Bitcoin News Update: Hive Invests $300M in ATM to Boost AI Efforts While Stock Drops Amid Doubts

- Hive Digital Technologies launched a $300M ATM equity program to fund its "dual-engine" strategy of Bitcoin mining and AI infrastructure expansion. - The program enables flexible capital raising through 11 underwriters, supporting a renewable-powered data center in Canada and recent 285% revenue growth. - Despite strong financial performance, shares fell to $3.10, reflecting market skepticism about execution risks and competitive pressures in AI infrastructure. - Analysts highlight Hive's 90% renewable e

Bitcoin mining company

This move highlights Hive's "dual-engine" approach, using

The ATM offering gives Hive a flexible way to access additional capital without committing to a set price or timing, differing from conventional public offerings. Shares can be sold through "at-the-market distributions" under Canadian securities laws and Rule 415 of the U.S. Securities Act, which ensures compliance while preserving operational flexibility

Industry analysts see the program as a strategic lever to advance Hive's infrastructure goals. The company's BUZZ HPC segment is becoming increasingly important to its growth story, reflecting a wider industry transformation as mining companies shift from speculative ventures to critical infrastructure providers for AI and cloud services

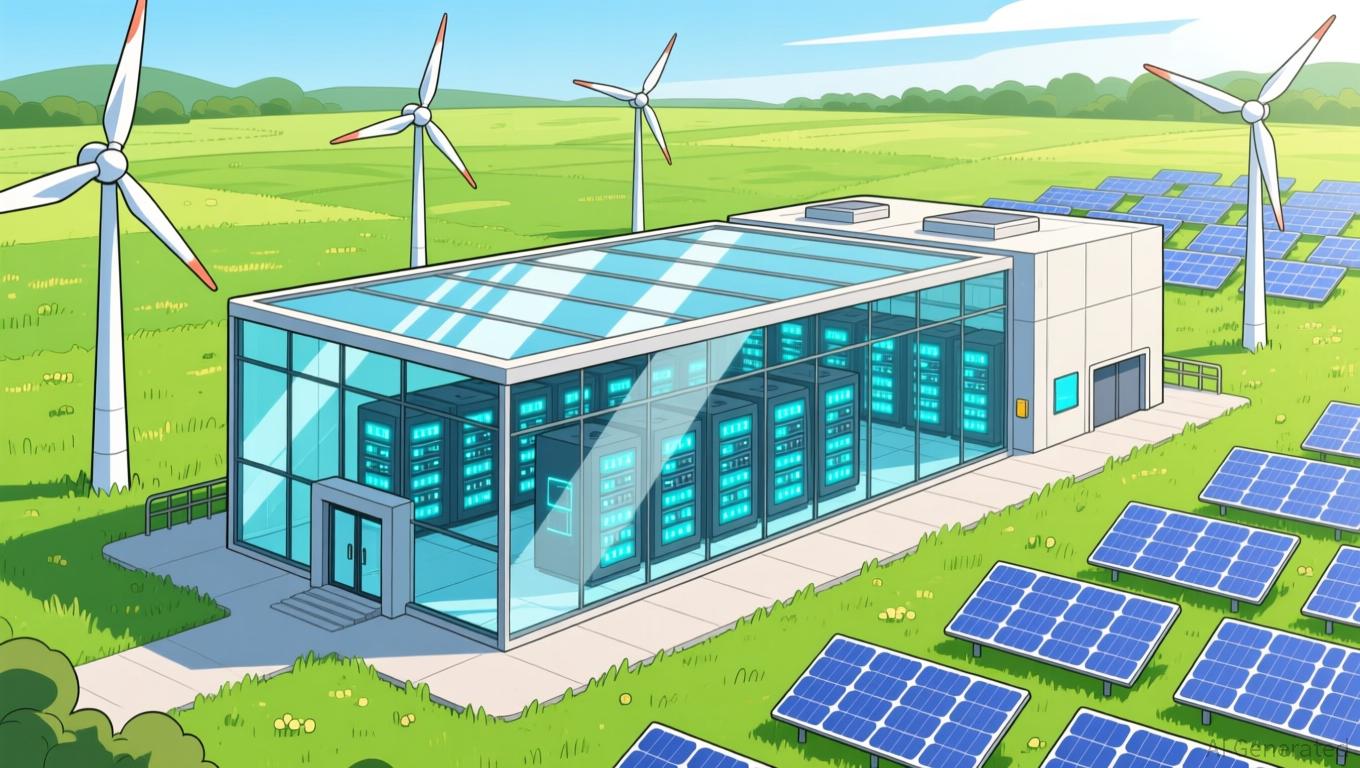

Profit margins from Bitcoin mining and energy expenses are crucial factors in Hive's dual-engine strategy, and the company is keeping a close eye on both operational performance and Bitcoin price swings. Leadership has indicated that the data center's energy mix—90% from renewable sources—will give Hive an edge in both cost efficiency and ESG standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global Crypto Regulation Era Begins as UK Implements OECD Disclosure Standards

- UK adopts OECD's CARF framework for crypto regulation, avoiding tax hikes but enforcing stricter compliance by 2026. - HMRC updates guidelines requiring crypto providers to report user data globally, aligning with 70+ countries' 2027 data exchange plans. - Compliance demands automated data collection, KYC upgrades, and penalties for non-compliance under new transparency rules. - Framework excludes self-custody wallets but covers major transactions, reshaping crypto's integration into global financial sys

Cosmos Addresses ATOM’s Inflation and Price Fluctuations through Community-Led Tokenomics Reform

- Cosmos community proposes ATOM tokenomics overhaul to shift from artificial scarcity to usage-based fees and network activity-driven inflation. - Five-step governance process emphasizes transparency, stakeholder collaboration, and addressing 25% price drop, high inflation, and speculative volatility. - Framework separates core economics from add-ons, incentivizes long-term stakers, and aligns ATOM as reserve/settlement asset across Cosmos Stack. - Ecosystem partners like Akash and Pocket Network advance

"Virtual Gold, Real Firearms: The Emerging Security Threat in Cryptocurrency"

- A $11M crypto heist in SF targeted Lachy Groom, a former OpenAI CEO partner, via an armed "wrench attack" by a delivery-worker impersonator. - Global "wrench attacks" surged to over 60 in 2025, exploiting blockchain's anonymity and irreversibility to steal digital assets through physical coercion. - Experts warn of rising crypto security risks as attackers profile victims via social media, prompting calls for institutional-grade storage and multi-signature wallets. - The incident highlights vulnerabiliti

Strategic Development of Infrastructure within Webster Economic Corridor in Upstate New York

- Upstate NY's Webster Economic Corridor is transforming into a hub for advanced manufacturing and semiconductors via strategic infrastructure investments. - $9.8M FAST NY grants and $4.5M NY Forward funds modernize industrial sites and downtown areas, enhancing business readiness and community engagement. - A $650M fairlife® facility will create 250 jobs, demonstrating how public-private partnerships (PPPs) catalyze private investment through site readiness. - Federal infrastructure bank proposals aim to