3 Key US Economic Reports Could Move Bitcoin Before Thanksgiving

Bitcoin faces a pivotal week as three delayed US economic reports are set for release before Thanksgiving, potentially reshaping expectations for Federal Reserve policy and influencing crypto markets. These economic indicators arrive at a crucial time for risk assets, with December rate cut probabilities near 70%. Bitcoin continues to show heightened sensitivity to macroeconomic shifts,

Bitcoin faces a pivotal week as three delayed US economic reports are set for release before Thanksgiving, potentially reshaping expectations for Federal Reserve policy and influencing crypto markets.

These economic indicators arrive at a crucial time for risk assets, with December rate cut probabilities near 70%. Bitcoin continues to show heightened sensitivity to macroeconomic shifts, making this week especially important for investors.

Delayed US Economic Data Intensifies Market Focus

The 43-day US government shutdown created a backlog of economic indicators, compressing multiple high-impact releases.

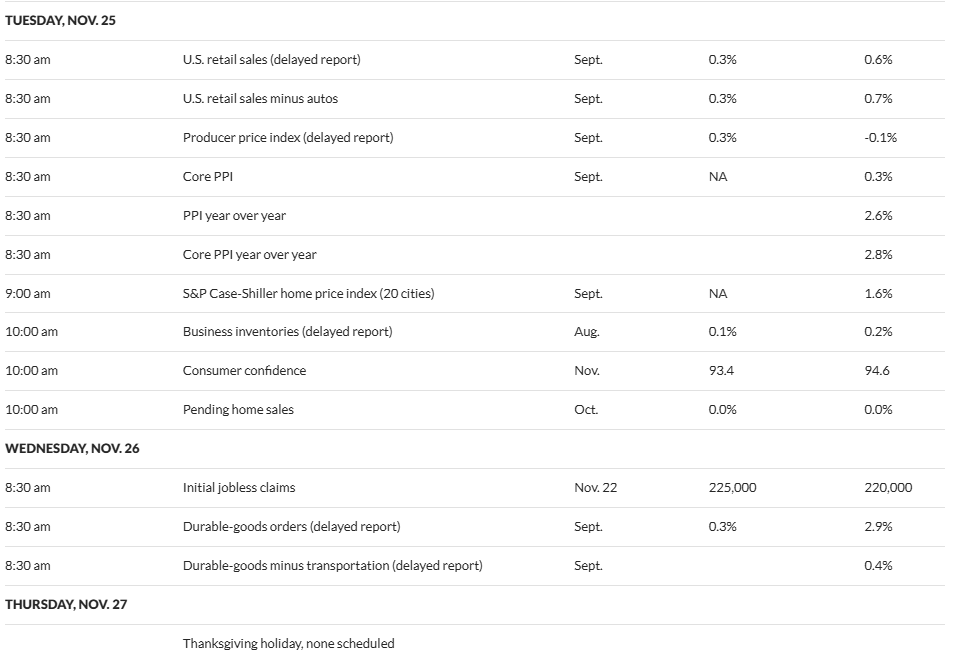

US Economic Reports Before Thanksgiving. source:

MarketWatch

US Economic Reports Before Thanksgiving. source:

MarketWatch

According to MarketWatch’s economic calendar, Tuesday, November 25 at 8:30 a.m. ET brings both September retail sales and the Producer Price Index (PPI), while Wednesday delivers initial jobless claims data.

This convergence matters because markets currently lack up-to-date consumer spending and inflation metrics. The prior retail sales report revealed a strong 0.6% monthly gain, while the Producer Price Index (PPI) fell 0.1% in August. Year over year, core PPI stood at 2.8%, offering a baseline for wholesale inflation trends.

Retail Sales

For September, retail sales consensus predicts a 0.3% month-over-month increase. Any miss below that mark could signal economic cooling, potentially spurring a dovish sentiment among the Federal Reserve policymakers.

For Bitcoin, weaker spending often aligns with rising speculation about rate cuts, which typically weakens the dollar and may support crypto prices.

Recent action highlights this pattern. Bitcoin hit seven-month lows after strong US jobs data reduced rate cut optimism, causing spot Bitcoin ETFs to see nearly $1 billion in outflows, the second largest on record. This episode shows how labor market strength can shape crypto positioning.

Bitcoin hit 7-month lows after strong U.S. jobs data cut rate-cut hopes.Spot BTC ETFs saw nearly $1B outflows, the second-largest on record.Bitwise also launched its spot XRP ETF, adding fuel to the altcoin ETF wave.Full recap: https://t.co/AXFUhMNrBp pic.twitter.com/EhuXDaDHvO

— GSG (@gsg_digital) November 24, 2025

PPI Data Sets the Stage for December

The Producer Price Index release is crucial as it serves as the last significant inflation data before October’s Personal Consumption Expenditures report.

Markets have priced in about a 67.3% chance of a December Federal Reserve rate cut, but that outlook will shift with new data.

December Rate Cut Probabilities. SOurce: CME

FedWatch SourceTool

December Rate Cut Probabilities. SOurce: CME

FedWatch SourceTool

A higher-than-expected PPI, particularly in core measures excluding food and energy, could quickly shift expectations.

If core wholesale inflation accelerates, traders may reduce December cut odds below 60%, strengthening the dollar and putting pressure on crypto.

September’s consensus calls for a 0.3% monthly PPI increase. Any number notably above that would challenge the view of moderating price pressures. On the other hand, a softer print would support expectations for continued monetary easing.

Initial Jobless Claims to Bring Holiday Volatility

Wednesday’s initial jobless claims will give the latest labor market update before the Thanksgiving holiday. Analysts expect 225,000 new claims for the week ending November 22, a slight rise from 220,000 previously.

The latest jobless claims report shows a labor market that is still stable but gradually cooling. Seasonally adjusted initial claims fell by 8k to 220k (consensus was probably aorund 50k higher), and the 4 week average edged down to 224.25k. Layoffs remain low by historical… pic.twitter.com/SQu7KhtMGm

— Macro84 (@macro84) November 21, 2025

Any figure above 225,000 may suggest labor market weakness, one of the fastest triggers for Bitcoin rebounds as hopes for easing rise.

Employment statistics remain a focus for the Federal Reserve, with Chair Jerome Powell emphasizing the need to maintain labor market health as the Fed controls inflation.

The reporting schedule also matters. Markets close Thursday for Thanksgiving and operate shortened hours Friday, which could amplify volatility if Wednesday’s data surprises.

Since Bitcoin trades around the clock, crypto markets could move strongly even as traditional markets close.

Other indicators add to the outlook. The US Empire State Manufacturing Survey surged to 18.7 this month, the highest in a year and well above the 6.0 forecast. This could hint at economic resilience, potentially complicating the narrative surrounding the rate cut.

[1/6] All eyes on Dec 1st. 👀 $BTC $ALCPB➡️ release date of ISM dataThe "US Empire State Manufacturing Survey" is a precursor to the ISM (the business cycle) and jumped to 18.7 this month; the highest in a year and much better than forcasts of 6.🧵⬇️Source: @RealVision pic.twitter.com/it2Ltxzbx4

— ℏ &⚡️4freedom (@sound0ffreed0m) November 24, 2025

The collision of these data points makes this period crucial for crypto markets. Bitcoin’s correlation with Federal Reserve policy expectations has tightened in 2025, turning every major economic release into a potential trigger for price swings.

As markets absorb postponed September data and new November labor figures, the changing outlook is likely to drive crypto price action through the end of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Security Concerns Hinder Nigeria's 5G Aspirations

- Nigeria's 5G coverage remains at 3% three years post-launch, lagging behind regional peers and global trends like MENA's projected 48% adoption by 2030. - Security crises, including 300+ schoolkid kidnappings, have diverted government resources from infrastructure, delaying 5G rollout amid economic instability. - Despite 15.7% annual fintech growth, Nigeria's embedded finance sector faces innovation limits without widespread 5G to enable real-time data processing. - Contrasting South Africa's 20% online

TWT's Updated Tokenomics Framework: Key Changes and Market Impact for 2025

- TWT faces potential tokenomics shifts in 2025, inferred from industry trends toward buybacks and utility diversification. - Projects like Treehouse DAO and XRP Tundra highlight growing emphasis on deflationary mechanics and transactional utility. - TWT's long-term success depends on aligning with these trends through governance upgrades or cross-chain integration. - Investor sentiment remains cautious due to lack of official TWT announcements, despite broader market demand for sustainable token models.

Bitcoin Updates: Bitcoin ETF Withdrawals Underscore Rising Altcoin Momentum Amid Changing Crypto Focus

- BlackRock's IBIT Bitcoin ETF saw $3.79B in November outflows, marking its worst month since launch amid Bitcoin's 13% weekly price drop below $80,000. - Analysts link redemptions to profit-taking after October's $126,000 peak and macro concerns like delayed Fed rate cuts, creating a self-reinforcing price decline cycle. - Institutional buyers see Bitcoin's $90,000 level as a buying opportunity, while altcoin ETFs like Solana's BSOL attract $660M inflows with competitive staking yields. - Citigroup warns

Bitcoin News Today: Bitcoin Faces $80K Turning Point: Will a Short Squeeze Ignite or Is a Further Decline Ahead?

- Bitcoin fell below $80,000 in November 2025, triggering debates over short-squeeze rebounds vs. deeper bear markets amid macroeconomic fears and ETF outflows. - A "death cross" technical signal and $800M in on-chain losses highlight market fragility, with $1T wiped from crypto since October. - Analysts remain divided: bullish targets ($200K) clash with bearish warnings of $74,500 retests, while institutions like Harvard buy dips. - Negative funding rates suggest short-covering potential, but $20B in liqu