Institutions Turn to Purpose-Built Blockchains as Privacy Concerns Drive Shift Away from Ethereum

Financial institutions are shifting away from Ethereum (ETH) and opting for purpose-built blockchains tailored to meet their institutional needs. Recent developments, such as Klarna’s launch of its stablecoin on an alternative network and the rise of privacy-focused chains like Canton, raise questions about the network’s dominance. Corporate Blockchain Adoption Signals New Threat to Ethereum: Here’s

Financial institutions are shifting away from Ethereum (ETH) and opting for purpose-built blockchains tailored to meet their institutional needs.

Recent developments, such as Klarna’s launch of its stablecoin on an alternative network and the rise of privacy-focused chains like Canton, raise questions about the network’s dominance.

Corporate Blockchain Adoption Signals New Threat to Ethereum: Here’s Why

Klarna announced KlarnaUSD, becoming the first bank to issue a stablecoin on Tempo, a payments blockchain from Stripe and Paradigm. This decision has sparked debate in the crypto community. Some view it as a bearish signal for Ethereum.

“Someone tell me why this isn’t bearish for Ethereum? A major fintech with a big move into stablecoins is not launching it on Ethereum. If Tempo didn’t exist then this would have likely launched on Ethereum or an ETH L2…Tempo taking marketshare in what is the main thesis for Ethereum: stablecoins,” an analyst stated.

Ethereum hosts major stablecoins, including Tether (USDT) and USDC (USDC), which together command over $100 billion in market capitalization. They drive significant network activity and fees. By opting for Tempo, Klarna bypasses Ethereum’s ecosystem, potentially diverting liquidity and innovation.

Another analyst, Zach Rynes, emphasized that Klarna’s decision demonstrates that corporate blockchains are gaining adoption, while public chains continue to be overshadowed by large fintech companies.

“Another confirmation that corpo L1 chains are here to stay and that your favorite commoditized ‘neutral’ public chain #375936 is getting steamrolled by Fintech yet again,” he said.

The rise of the Canton Network further exemplifies this. It is a Layer 1 network built with privacy controls at its core. Institutions can choose how visible or restricted their activity is, enabling setups that range from fully permissionless to completely private systems.

Despite these differences, applications on Canton can still connect and interact across the network. Goldman Sachs’ Digital Asset Platform (GS DAP) uses the Canton network natively.

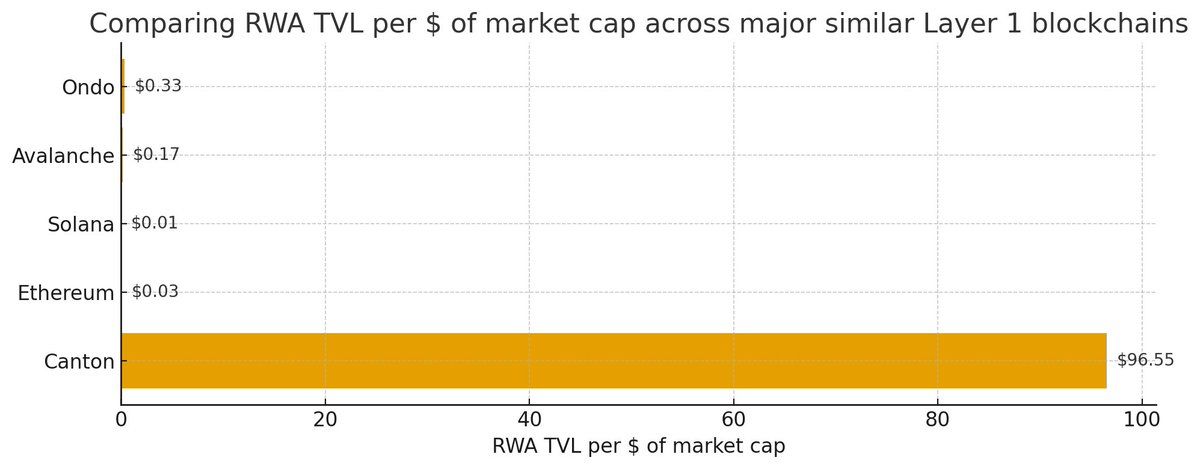

Notably, Canton exhibits a significant level of capital efficiency, producing around $96 of RWA Total Value Locked (TVL) for every $1 of market capitalization. In contrast, Ethereum generates approximately $0.03 of RWA TVL for every $1 of market cap.

A Comparison of RWA TVL Per Dollar of Market Cap. Source:

X/MattMena__

A Comparison of RWA TVL Per Dollar of Market Cap. Source:

X/MattMena__

But why are institutions moving away from Ethereum? Privacy could be the primary driver of this exodus. Public blockchains like Ethereum make all transactions permanently visible, a core challenge for institutions.

When banks or corporations transfer large sums, this transparency poses a significant risk. Competitors can analyze patterns, front-run trades, and uncover strategic business ties.

According to COTI Network’s analysis, enterprises adopting Web3 often overlook blockchain transparency as a liability. The article notes that public blockchains expose all transactions and metadata, which can reveal sensitive data or undermine negotiation leverage. This creates regulatory concerns with laws such as GDPR and exposes trade secrets.

This disconnect explains why institutions are building private blockchains or seeking public networks with enhanced privacy. Transparency, a celebrated virtue in crypto, creates vulnerabilities when handling billion-dollar trades and confidential relationships.

This trend signals a split: public networks like Ethereum for decentralized or retail use, while institutions move to private or specialized chains with confidentiality. Whether Ethereum can win back institutional trust or specialized networks take over remains uncertain as finance undergoes a digital transformation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.