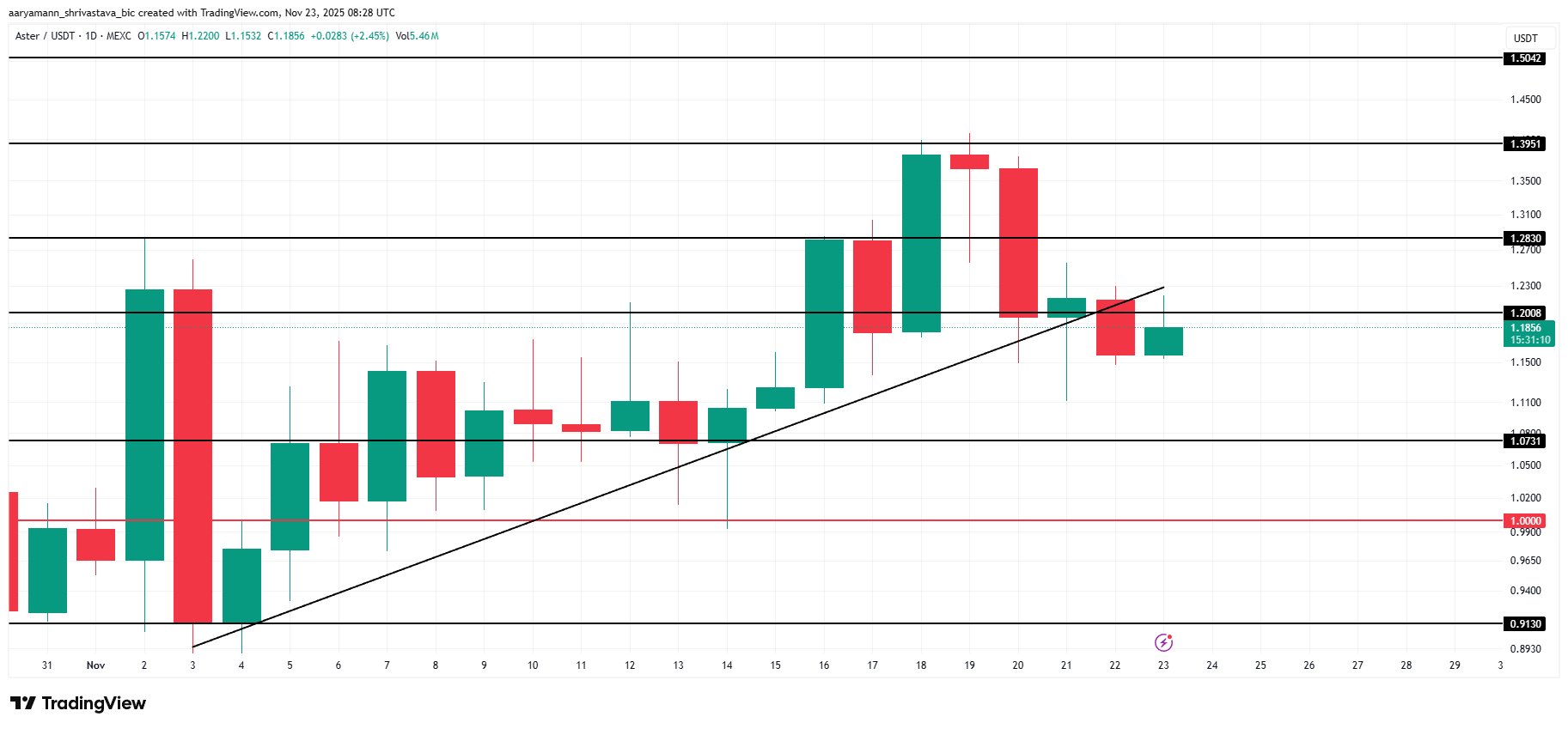

Aster trades at $1.18, sitting just below the $1.20 resistance level. The altcoin’s nearly three-week uptrend broke in the last 24 hours, creating uncertainity about the trajectory ahead.

Given the current indicators, Aster could reclaim $1.20 as support and either consolidate below $1.28 or climb toward $1.39. This outlook relies heavily on bullish stability and continued backing from accumulation-heavy investors.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if whales reverse course and begin to sell, Aster’s price could fall to $1.07. Losing that level would invalidate the bullish thesis.

This would confirm that bearish momentum has taken control, potentially leading to a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Fed Sends Conflicting Messages as Bitcoin Struggles at $85k—Is This a Bear Market or Just a Temporary Setback?

- Bitcoin fell below $85k, triggering record ETF outflows as Fed policy uncertainty fuels volatility. - Mixed Fed signals from officials like John Williams and Beth Hammack deepen market jitters. - Analysts split between bearish cycles predicting $36k by 2026 and bullish targets up to $1.2M. - Investors use tax-loss harvesting, while Cramer criticizes crypto optimism amid 2018-like patterns. - Macroeconomic clarity on Fed rates and inflation will determine Bitcoin’s path in coming months.

XRP News Today: SEC Approval Fuels Franklin's Broader Crypto ETF Growth

- Franklin Templeton expands its crypto ETF to include XRP , Solana , and Dogecoin from Dec 2025, reflecting rising demand for diversified digital assets. - The move follows Cboe BZX Exchange rules under SEC standards, enabling the fund to track a broader index with quarterly rebalancing and in-kind liquidity mechanisms. - Franklin also launched XRPZ ETF (a grantor trust) and joins Grayscale in offering spot altcoin exposure, coinciding with XRP's 2.3% price rally amid institutional interest. - Over 40 cry

South Korea’s $13.8B Fintech Consolidation Connects Conventional Finance with Crypto, Aiming for Worldwide Leadership

- South Korea's Dunamu merges with Naver to form a $13.8B fintech entity, combining blockchain and payments expertise for global crypto expansion. - The stock-swap deal reduces Naver's ownership to 17% while retaining operational control through voting rights, addressing shareholder concerns. - Regulators assess the merger's compliance with anti-money laundering rules and market competition risks amid South Korea's evolving crypto regulations. - A potential 2026 Nasdaq IPO could capitalize on strong earnin

Ethereum Updates Today: Dual Challenges: Trump’s Tariff Policies and Cryptocurrency Fluctuations Put Global Markets to the Test

- Trump exempts Brazilian coffee, beef from 40% tariffs, shielding key exports amid Lula's strategic defiance. - Lula's tariff victory boosts agricultural sector and political standing as U.S. economic concerns grow. - Bitcoin drops to $82,000 while crypto funds face $1.94B outflows amid Ethereum's deflationary challenges. - Market volatility underscores global fragility as Trump's trade policies and crypto turbulence intersect.