Key Market Information Discrepancy on November 27th - A Must-Read! | Alpha Morning Report

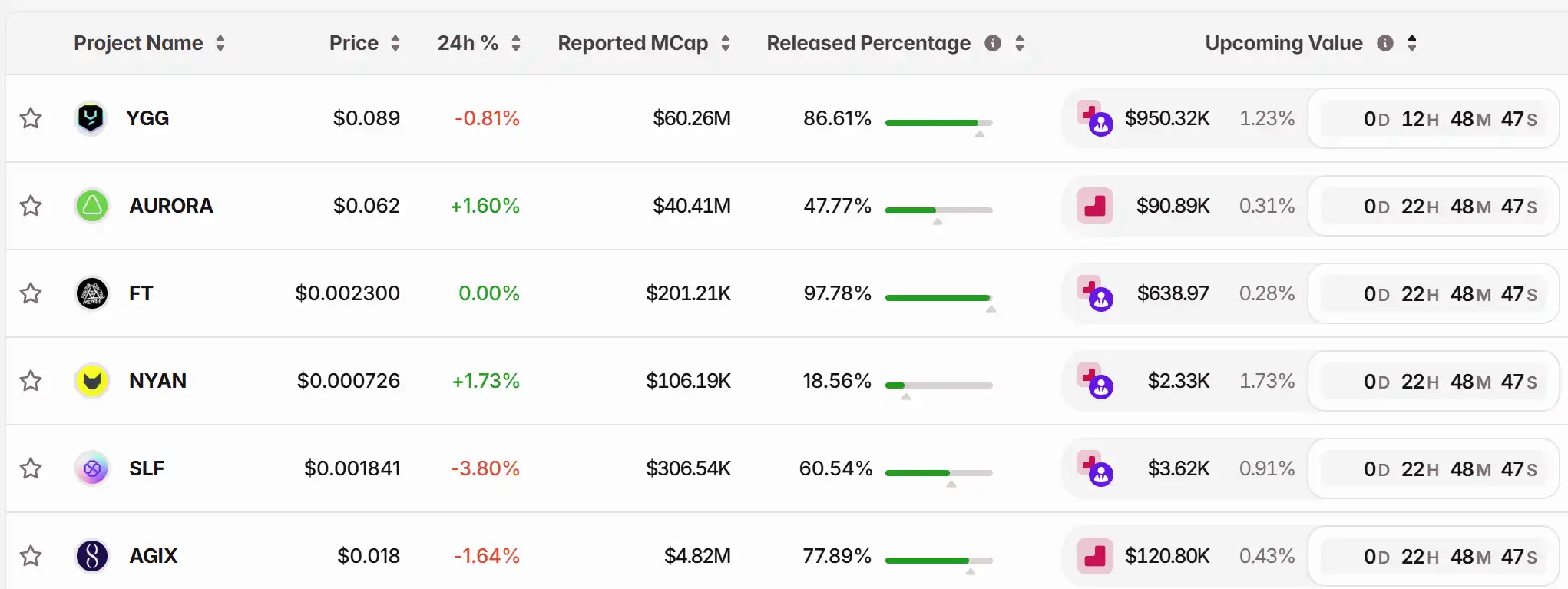

1. Top News: Crypto Market Rebounds, Bitcoin Reclaims $90,000 After One Week 2. Token Unlocking: $YGG, $AURORA, $FT, $NYAN, $SLF, $AGIX

Featured News

1.Crypto Market Rebounds, Bitcoin Returns to $90,000 After a Week

2.JPMorgan Overturns "No Rate Cut" Prediction from a Week Ago, Now Expects Fed to Cut Rates in December

3.Tether CEO Responds to S&P's Downgrade of USDT Rating, Highlighting the Fragility of the Old System That Worries the Powers That Be

4.Bithumb to Suspend USDT Market Beta Testing Service, Reopening Time to be Notified Separately

5.$226 Million Liquidated Across the Network in the Past 24 Hours, Double Liquidation in Long and Short Positions

Articles & Threads

1. "Even the Ex-Boyfriend of ChatGPT's Creator Was Robbed of Millions, How Wild Are Crypto Heists"

This month alone, there have been at least three major real-world robbery cases in the crypto industry. For criminals, forcing someone to reveal their cryptocurrency wallet password is evidently quicker and easier than robbing all the cash in someone's home or their bank card PIN. What's even worse is that crypto people's lifestyles are inherently 'high exposure': flaunting wealth on Twitter, appearing at conferences, getting mentioned in articles, using insecure Wi-Fi, or simply attending an industry event... all leave traces in the shadows, telling others which 'crypto asset billionaire' is worth targeting.

2. "Need Funding, Need Users, Need Retention: Growth Guide for 2026 Crypto Projects"

The marketing of the crypto industry is undergoing a profound transformation: the trend lifecycle is becoming shorter, competition is intensifying, and traditional approaches are gradually becoming ineffective. For entrepreneurs, growth leaders, and marketing teams, understanding these changes is not only a matter of survival but also a key to gaining a competitive edge. Based on a presentation by Emily Lai, Chief Marketing Officer of Hype Partners, this article systematically outlines the 7 core trends in crypto marketing for 2026, covering recruitment, performance marketing, content creation, channel diversification, event experiences, incentive mechanisms, and AI-driven operations. It also shares industry forecasts and a set of forward-thinking frameworks.

Market Data

Daily Market Overall Funding Heatmap (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: The 2025 Transformation of Crypto—Gold-Linked Assets, DeFi Innovations, and Bitcoin Hybrids Tackle Market Obstacles

- 2025 crypto presales highlight gold-backed BPG1, DeFi platform MUTM, and BTCM hybrid addressing liquidity, security, and scalability challenges. - BlocPal/VNX's BPG1 token offers auditable gold exposure via blockchain, emphasizing real-world asset tokenization and cross-border regulatory alignment. - Mutuum Finance's $20M presale features Halborn-audited DeFi tools, while BTCM's Bitcoin-like scarcity model gains traction amid Fed policy shifts. - Projects demonstrate crypto's maturation through instituti

Designers: Essential for Connecting Metrics to Product Vision

- Chris Novak warns "death-by-measurement" risks eroding product vision through overreliance on fragmented KPIs, particularly in emotionally driven industries like gaming. - Siloed metrics create internal competition (e.g., storefront vs. subscription teams) and micro-optimizations that distort cohesive user experiences according to Novak's analysis. - Designers can unify metrics with product passion by identifying conflicts through cross-functional collaboration, yet this strategic role is often overlooke

BNB News Update: Major Economic Shifts and AI Predictions Leave BNB's $900 Outlook Uncertain

- BNB approaches $900 resistance near 0.50 Fibonacci level, a key technical pivot for potential breakout/reversal. - Market context includes AI infrastructure growth (Amazon's HPC investments) and macroeconomic pressures from corporate debt restructuring. - Technical analysis dominates BNB's price action, with mixed historical outcomes at this level requiring volume confirmation. - Absence of fundamental catalysts means speculation and algorithmic trading drive current volatility amid broader market uncert

Bitcoin’s $17B Open Interest Crash: What It Really Means

Bitcoin's open interest plunged from $45B to $28B. Is this a bearish sign or just a leverage reset? Here's what you need to know.Not a Bear Market, Just a ResetWhat This Means for Bitcoin Traders