Institutions Join the Rush as Zcash Becomes the New Treasury Favorite

Two publicly traded companies increased their exposure to Zcash (ZEC) in November, signaling a shift as institutions increasingly bet on privacy-focused cryptocurrencies. The moves reflect rising confidence in privacy assets as viable treasury tools, at a time when ZEC has defied the broader market downtrend and outperformed major cryptocurrencies with notable gains. Corporate Treasuries Turn

Two publicly traded companies increased their exposure to Zcash (ZEC) in November, signaling a shift as institutions increasingly bet on privacy-focused cryptocurrencies.

The moves reflect rising confidence in privacy assets as viable treasury tools, at a time when ZEC has defied the broader market downtrend and outperformed major cryptocurrencies with notable gains.

Corporate Treasuries Turn to Privacy Assets

In a recent press release, Reliance Global Group, a Nasdaq-listed insurance technology firm, announced that it executed a major strategic shift in its Digital Asset Treasury (DAT). The firm liquidated all previous crypto holdings and reallocated entirely into ZEC.

This follows a comprehensive strategic review led by the company and Blake Janover, Chairman of the Crypto Advisory Board. They concluded that Zcash is the “most compelling opportunity for a long term DAT strategy.”

“Bitcoin introduced the world to decentralized digital money, but Zcash advances that foundation by delivering optional privacy in a way that we believe is both technologically superior and fundamentally aligned with institutional requirements,” Board member Moshe Fishman stated.

The company cited several reasons why ZEC emerged as its preferred asset, starting with its exceptional price rally. Reliance noted that Zcash delivered a sharp upside move and held up strongly during a challenging period for the broader cryptocurrency market.

According to the firm, this strength signals the beginning of a much larger adoption phase, especially as Zcash’s privacy-focused technology andcompliance-ready features gain increasing interest from enterprises and financial institutions.

Reliance Global also highlighted ZEC’s Bitcoin-based architecture, enhanced with advanced zero-knowledge cryptography, its flexible transaction model, leadership in zk-SNARK innovation, selective disclosure tools for auditors and regulators, and strong confidentiality features. These factors together position ZEC as a compelling, institution-ready digital asset.

Cypherpunk Adds $18 Million in ZEC, Now Controlling 1.43% of Total Supply

In addition to Reliance Global, Cypherpunk Technologies also expanded its ZEC holdings. Last week, the digital-asset treasury firm backed by the Winklevoss twins announced that it had purchased an additional 29,869.29 ZEC for $18 million.

This brings its total holdings to 233,644.56 ZEC, representing roughly 1.43% of Zcash’s total supply. The firm acquired its position at an average cost of $291.04 per coin.

“In a world where privacy is scarce, privacy becomes the most valuable commodity. Cypherpunk sees Zcash as digital privacy in asset form, the same way Bitcoin has proven to be digital gold. Zcash also represents an important hedge against the transparency of Bitcoin and the existing financial infrastructure in an AI-abundant future,” the press release read.

According to the latest data from CoinGecko, the firm is currently sitting on an unrealized profit of $43.7 million. This stands in sharp contrast with BTC-and ETH-holding firms, many of which are currently sitting on paper losses.

For instance, BitMine’s unrealized losses reached $4 billion last week and have since narrowed to $3.7 billion. Meanwhile, Metaplanet’s unrealized losses have climbed to roughly $609 million.

ZEC Surges 300% as BTC and ETH Slide Into Double-Digit Losses

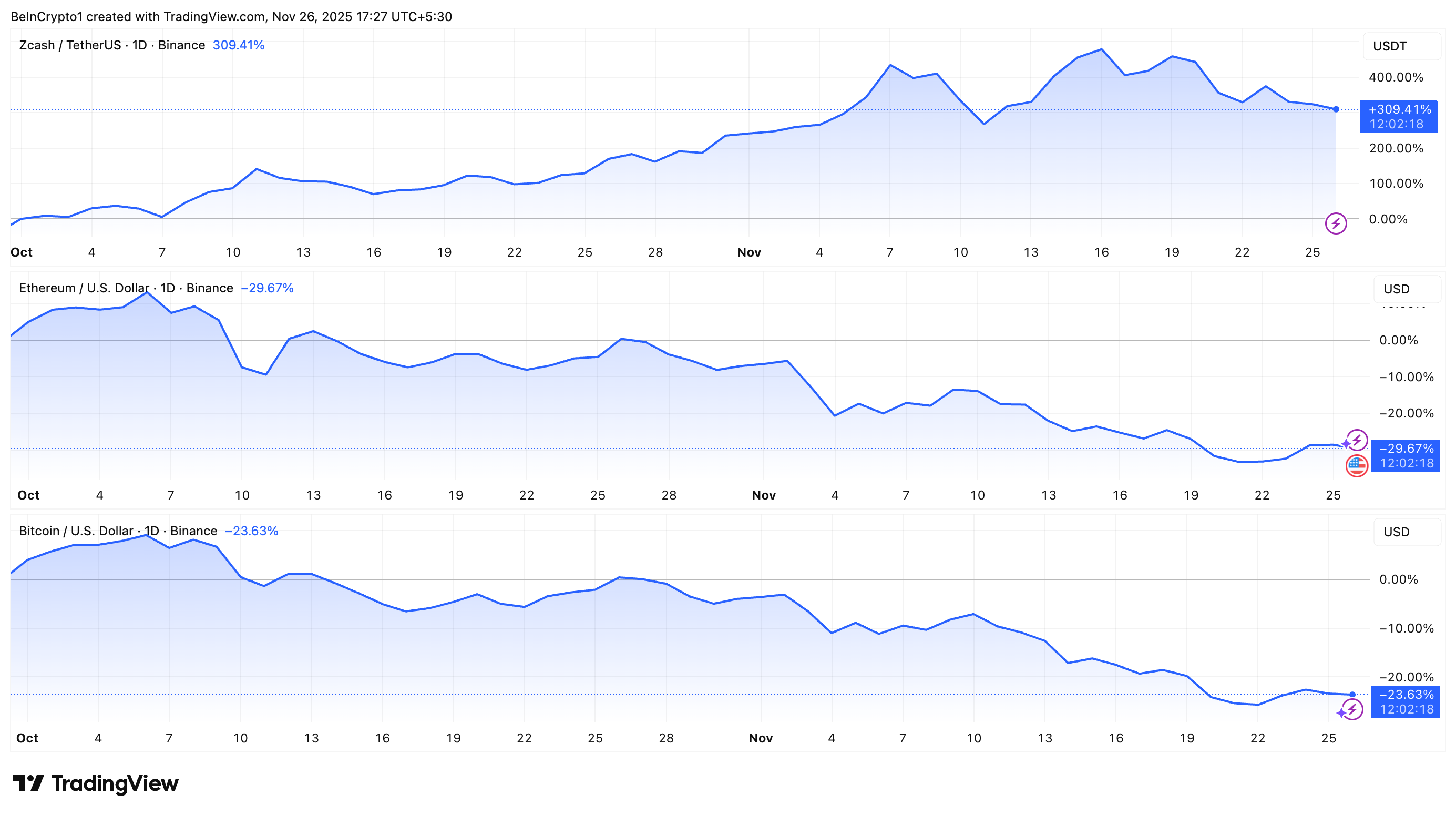

This divergence is attributed to the price performance of the underlying assets. Since October, ZEC’s price has appreciated by over 300%. At the same time, BTC has dipped 23.6% and ETH has posted an even steeper loss of 29.6%

Price Performance of ZEC, ETH, and BTC Since October. Source:

TradingView

Price Performance of ZEC, ETH, and BTC Since October. Source:

TradingView

While ZEC has faced pressure recently, shedding around 20% of its gains over the past week, the broader outlook still appears constructive. BeInCrypto’s technical analysis shows that Zcash is trading inside an ascending triangle.

This pattern often signals a potential continuation of upward momentum. Additionally, the Relative Strength Index (RSI) is showing a hidden bullish divergence. This is again a bullish continuation signal.

Overall, the indicators point to a positive outlook for ZEC, but confirmation will depend on market behavior in the next few sessions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Latest Price Swings: Exploring the Causes and Potential Prospects

- Bitcoin's 2025 price drop to $1.7T reflects macroeconomic pressures and shifting investor sentiment. - Fed's cautious rate cuts and rising U.S. dollar amplify crypto sell-offs amid trade tensions. - Extreme fear index and herd behavior drive panic selling, contrasting long-term investor strategies. - SEC's ETF approval and regulatory clarity may unlock institutional demand amid evolving policy frameworks. - Strategic positioning via technical analysis, diversification, and contrarian tactics offers resil

Solana News Update: Crypto Markets Rally and Volatility Rises Following Fed's Dovish Shift Ahead of December Decision

- JPMorgan predicts a 25-basis-point Fed rate cut in December 2025, aligning with 79% market probability via CME FedWatch. - Dovish policy sparks crypto surge: Bitcoin hit $107,000 as lower rates reduce holding costs for non-yielding assets. - Trump-aligned economist Kevin Hassett's potential Fed chair nomination could boost crypto-friendly regulatory approaches. - Market sectors react diversely: tech stocks and fintech gain from cheaper capital, while traditional banks face margin compression. - December

XRP News Today: Ripple’s XRP-Based Device Seeks Banking License to Challenge Traditional Financial Systems

- Ripple's XRP-powered ecosystem, leveraging blockchain and stablecoins, is positioned to rival JPMorgan and SWIFT through real-time payments and institutional services. - The company has acquired six firms to expand custody, stablecoin, and treasury capabilities, transitioning XRP into institutional markets via DATS and ETFs. - Seeking a U.S. banking charter could make Ripple the first crypto-native entity to operate with bank-grade compliance, accelerating blockchain adoption in finance .

XRP News Today: SEC Greenlights XRP ETFs, Driving $587M Inflows and Anticipating a Surge to $10

- SEC-approved XRP ETFs from Bitwise, 21Shares, and others inject $587M in inflows, signaling institutional adoption and regulatory legitimacy. - ETFs with fees as low as 0.19% and waived charges aim to boost liquidity, outpacing Solana's ETFs and attracting $6.12B in 24-hour trading volume. - Technical analysis highlights XRP's retesting of $2 support and growing on-chain activity, suggesting potential for a $10 rally amid Bitcoin's declining dominance. - Risks include whale-driven volatility and SEC conc