I. From "Benchmark of Dollar-Cost Averaging" to Strategic Silence

As the largest bitcoin holder among Nasdaq-listed companies, MicroStrategy's "debt financing-buy and hold" model has always been its most distinctive label. The company's Executive Chairman, Michael Saylor, has even bluntly stated: "The most important product of our company is bitcoin." However, this benchmark enterprise, regarded as the "anchor" of the cryptocurrency market, chose to remain silent at a critical moment.

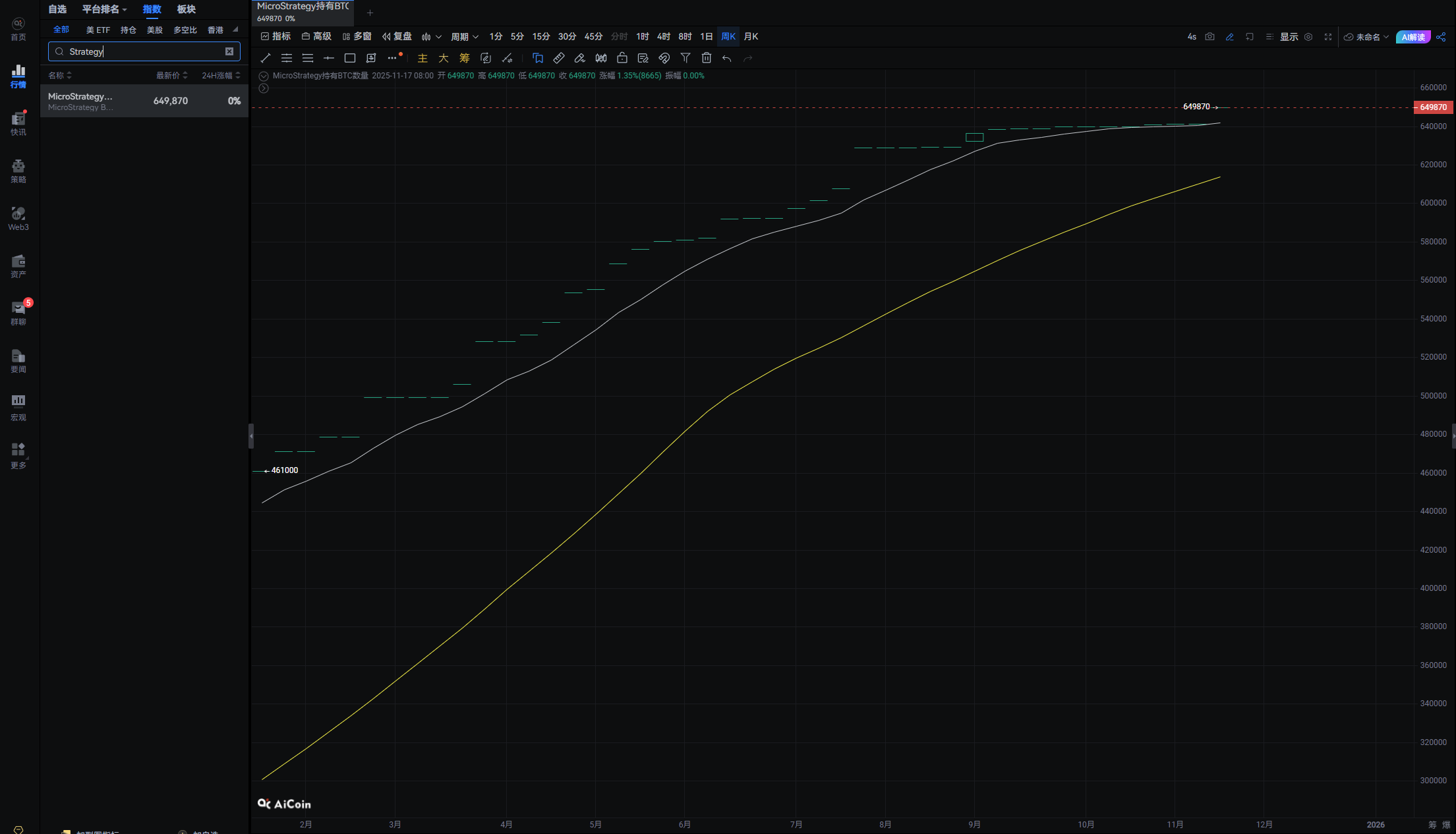

In the past 24 hours, MicroStrategy has not disclosed any new purchase records. On November 17, MicroStrategy announced that it had spent $835.6 million to purchase 8,178 bitcoins. This acquisition far exceeded its previous weekly investment of 400 to 500 bitcoins. This purchase increased its total bitcoin holdings to 649,870 coins, worth nearly $56 billion. It is reported that MicroStrategy acquired its bitcoins at an average price of $74,430. Currently, bitcoin is trading at about $86,000, meaning MicroStrategy's bitcoin investment is still up nearly 16%.

Data shows that MicroStrategy only increased its bitcoin holdings by 9,062 coins throughout November, a sharp drop of 93.26% compared to the 134,480 coins purchased during the same period last year. Although Saylor himself quoted the lyrics "I Won't ₿ack Down" on social media to show his determination, this silence has still sparked much speculation in the market. A cryptocurrency analyst commented: "The market has become accustomed to MicroStrategy's weekly 'check-ins.' When this predictability suddenly disappears, especially during a market downturn, investor anxiety is immediately amplified." As of press time, the company's stock price has pulled back about 70% from its high, but it remains the world's largest publicly traded bitcoin holder, with a total of 649,870 BTC, and its market price is still about 1.2 times its net asset value.

II. A Comprehensive Test of Market Confidence

Although the direct capital impact of this purchase pause is limited, it has served as a comprehensive stress test for market confidence.

On the price front, bitcoin's volatility near the key support level of $82,000 has significantly intensified. According to data, in the past 24 hours, the open interest in the bitcoin derivatives market increased by 5%, but the funding rate turned slightly negative, indicating that bearish forces are strengthening.

In terms of related assets, MicroStrategy's stock fell more than 3% in pre-market trading. Notably, the stock's decline this year has far exceeded that of bitcoin itself, posing a severe challenge to its narrative as a "bitcoin proxy." Meanwhile, the share prices of several bitcoin mining companies also fell by about 4%, showing the transmission effect of market sentiment.

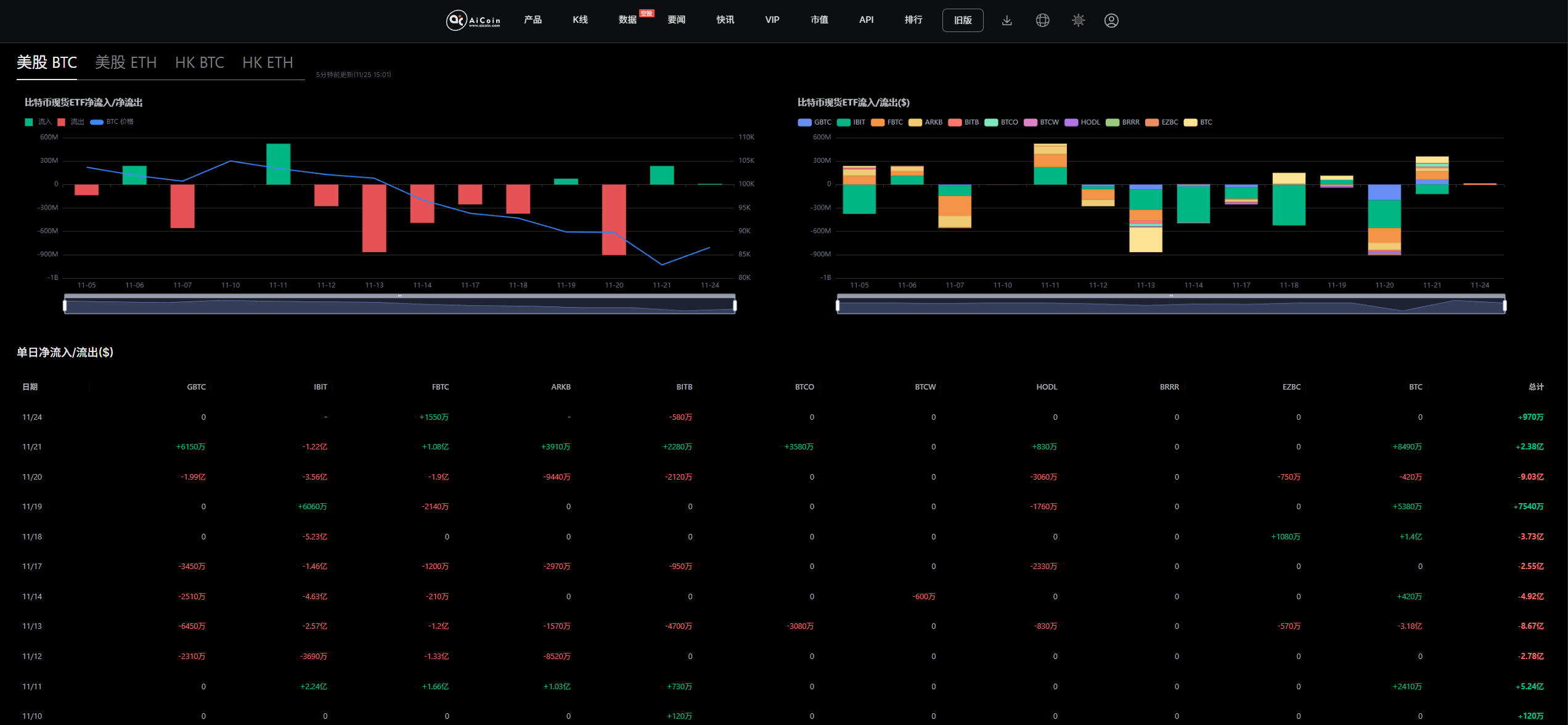

Capital flows are undergoing noteworthy changes. Market analysis shows that institutional funds may be shifting from high-risk "proxy plays" to more direct bitcoin exposure. Spot bitcoin ETFs are gradually replacing MicroStrategy's traditional role and becoming a new choice for institutional allocation.

However, on-chain data also reveals positive signals. The issuance volume of bitcoin-backed credit instruments has recently seen significant growth, soaring from $3-4 million in mid-September to nearly $20 million by the end of November. This change indicates that the market's recognition of bitcoin as high-quality collateral is increasing, which may provide new financing channels for future purchases.

III. The Sword of Damocles Hanging Over the Market

The primary risk comes from the potential large-scale withdrawal of passive funds. There are reports that index provider MSCI is considering formulating a new rule that could exclude companies with more than 50% of their balance sheet in digital assets from its main indices. Bitcoin treasury company MicroStrategy has underperformed the market recently, and with the recent market downturn, MSCI may remove the company from key stock indices on January 15, 2026. Analytical institutions estimate that if MicroStrategy is excluded from major indices, it could trigger stock sell-offs worth between $28 billion and $110 billion in market value. Such a concentrated sell-off would not only severely depress the company's stock price, but could also further restrict its ability to purchase bitcoin through a negative feedback loop of "declining collateral value - weakened financing capacity."

Secondly, the "financing-accumulation" business model itself is facing questions about its sustainability. JPMorgan has warned that if bitcoin prices fall another 15%, MicroStrategy's bitcoin holdings will face a book loss. Meanwhile, the company's stock price has fallen about 70% from its peak, making its favored "stock issuance financing" method much more costly. The cliff-like drop in November's purchase volume has forced investors to question whether this once-revered business model has hit its ceiling.

IV. Key Signals and Observation Points

The next one to two weeks will be a critical period for judging the market's direction, and investors need to focus on two core signals:

1) MicroStrategy's subsequent moves. The market is closely watching whether Saylor will break his silence and when and how he will explain this purchase pause. If he resumes purchases within the next week and can provide a convincing reason, market sentiment may quickly recover. On the contrary, if this silence continues, it may reinforce expectations that the company's business model is facing obstacles.

2) Capital flows into spot bitcoin ETFs. As MicroStrategy's "buying machine" may stall, whether spot bitcoin ETFs can continue to attract net capital inflows will be an important touchstone for measuring whether institutional demand remains resilient. If ETFs can effectively fill or even surpass the demand gap left by MicroStrategy, market concerns will be greatly alleviated.