World Liberty Financial (WLFI), the cryptocurrency initiative associated with the Trump family, has recently carried out a notable token repurchase, spending $7.79 million to buy back 46.56 million

WLFI

tokens at an average rate of $0.1674,

as reported by LookonChain’s blockchain data

and several crypto news outlets. This action takes place as the project faces increased regulatory attention and market instability, contending with multiple hurdles such as an SEC probe into its reserve partner and a recent phishing incident that resulted in a significant token burn.

This repurchase, completed within five hours, represents a calculated move to help steady the token’s value and rebuild trust among investors.

WLFI’s main reserve wallet alone used $5.54 million

to buy back 32.93 million tokens. These acquisitions were made using

USD1

, WLFI’s dollar-pegged stablecoin, indicating strong internal belief in the project’s future prospects.

Experts point out

that such buyback strategies are typical in the crypto industry, as they decrease the available supply and may drive prices higher if demand holds steady.

The timing of this buyback is especially important, considering the ongoing regulatory and market challenges.

ALT5 Sigma, which manages WLFI’s reserves, is currently being investigated

for possible breaches of SEC disclosure requirements, including inconsistencies in executive suspensions and a lack of clarity regarding a $1.5 billion WLFI token acquisition in August, with more than $500 million allegedly directed to organizations tied to Donald Trump. At the same time,

Trump’s total wealth has decreased by $1.1 billion

since September, partly due to the falling value of TMTG, his crypto and social media venture, and the overall decline in WLFI’s price, which has dropped from $0.31 at launch in September to $0.158.

Adding to these difficulties

, WLFI recently revealed a phishing scam that compromised user wallets, prompting an emergency burn of 166.7 million tokens (worth $22 million) and a redistribution of assets to verified users. The project’s treasury, which holds assets exceeding $860 million, has now set aside $11 million for a TWAP buyback on CowSwap, with $1.2 million already utilized.

Blockchain records indicate

that major investors continue to accumulate, including one large holder who spent $25 million in USD1 to acquire 165.79 million WLFI tokens over three days.

Reactions from the market to the buyback have been varied.

WLFI jumped 6% to $0.1640

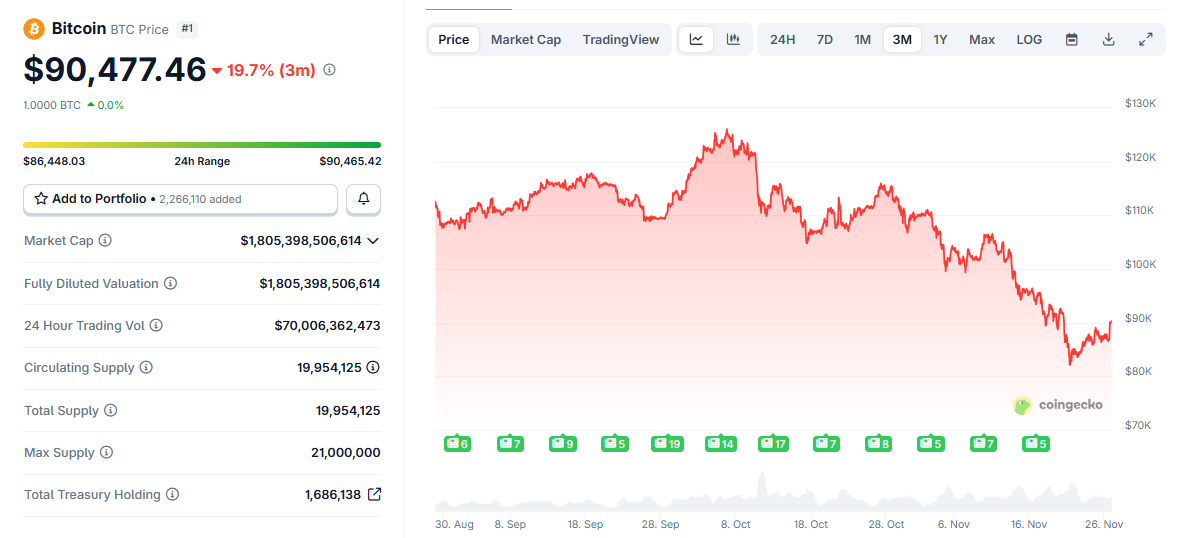

during the repurchase, but the larger crypto market remains under strain, with

Bitcoin

and

Ethereum

trading below $88,000 and $2,967, respectively.

Analysts such as Mayank Dudeja emphasize

that WLFI needs to stay above $0.1450 to keep its upward momentum, with a possible target of $0.25 if it surpasses key resistance. Conversely, falling below $0.1400 might lead to a retest of the $0.1250 support level.

This buyback also highlights WLFI’s unique position as both a DeFi platform and a politically themed

meme

token.

Recent actions, like investing in the SPSC meme coin

, show attempts to combine practical use with community-driven enthusiasm. Despite these initiatives, the project still faces significant obstacles from regulatory investigations, security incidents, and general market skepticism.