Is MicroStrategy’s mNAV Premium Gone for Good?

Strategy’s mNAV premium has fallen to near 1x, signaling fading investor appetite for its leveraged Bitcoin model and increasing pressure on its capital structure.

MicroStrategy’s market premium over its Bitcoin holdings has narrowed to near parity, raising questions about the future of Michael Saylor’s levered Bitcoin model.

The latest disclosures show the company holding 649,870 BTC at a cost of roughly $48.4 billion, yet its equity no longer trades at the high multiples that powered earlier expansion.

A Collapsing Premium and Rising Capital Pressures

The company’s mNAV fell below 1x in November. mNAV, or market-to-net-asset value, measures how much investors are willing to pay above (or below) the value of Strategy’s underlying Bitcoin.

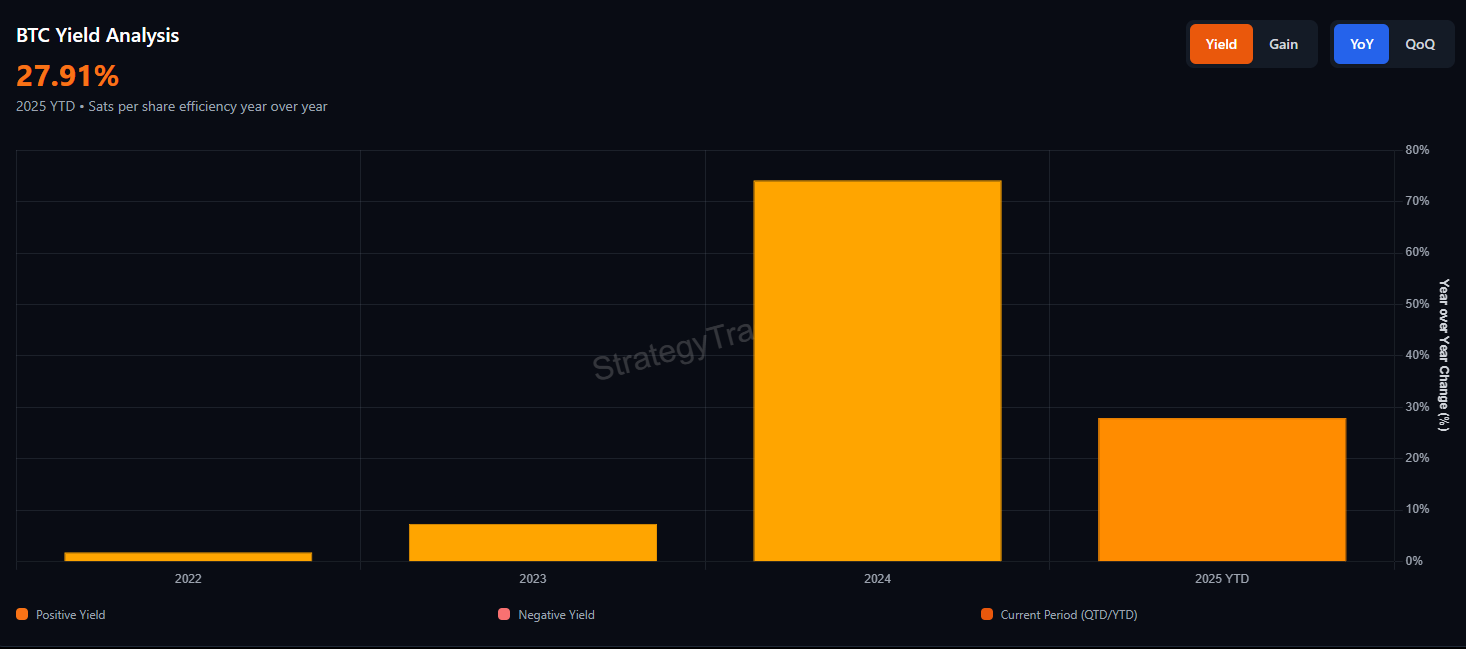

It matters because Strategy’s entire accumulation strategy depends on issuing equity at a premium—allowing each new share sold to increase Bitcoin per share for existing holders.

MicroStrategy mNav As of November 25, 2025. Source:

MicroStrategy mNav As of November 25, 2025. Source:

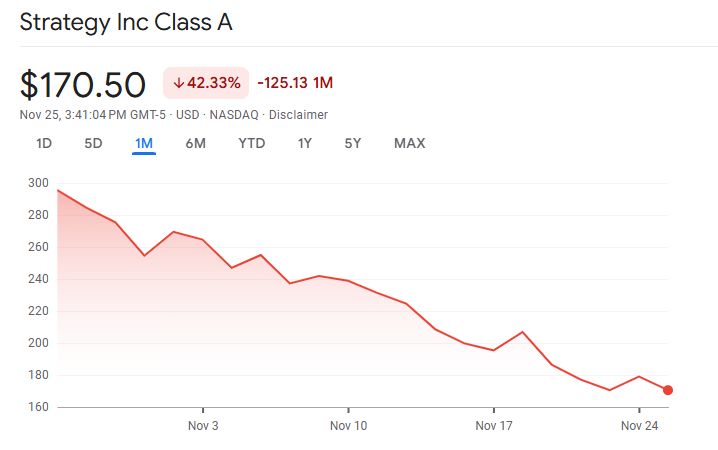

This sharp mNAV reversal follows a broader market downturn. Bitcoin fell more than 30% from its October peak, dropping below $90,000.

Meanwhile, Strategy shares fell faster, reflecting concerns about the company’s reliance on capital markets and rising preferred stock costs.

Strategy’s capital structure has become a central issue. The firm holds only $54 million in cash and owes more than $640 million in annual preferred dividends.

MicroStrategy Stock Price. Source:

MicroStrategy Stock Price. Source:

The company’s software business remains cash-flow negative for 2025, widening the gap between obligations and internal liquidity.

As a result, Strategy has leaned on capital markets. It raised about $20 billion in the first nine months of 2025 across convertibles, preferred stock, and at-the-market equity.

That funding kept its Bitcoin accumulation going while servicing older instruments with high and rising coupons.

However, the mechanics that once made this model accretive have weakened. When Strategy traded at large premiums to net asset value, issuing shares increased Bitcoin per share for holders.

That effect disappears when the premium collapses. Issuing stock near NAV risks dilution rather than accretion.

Pressure increased as the cost of capital climbed. The company’s STRC preferred shares raised their dividend from 9% in July to 10.5% in November to maintain par value.

New preferred offerings carry coupons above 10%, with penalty rates up to 18% if unpaid. These terms increase the annual burden and reinforce investor concerns about sustainability.

MicroStrategy Bitcoin Yield. Source: Saylor Tracker

MicroStrategy Bitcoin Yield. Source: Saylor Tracker

Market Liquidity, MSCI Risks, and the Future of the Premium

Market confidence further deteriorated after the October 10 crash. Bitcoin dropped about 17% as leveraged liquidations exceeded $19 billion. Order-book depth collapsed across exchanges, highlighting the fragility of liquidity during stress.

For a holder of more than 3% of Bitcoin’s supply, this episode amplified fears about potential forced selling.

The index-inclusion threat compounds the problem. MSCI is consulting on excluding companies with more than 50% of assets in digital currencies from its indices.

Strategy sits near 77% Bitcoin by asset share. JPMorgan estimates such an exclusion could trigger around $2.8 billion in passive outflows, with up to $8.8 billion possible if other index providers follow.

If indices proceed with exclusion in February 2026, MicroStrategy’s mNAV could compress further. Lower premiums reduce the viability of equity issuance, which Strategy has used to manage its obligations and continue accumulation.

A persistent discount would complicate refinancing and weaken the company’s ability to defend its capital structure.

Strategy maintains that its balance sheet offers long-term strength. It recently claimed “71 years” of dividend coverage based on the current market value of its Bitcoin.

However, that calculation assumes frictionless sales, no price impact, and no tax obligations. The October crash demonstrated how quickly liquidity can evaporate under stress.

Will MicroStrategy’s Bitcoin Premium Return?

The narrowing mNAV reflects a market reassessment of leverage, liquidity, and risk. Investors appear less willing to pay a premium for exposure they can now access through spot Bitcoin ETFs without corporate debt and preferred stock layers.

The premium may return if Bitcoin rallies sharply or if index providers soften their stance. Yet the structural pressures remain.

Rising dividend obligations, negative operating cash flow, and a weakening equity premium leave Strategy more exposed than before.

MSTR Vs Bitcoin Performance YTD. Source: Saylor Tracker

MSTR Vs Bitcoin Performance YTD. Source: Saylor Tracker

Until those pressures ease, the market’s message is clear. Investors are no longer paying extra for the Strategy model, and the days of easy accretive issuance appear to be over.

Whether the premium returns now depends on Bitcoin strength, index decisions, and Strategy’s ability to navigate its most difficult period yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Webster, NY: A Center for Revitalization and Growth Fueled by Infrastructure

- Webster , NY, leverages public-private partnerships to drive real estate and industrial growth through $4.5M downtown revitalization and $9.8M infrastructure upgrades. - Brownfield Opportunity Area designations and waterfront projects unlock underused land, attracting $650M fairlife® facility and mixed-use developments with state-funded remediation. - Strategic infrastructure investments at Xerox campus and Sandbar Waterfront enhance industrial readiness and property values, creating scalable opportuniti

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar