Cardano is recording renewed selling pressure as investors question what crypto to buy now, especially after ADA’s value has tumbled across October in 2025. Traders searching for the best crypto to buy or the best cryptos to buy now are seeing Cardano slide toward yearly lows, raising broader concerns about which crypto to buy today for long-term positions.

ADA’s prolonged decline is tied to its slower ecosystem development and Bitcoin’s extended drop below key psychological levels. This combination has created a difficult environment for holders, but the broader shift in sentiment is pushing many investors to look elsewhere for stronger upside potential.

Cardano’s Latest Price Weakness

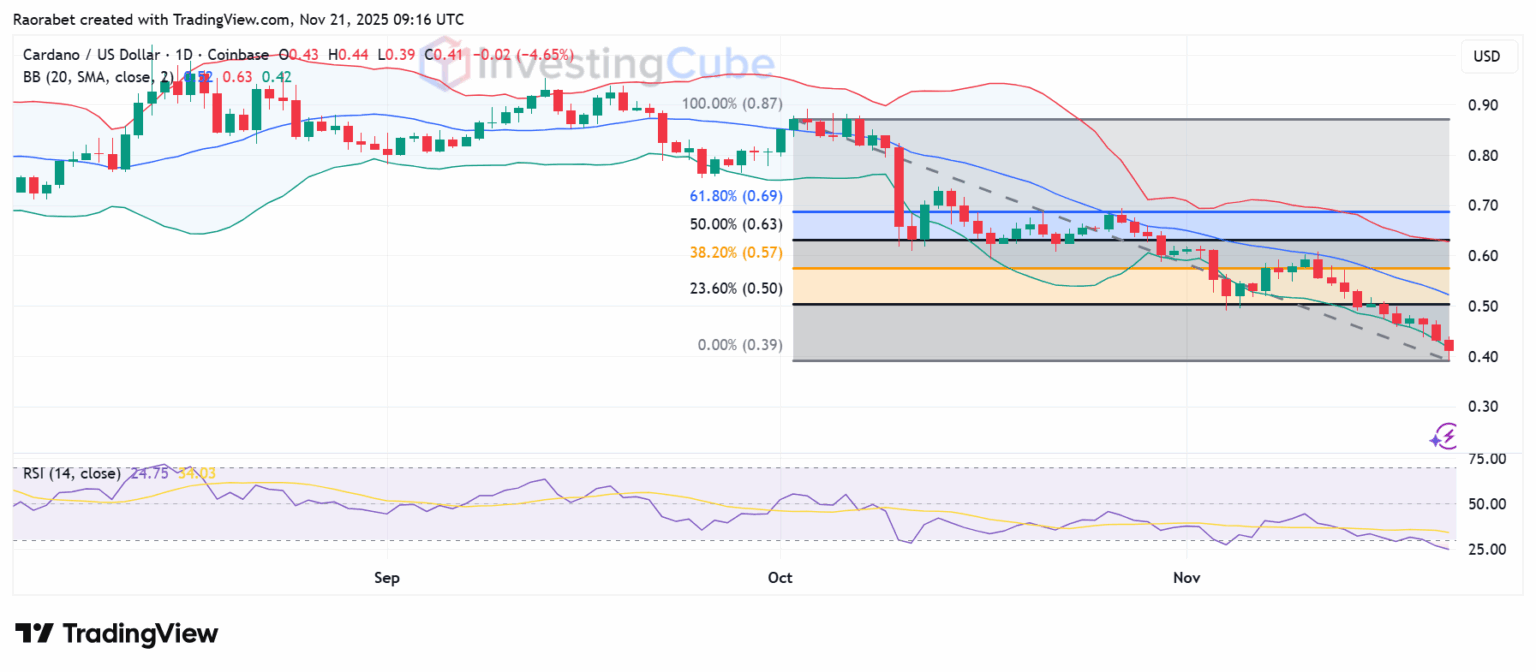

ADA has been falling sharply, losing more than 30% since early October in 2025 and trading near $0.46 after brushing year-to-date lows. The coin is now down 36% over the past month and 51% YTD, revealing how difficult the current stretch has become. Investors have been reacting to the perception that Cardano continues to grow at a slower pace than competitors such as Solana, and this narrative has caused significant capital rotation.

The correlation between ADA and Bitcoin has sat around $0.85, so Bitcoin’s recent decline below $100,000 intensified the pressure on altcoins. Analysts observing the crypto news today have noted that several users are selling into fear, a trend that has kept ADA away from any meaningful recovery attempts.

A different thread of data has been emerging with on-chain metrics pointing to potential exhaustion in selling. Santiment indicates that ADA’s 30-day MVRV ratio has dropped to negative 19.7%, a zone previously associated with heavy undervaluation. Whale purchases totaling 348 million ADA over the past month and rising wallet counts near 3.175 million also hint that a bottom may be forming.

Even so, traders still caution that the price could revisit the $0.30 region before any convincing shift happens. The technical setup remains bearish, and a return above resistance at $0.50–0.55 would be needed to calm short-term concerns for anyone determining what crypto to invest in next.

Mutuum Finance (MUTM) 项目进展

A separate incentive mechanism continues to lift engagement as Mutuum Finance (MUTM) introduced a daily 24-Hour Leaderboard system. The top contributor within each cycle receives a $500 MUTM reward as long as at least one transaction is completed in the 24-hour window, and the rankings reset at 00:00 UTC. The team has also introduced a dashboard featuring a leaderboard of the top 50 holders, creating ongoing participation that strengthens the community.

Security And Roadmap Updates

Mutuum Finance (MUTM) has confirmed steady progress toward its V1 protocol launch, and the development team announced that the V1 protocol will debut on the Sepolia testnet in Q4 in 2025. ETH and USDT will be supported for lending, borrowing, and collateral activities. Core features such as the liquidity pool, mtToken, debt token, and liquidator bot are part of this release.

Halborn Security is conducting an independent audit of MUTM’s lending and borrowing contracts, and the code has entered a formal analysis stage. These developments are reassuring buyers who are assessing what is the best cryptocurrency to invest in for upcoming cycles. Additionally, Mutuum Finance (MUTM) is running a $100,000 giveaway, where ten winners will receive $10,000 dollars each.

Stable Utility And Lending Structure

Mutuum Finance (MUTM) is also building a dual liquidity system, supporting Peer-to-Contract pools for predictable yield and Peer-to-Peer markets for isolated lending. This model gives users flexibility as they navigate the crypto market while ensuring broader liquidity remains stable. The steady rise in participation has created a sense of urgency among buyers who are comparing options across top cryptocurrencies, next big crypto candidates, or the best cheap crypto to buy now.

Investors searching for the top crypto to buy, or the next big cryptocurrency are increasingly highlighting how Mutuum Finance (MUTM) offers a structured and transparent path toward long-term use cases. Phase 6 is almost sold out, and the shift to Phase 7 will reduce access to the cheapest cryptocurrency pricing.

The crypto market remains volatile and ADA’s decline continues to push traders toward alternatives offering clearer growth paths. Mutuum Finance (MUTM) is emerging as a stronger option for anyone exploring what crypto to buy now, and its recent市场表现 shows expanding interest. Prospective buyers are encouraged to review the project’s updates before下一步价格阶段。