XRP Open Interest Falls to One-Year Low

- XRP open interest reaches one-year low amid market dynamics.

- Reduced speculative activity noted in the derivatives market.

- Whale selling and regulatory concerns drive XRP declines.

XRP open interest experienced a drastic decline to a one-year low as of November 26, 2025, raising concerns about market activity and speculative trading within the cryptocurrency sector.

The drop signals potential issues facing XRP, possibly impacting trader confidence and influencing market behavior across other cryptocurrencies amid ongoing regulatory and institutional uncertainties.

XRP Market Overview

The XRP open interest has declined to a one-year low, marking a significant downturn in the derivatives market. CoinGlass data indicates the open interest now averages $3.79 billion, showing decreased engagement from traders.

Key players in the industry, including Ripple’s CEO Brad Garlinghouse and CTO David Schwartz, have provided no public commentary on the current market changes. Additionally, no statements have emerged from major exchanges like Binance and Coinbase.

Speculative Activity and Market Reactions

Impacted markets reflect a general reduction in leverage and speculative trading activities. The absence of primary-source statements leaves observers relying on secondary reports. Whale selling has compounded the reduction in speculative activities.

No new institutional funding or ETFs directly relate to the current situation. The muted liquidity affects both individual and institutional investors, shaping market behavior and future expectations.

Historical Patterns and Future Outlook

Historical patterns show similar trends leading to consolidation or extended bear markets. XRP’s situation, contrasted with related assets, suggests regulatory uncertainty remains a significant influence.

Future potential outcomes include further regulatory scrutiny and shifts in trading volumes. Historical data from previous years suggest significant market contractions lead to longer bear periods. Understanding these trends is vital for assessing future market stability.

Max Green, Research Director, Brave New Coin, – “The whale activity we’ve seen suggests significant distribution, indicating that market sentiment is heavily influenced by larger traders positioning themselves.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

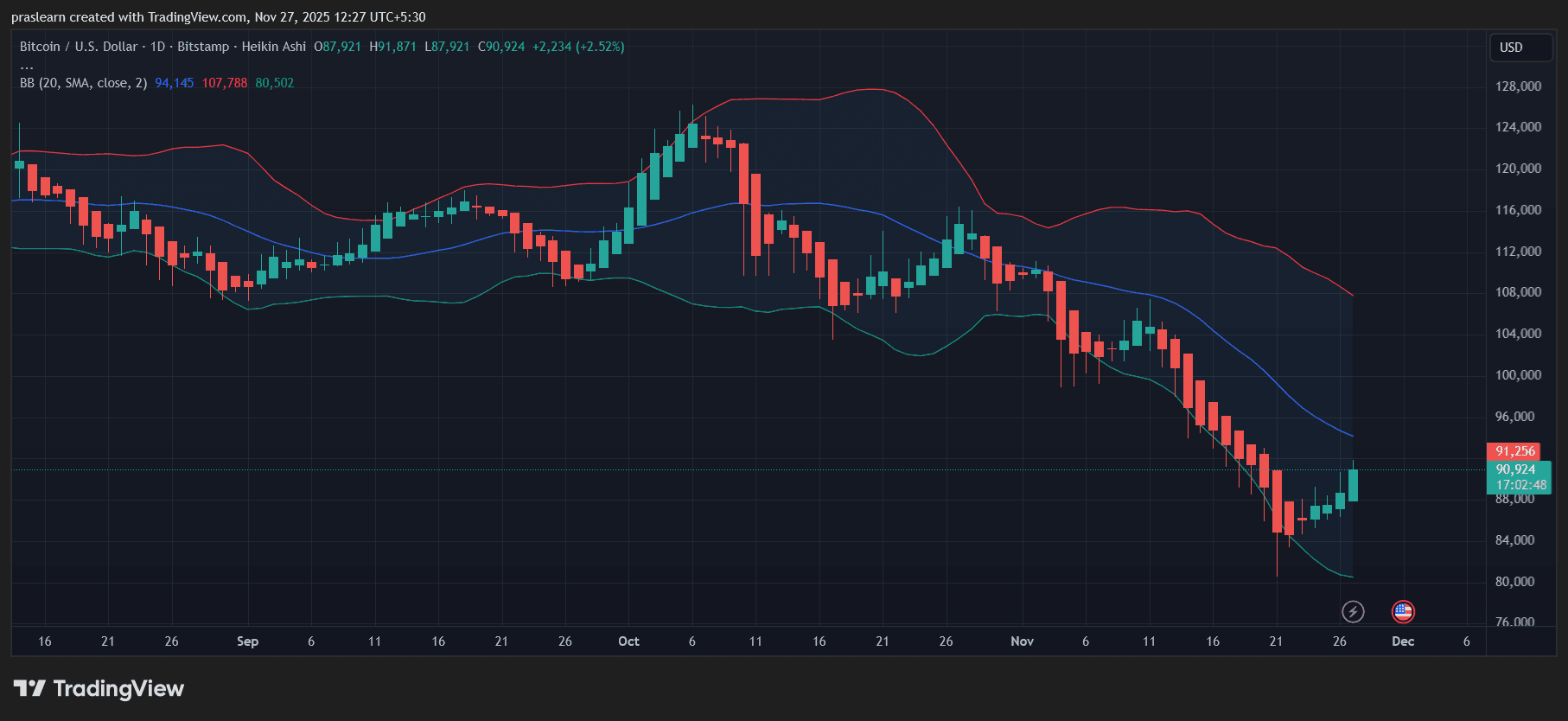

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi