JPMorgan's Crackdown on Crypto Challenges U.S. Hopes for Digital Assets

- JPMorgan closed Jack Mallers' accounts at Strike, sparking debates over crypto "debanking" and regulatory pressures on banks . - Pro-crypto lawmakers accused the bank of enforcing "Operation Chokepoint 2.0," despite Trump's 2025 executive order banning such practices. - Industry leaders warned restricted banking access risks pushing crypto offshore, undermining U.S. competitiveness in digital assets. - JPMorgan's research warning about MSTR's potential $8.8B outflows intensified calls for a customer boyc

JPMorgan Chase & Co. has once again sparked controversy over the issue of "debanking" in the crypto sector after

This episode has drawn strong backlash from both crypto supporters and lawmakers, who claim it highlights the ongoing pressure on established banks to limit services for digital asset companies.

JPMorgan's move also appears to conflict with the Trump administration's broader push to establish the U.S. as a leader in digital assets.

Industry experts have condemned the bank for worsening the divide between traditional finance and the crypto world.

The dispute arises as

JPMorgan has yet to

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Australia’s Cryptocurrency Regulations Set to Unlock $24 Billion in Value While Enhancing Investor Protections

- Australia introduces 2025 Digital Assets Framework Bill to unlock $24B productivity gains while imposing strict client asset safeguards. - Legislation creates two new crypto financial product categories under Corporations Act, requiring AFSL licensing for platforms and tokenized custody services. - Exemptions for small operators (<$10M volume) balance innovation with regulation, aligning with global trends like U.S. GENIUS Act and SEC's Project Crypto. - Industry debates regulatory proportionality as Aus

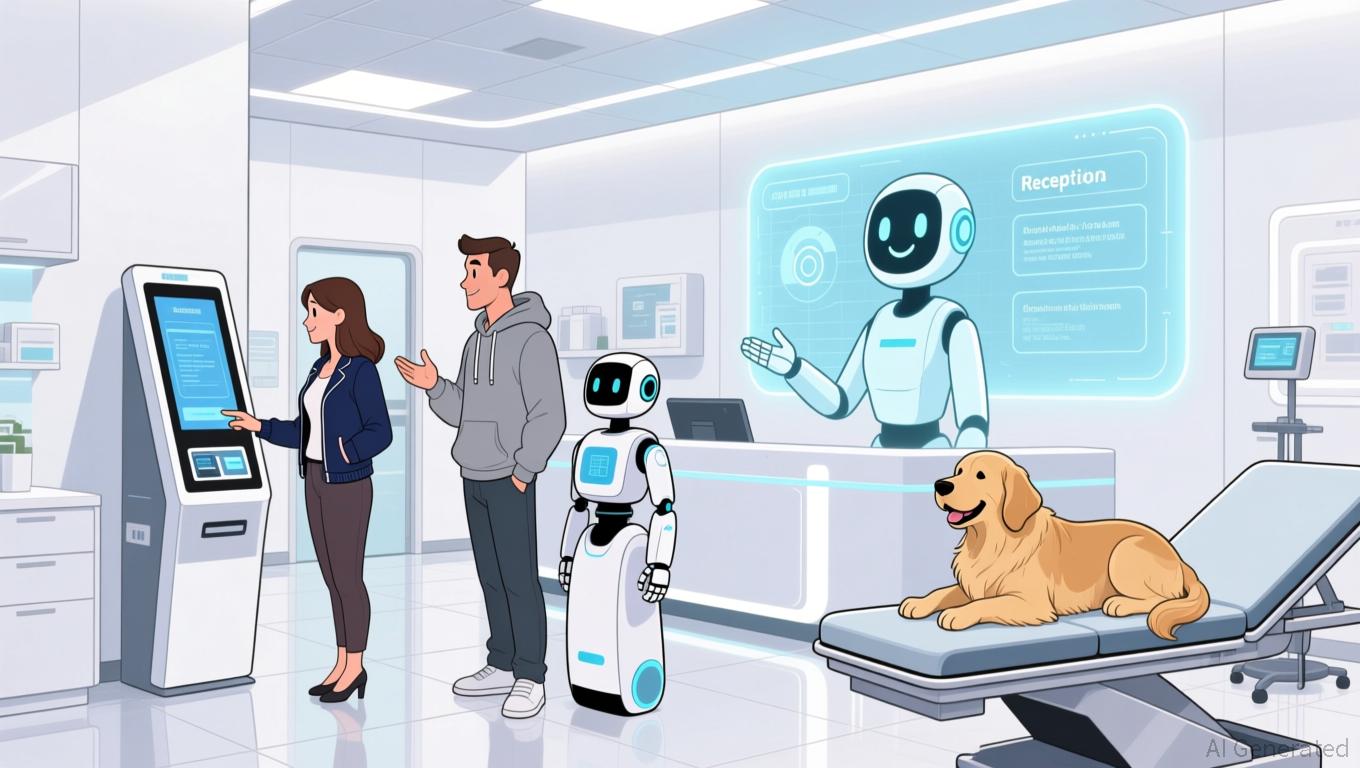

Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.

Bitcoin News Today: Nasdaq Promotes IBIT Options to Premier Gold Standard Liquidity Level

- Nasdaq ISE proposes quadrupling IBIT options limits to 1M contracts, aligning with high-liquidity ETFs like EEM and GLD . - Current 250K contract cap hinders institutional strategies; IBIT now leads Bitcoin options by open interest, surpassing Deribit. - Proposal includes removing FLEX IBIT position limits, enabling customized hedging for large funds, with experts calling it "routine" for high-volume assets. - SEC's December 17 comment deadline precedes potential approval, which could accelerate Bitcoin'

XRP News Today: XRP ETF Inflows Surpass Bitcoin Withdrawals Amid Changing Institutional Investment

- XRP ETFs absorbed 80M tokens in 24 hours, driven by institutional/retail demand, pushing AUM to $778M and outpacing Bitcoin outflows. - Grayscale's GXRP and Franklin Templeton's XRPZ led with $67.4M and $62.6M inflows, capitalizing on Ripple's $125M SEC settlement enabling spot ETFs. - ETFs pressured XRP's circulating supply, signaling confidence in its cross-border payment utility while technical indicators show cautious price recovery potential. - Market divides persist between ETF liquidity and direct