Monad Token Defies Market Rout With Sharp Post-Launch Rally

Monad’s MON token surged more than 35% on launch day, breaking the industry’s usual post-airdrop decline. The move stands out in a harsh November downturn, with MON outperforming even as broader crypto sentiment hits extreme fear.

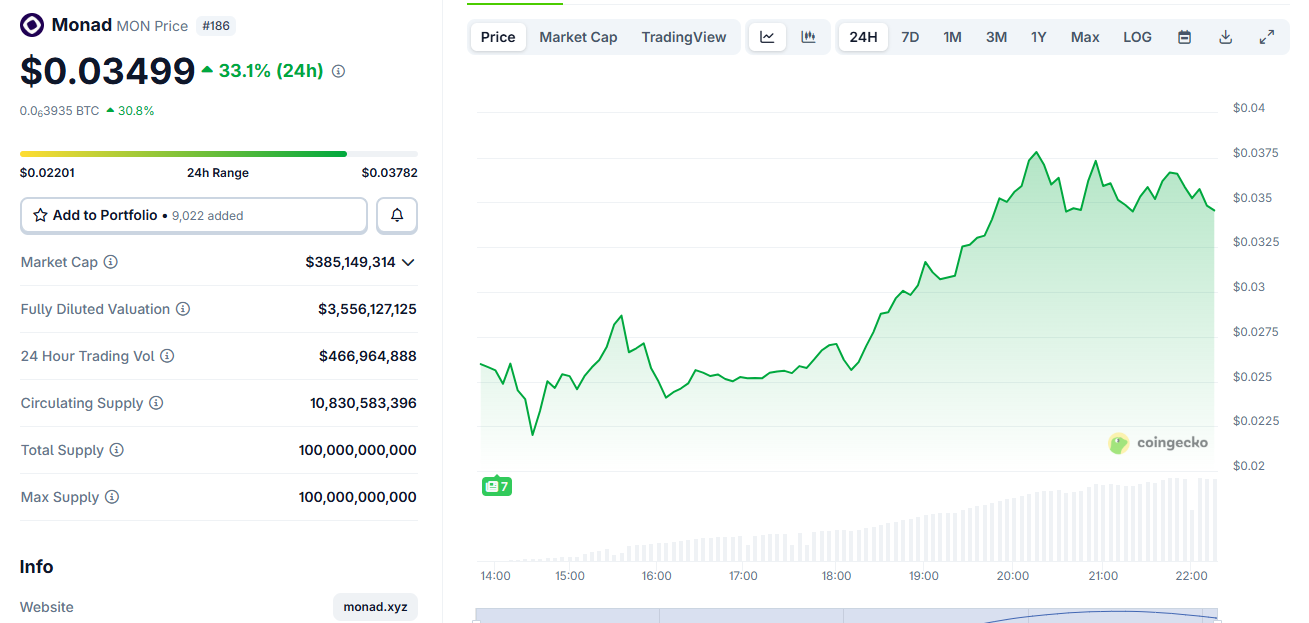

Monad’s MON token surged more than 35% within 24 hours of launch, defying both a cold airdrop market and a deep November sell-off across digital assets.

MON traded around $0.035 on Monday, rising from an early range near $0.025 as liquidity spread across major exchanges.

Monad Shines Bright Amid the Bear Market

The move stands out against a market where most airdrops have struggled. Recent industry research shows nearly 90% of airdropped tokens decline within days, driven by thin liquidity, high FDVs, and aggressive selling from recipients.

MON instead climbed strongly despite more than 10.8 billion tokens entering circulation from airdrop claims and a public token sale.

$MON TGE today.Simplest Monad airdrop play is still liquid staking. Stake and forget while farming points.If Monad does well, one of the $MON LSTs will be Lido of ETH and Jupiter for Solana.Question is which.I look for:– Exclusive to Monad– No TGEd yet– Already…

— Ignas | DeFi November 24, 2025

The token launched on November 24 alongside Monad’s mainnet. Around 76,000 wallets claimed 3.33 billion MON from a 4.73 billion-token airdrop, while 7.5 billion more unlocked from Coinbase’s token sale.

Monad Price Chart. Source:

CoinGecko

Monad Price Chart. Source:

CoinGecko

The airdrop alone was valued near $105 million at early trading prices.

MON’s performance also contrasts with the broader market downturn. Bitcoin fell below $90,000 last week after long-term holders sold more than 815,000 BTC over 30 days.

Total crypto market value has dropped by over $1 trillion since October, and sentiment sits in extreme fear territory.

However, MON’s trading demand remained resilient. Its price recovered from initial selling pressure and climbed steadily through the afternoon session.

Most large exchanges listed the token at launch, including Coinbase, Kraken, Bybit, KuCoin, Bitget, Gate.io, and Upbit, supporting deeper liquidity.

Analysts attribute the move to pent-up interest in Monad’s high-performance L1 design and a launch structure that avoided the steep inflation seen in other airdrops this year.

People really gravedancing on Monad right before a 4 hour 50% up candle at the most obvious support on planet earthMan I love this game

— DonAlt November 24, 2025

The project delivered one of 2025’s largest distributions but kept real circulating supply focused on early users and public sale participants rather than speculative farmers.

MON’s rally comes as a rare outlier in November’s bear cycle. Its early strength now positions the token as one of the few airdrops this year to post immediate gains instead of sharp declines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOJ Restricts AI Access to Live Data to Prevent Algorithm-Driven Rent Increases

- DOJ settled with RealPage to block real-time data use in rent algorithms, ending claims of algorithmic collusion enabling price hikes. - The agreement prohibits using current lease data for pricing models and restricts access to competitors' nonpublic data. - Over 20 property firms, including Greystar, reached settlements, while states and cities enacted laws to curb algorithmic rent-setting. - Critics argue historical data limits may reduce pricing accuracy, but regulators aim to prevent AI-driven marke

Rise in 'Wrench Attacks' as Cryptocurrency Holders Encounter Increasing Levels of Violence

- A San Francisco resident was robbed of $11M in crypto by an armed impostor posing as a delivery driver, highlighting escalating "wrench attacks" targeting digital wealth holders. - Such physical assaults on crypto investors surged 169% in 2025, with 48 cases reported globally, including kidnappings in NYC and LA involving torture for wallet access. - Experts warn self-custody storage vulnerabilities, urging investors to blend institutional services with operational secrecy to mitigate risks from coercive

XRP News Today: XRP ETFs Offer Long-Term Optimism Amid Intensifying Short-Term Downtrend

- XRP price fell below $2 despite new spot ETFs, with open interest hitting November 2024 lows amid crypto outflows and bearish sentiment. - Bitwise and 21Shares launched XRP ETFs, but $22M first-day volume failed to offset 7% price drop and whale-driven selling of 200M tokens. - SEC approvals enabled ETFs from Franklin Templeton/Grayscale, yet derivatives data shows $473M Binance open interest decline and negative funding rates. - Analysts note ETFs could attract institutional capital long-term, but short

PENGU USDT Sell Alert and Changes in Market Sentiment: Initial Indicators in Stablecoin Activity and What They Mean for Cryptocurrency Price Fluctuations

- Pudgy Penguins (PENGU) faces mixed signals in late 2025, with bullish on-chain metrics contrasting its 28.5% drop post-Pudgy Party launch and USDT-linked volatility risks. - USDT dominates 82.5% of centralized exchange volume but faces declining DEX share and regulatory scrutiny, shifting investor preference toward compliant stablecoins like USDC . - PENGU’s reliance on USDT amplifies systemic risks, as liquidity shocks and redemption trends highlight vulnerabilities in stablecoin transparency and govern