South Africa Confirms Standard Chartered’s Troubling Stablecoin Warning

South Africa’s central bank has echoed a warning from Standard Chartered, confirming that the rapid rise of stablecoins could destabilize emerging-market (EM) banks. Standard Chartered projects that digital dollars could drain as much as $1 trillion from EM bank deposits over the next three years, as consumers and corporates shift savings toward stable, USD-pegged alternatives.

South Africa’s central bank has echoed a warning from Standard Chartered, confirming that the rapid rise of stablecoins could destabilize emerging-market (EM) banks.

Standard Chartered projects that digital dollars could drain as much as $1 trillion from EM bank deposits over the next three years, as consumers and corporates shift savings toward stable, USD-pegged alternatives.

Standard Chartered’s Alarm: Emerging-Market Banks at Risk

In a recent research note, Standard Chartered highlighted 48 countries along an opportunity–vulnerability continuum.

As BeInCrypto reported, the bank’s Global Head of Digital Assets Research, Geoff Kendrick, identified Egypt, Pakistan, Bangladesh, and Sri Lanka as most exposed to deposit outflows.

“As stablecoins grow, we think there will be several unexpected outcomes, the first of which is the potential for deposits to leave EM banks,” they told BeInCrypto.

Even in high-risk economies, these outflows could represent roughly 2% of total deposits. While this represents only a small percentage in isolation, it could potentially destabilize countries already facing weak currencies and fiscal deficits.

Likewise, Madhur Jha, Head of Thematic Research, noted that stablecoins are accelerating a structural shift: banking functions are increasingly moving to non-bank digital platforms.

South Africa Confirms Growing Risk

South Africa’s Reserve Bank (SARB) has highlighted the financial stability risks posed by stablecoins and other crypto assets.

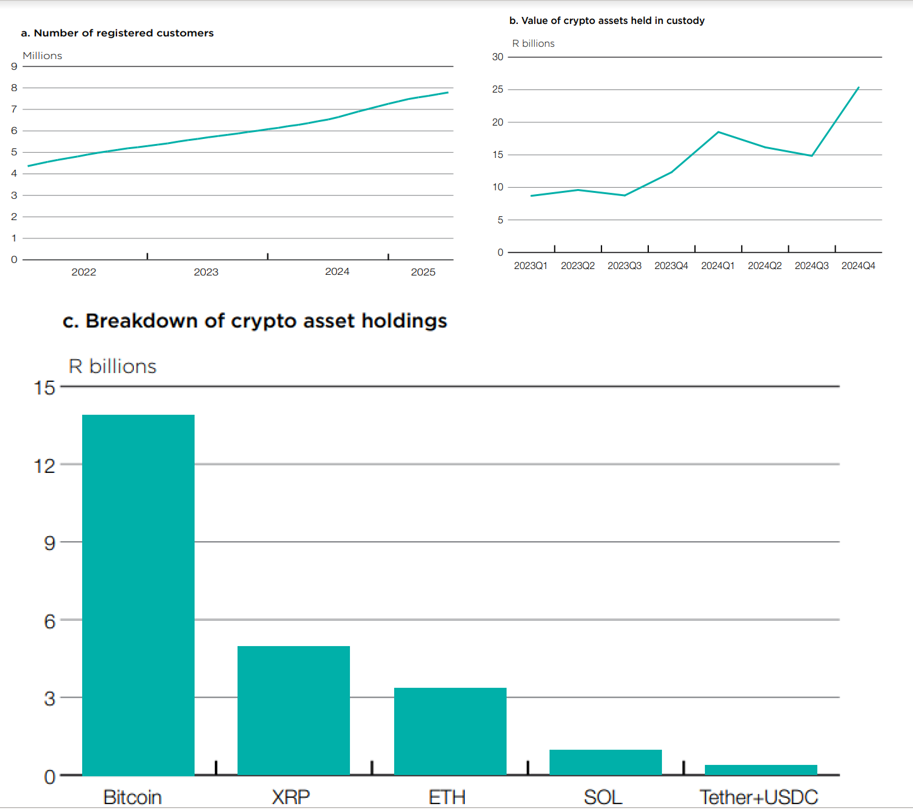

According to the 2025 Financial Stability Review, stablecoin adoption has surged, with trading volumes climbing from 4 billion rand in 2022 to nearly 80 billion rand ($4.6 billion) by October 2025.

Crypto assets and stablecoins as new risk. Source:

South Africa’s 2025 Financial Stability Review

Crypto assets and stablecoins as new risk. Source:

South Africa’s 2025 Financial Stability Review

The central bank warned that crypto’s fully digital and borderless nature could allow it to circumvent exchange control laws.

Herco Steyn, SARB’s lead macroprudential specialist, emphasized the urgency. He noted that without comprehensive regulations, authorities lack sufficient oversight of these fast-paced markets.

Regulatory Gaps and Market Implications

South Africa is actively developing new rules to bring cross-border crypto transactions under regulatory supervision. Despite this, major platforms like Luno, VALR, and Ovex now serve 7.8 million users and hold roughly $1.5 billion in custody.

The trend toward USD-pegged stablecoins reflects a market preference for lower volatility compared to traditional crypto assets, such as Bitcoin or Ether.

Standard Chartered’s warning, combined with South Africa’s confirmation, highlights the broader risk to EM banking systems.

Economies running twin deficits, including Türkiye, India, Brazil, South Africa, and Kenya, are particularly vulnerable to capital flight fueled by stablecoins.

Therefore, policymakers in emerging markets may be at a crossroads. As stablecoin adoption accelerates, countries must strike a balance between innovation and stability, implementing frameworks that prevent systemic risks while supporting the growth of digital finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin ETFs See $3.8B Outflows While Solana Gains Momentum as Investors Shift Funds

- U.S. Bitcoin ETFs lost $3.79B in November 2025, with BlackRock's IBIT leading $355.5M outflows amid Bitcoin's six-month low below $95,000. - Outflows driven by profit-taking and macroeconomic pressures, including weak labor markets, sticky inflation, and tighter liquidity conditions. - Solana ETFs attracted $531M in first week, capitalizing on 7% staking yields and lower fees as investors shift to alternatives during Bitcoin's decline. - Analysts remain divided on Bitcoin's trajectory, with Citigroup for

Webster, NY's Pathway to Economic Expansion and Real Estate Opportunities: An Infrastructure-Focused Growth Plan

- Webster , NY leverages $9.8M FAST NY grant and Xerox campus redevelopment to drive industrial revitalization and attract $1B+ private investment. - Strategic infrastructure upgrades and municipal boundary adjustments create shovel-ready sites for advanced manufacturing, boosting land values by 12-15% annually. - Institutional investors capitalize on pre-developed corridors, with projects like Coca-Cola's $650M dairy facility creating 250 jobs and reinforcing Webster's growth trajectory.

Bitcoin News Today: Bitcoin’s Death Cross Highlights Its Function as an Indicator of Fiat Liquidity

- Bitcoin's "death cross" signals bear market risks, historically preceding 64%-77% price drops after 50-day SMA crossed below 200-day SMA. - BTC fell to $80,500, breaching key support levels and triggering $800M in short-term holder losses amid extreme Fear & Greed Index pessimism. - Macro factors like Fed rate uncertainty and $3.5B ETF outflows worsened sentiment, with BlackRock/Vanguard trimming MicroStrategy BTC holdings. - Analysts debate outcomes: some see $100K-$110K potential as short liquidations

Hyperliquid (HYPE) Price Rally: A Tactical Move Amidst DeFi’s Changing Market Dynamics

- Hyperliquid's HYPE token surged to $60 in late 2025 driven by protocol upgrades, capital efficiency, and CLOB-driven market dominance. - Dual-layer HyperEVM/HyperCore infrastructure enabled 73% decentralized perpetuals market share with 0.02%-0.04% trading fees. - HLP program's TVL grew from $400M to $5B by 2025, offering 11% annualized returns to liquidity providers. - CLOB model outperformed AMMs with $15B+ open interest and $3T+ trading volume, bridging DeFi and CEX performance gaps. - DAT treasury an