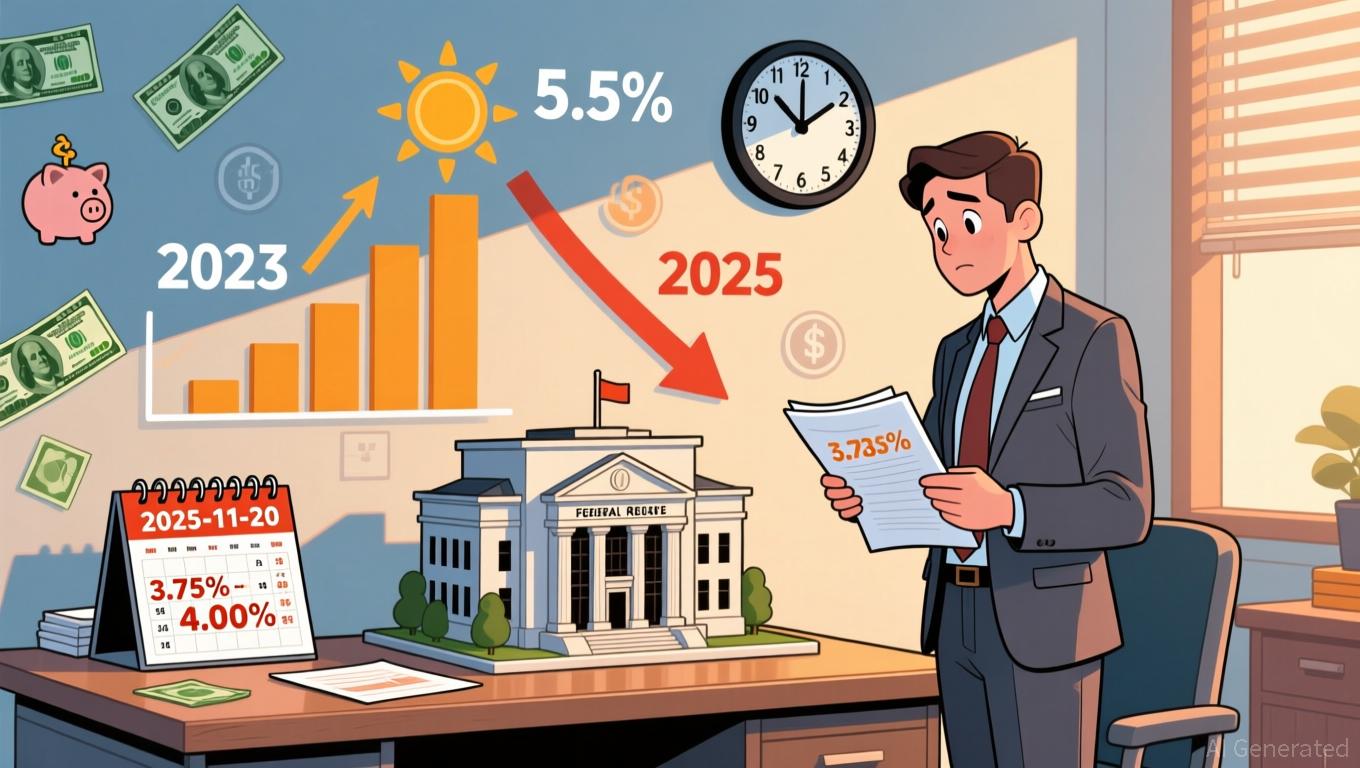

Post-peak CD returns threatened by Fed reductions—investors hurry to lock in rates

- CD rates peaked at 4.20% APY in late 2025 but declined as Fed rate cuts reduced federal funds to 3.75%-4.00%. - Short-term 12-month CDs remain competitive at 3.92% APY, outperforming longer-term products amid expected further Fed cuts. - Analysts urge investors to lock in current rates before December's anticipated third cut, as 2025's three reductions follow 2024's three cuts. - Strategic allocation to high-APY CDs maximizes returns, with $100k in 12-month terms generating $3920 vs. $3600 in 24-month te

In late November 2025, Certificate of Deposit (CD) rates peaked at an annual percentage yield (APY) of 4.20%, highlighting a market still adapting to changes in Federal Reserve policy. Recent figures from financial monitoring services indicate a modest drop in CD rates across most durations, a trend linked to the central bank’s ongoing rate reductions this year. Nevertheless, investors can still find attractive yields, especially with short-term options such as 12-month CDs

In October 2025, the Federal Open Market Committee (FOMC) lowered the federal funds rate to a 3.75%-4.00% range, following two rate cuts in 2025 and three in 2024. These moves, designed to curb inflation while supporting economic expansion, have caused CD rates to fall from their mid-2023 highs of 5.25%-5.50%. Even with this decline, today’s rates are still near historic highs, with the leading 10% of 12-month CDs yielding 3.92% APY

Experts in the market recommend that investors act soon to secure current rates before they decrease further. The FOMC is scheduled to convene again in December 2025, and another rate cut is widely expected. Data from CD Valet reveals that median rates for 24-month CDs have leveled off, while 36- and 48-month CDs have experienced slight drops. For those saving, short- and medium-term CDs—especially 12- or 24-month terms—continue to be the most appealing choices. A 12-month CD with a 3.92% APY could yield better returns than longer-term CDs, which have seen rates fall to 3.60%

More investors are adopting strategic deposit approaches. Financial professionals suggest putting larger amounts into CDs with higher APYs to maximize earnings. For example, investing $100,000 in a 12-month CD at 3.92% APY would earn $3,920 in interest, compared to $3,600 from a 24-month CD at 3.60%. This strategy takes advantage of the current market to boost returns before any further rate reductions occur.

Looking at history, timing is crucial. In the early 1980s, CD rates soared into double digits due to high inflation and aggressive Fed rate hikes. Today’s rates, though lower, reflect a more stable economic setting. Investors should keep an eye on FOMC announcements and adjust their CD investments as needed. With another rate cut likely in December, the opportunity to lock in favorable rates may soon narrow before rates settle at a new, lower level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Tether Faces Scrutiny Over Stability—S&P Issues Caution While Crypto Community Responds

- S&P Global Ratings downgraded Tether's USDT to "weak," citing high-risk Bitcoin exposure and reserve transparency concerns. - Tether criticized the rating as "misleading," defending its 1:1 dollar peg and $135B Treasury holdings as evidence of stability. - The downgrade highlights regulatory tensions as USDT faces scrutiny under new laws requiring stablecoins to be fully backed by low-risk assets. - Despite risks, USDT maintains $184B market cap and $76B daily volume, underscoring its critical role in cr

Bitcoin Updates: Tether’s Gold Holdings Confront U.S. Regulations, Drive Gold Prices Up by 50%

- Tether , issuer of USDT , now holds 116 tons of gold ($12.9B), surpassing reserves of central banks like South Korea and Hungary. - Its 26-ton Q3 gold purchase (2% of global demand) boosted gold prices 50% YTD, while Bitcoin reserves ($9.9B) challenge U.S. liquidity rules. - The firm plans to launch gold-free USAT for U.S. compliance, but S&P downgraded its dollar-peg stability due to non-liquid assets and transparency concerns. - Tether's $300M gold royalty investments and XAU₮ token ($2.1B market cap)

Robinhood’s Tokenized Shares Transform Global Finance, Approaching $10M RWA Ceiling

- Robinhood tokenized major stocks (GOOGL, NVDA , TSLA) on Arbitrum One, pushing RWA market cap toward $10M. - Arbitrum's low-cost layer-2 infrastructure enables seamless blockchain-traditional finance integration via tokenization. - Hybrid portfolios blending RWAs and meme tokens emerge, with DeFi collateralization and fractional ownership expanding use cases. - Platform blurs trading boundaries, risking amplified volatility while demonstrating blockchain's potential for financial accessibility. - Regulat

Cardano News Today: Cardano's Prospects for a 2026 Breakthrough Strengthen Thanks to Ecosystem Growth and Technological Advances

- Cardano's ADA token nears $0.50 as open interest rises 6%, supported by on-chain buy-side dominance and positive derivatives funding rates. - Technical indicators show RSI recovery and bullish MACD convergence, with $0.49 breakout potential triggering wedge pattern targets. - Founder Charles Hoskinson outlined 2026 roadmap including privacy token NIGHT, Kenya/Uganda microloan platform RealFi, and cross-chain scaling via Leios/Hydra. - Strategic focus on DeFi integration, TVL growth, and multi-chain inter