Grayscale Files for Spot Zcash ETF, ZEC Price Could Cross $600

Zcash has struggled to recover over the past several days, with broader market uncertainty limiting its upward momentum. Despite this stagnant price action, the privacy-focused altcoin may soon see renewed interest thanks to a major development from Grayscale. The asset manager’s latest regulatory filing has positioned Zcash as a potential candidate for one of the

Zcash has struggled to recover over the past several days, with broader market uncertainty limiting its upward momentum. Despite this stagnant price action, the privacy-focused altcoin may soon see renewed interest thanks to a major development from Grayscale.

The asset manager’s latest regulatory filing has positioned Zcash as a potential candidate for one of the next spot crypto ETFs in the US, sparking optimism for a rebound.

Zcash Traders Should Watch Out

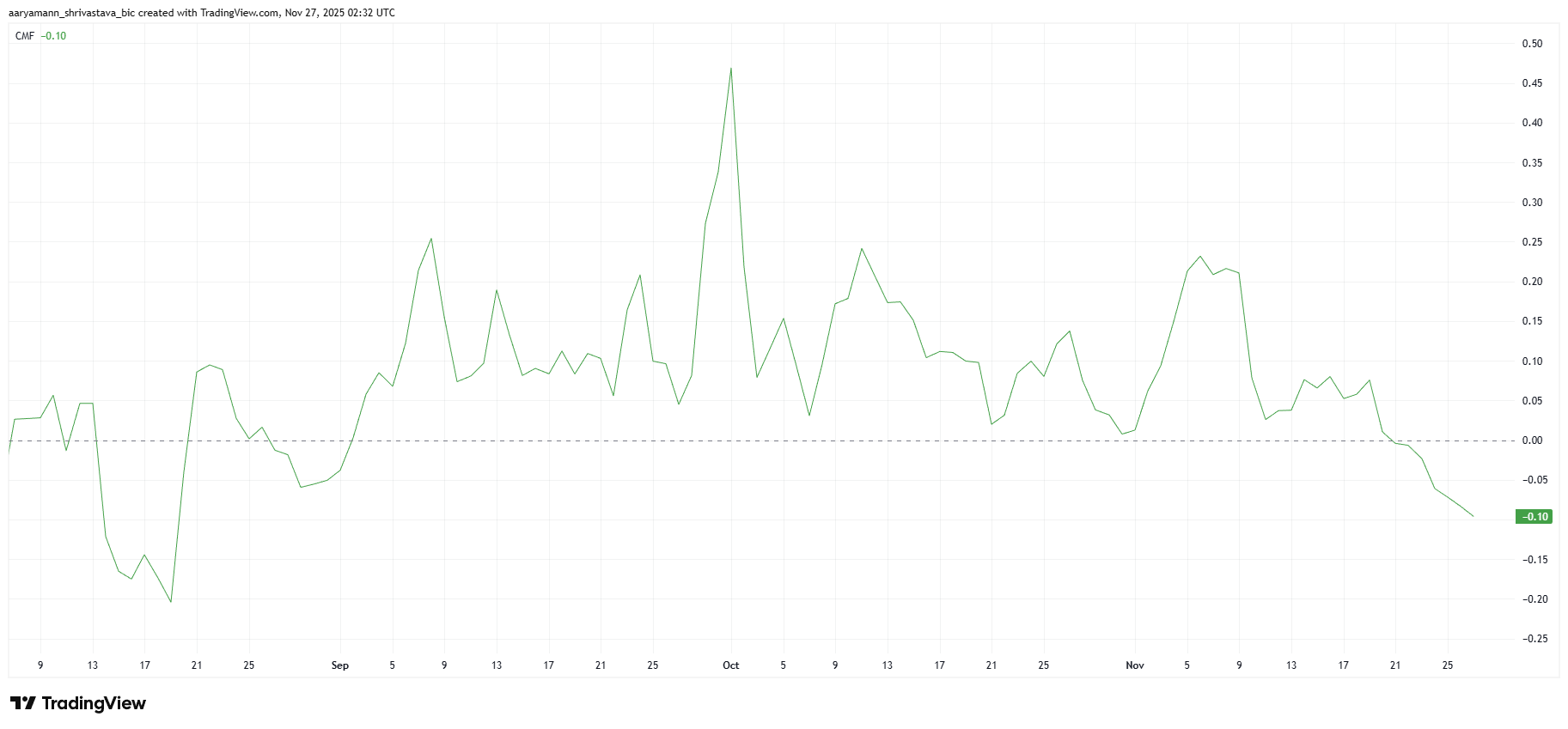

Market indicators show that Zcash has been facing persistent outflows. The Chaikin Money Flow (CMF) on the daily chart has been trending downward, reflecting weak demand from investors. As ZEC’s price failed to make meaningful gains, many holders began exiting positions to avoid deeper losses.

This sustained selling pressure has constrained attempts at recovery.

However, sentiment could shift significantly following Grayscale’s submission of the ZCSH Form S-3. This filing is a key regulatory step toward launching the first Zcash exchange-traded products (ETP), Grayscale stated.

If approved, a spot ZEC ETF would provide institutional-grade access and likely boost demand. Historically, ETF narratives have generated strong inflows, and Zcash could benefit similarly as investors anticipate greater market exposure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ZEC CMF. Source:

ZEC CMF. Source:

ZEC CMF. Source:

ZEC CMF. Source:

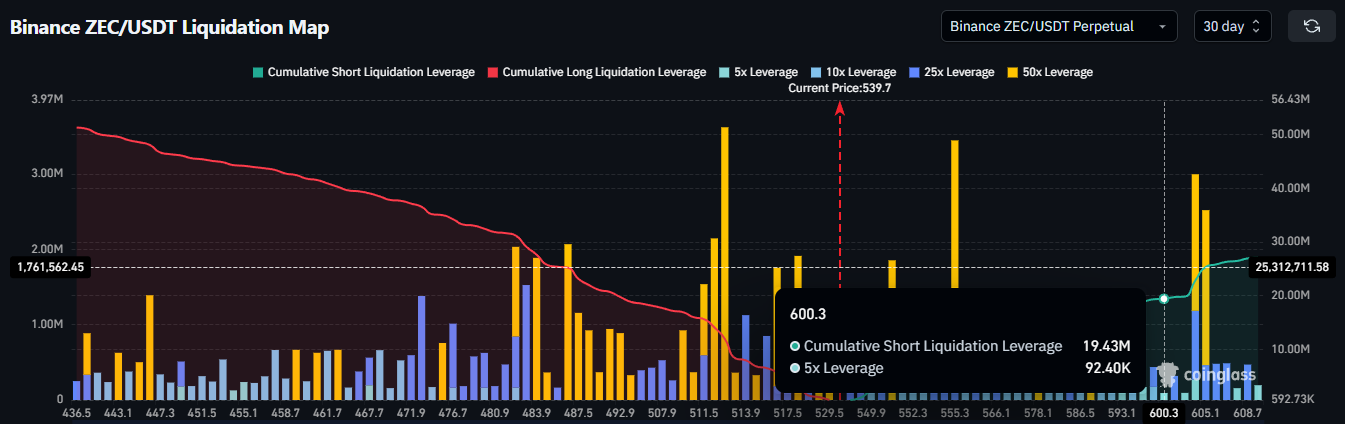

On-chain and derivatives data also signal potential upside. Zcash’s liquidation map shows that short traders may be in a vulnerable position. A modest price move toward the next resistance at $600 would trigger an estimated $19.43 million in short liquidations.

Such conditions create a delicate setup in which even small demand shocks — such as ETF-driven speculation — could generate outsized market reactions. If inflows return and shorts unwind, Zcash may experience a rapid upward surge.

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

ZEC Price Needs Support

ZEC is currently trading at $543, holding above the $520 support level while struggling to break above $600. This range has constrained the altcoin’s movement as investors wait for clearer signals from both market sentiment and regulatory developments.

If Grayscale’s filing revives investor confidence, ZEC may push toward $600. A successful breakout above that level could liquidate a significant number of short positions and also bring the altcoin closer to the $700 mark.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, if demand fails to return, Zcash may continue consolidating between $520 and $600. A breakdown below support could send the price toward $442, invalidating the bullish thesis and delaying recovery efforts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Infrastructure-Focused Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to upgrade infrastructure, targeting industrial growth via Xerox campus redevelopment and blight removal. - Xerox's 300-acre brownfield site transforms into a $650M industrial hub by 2025, creating 250 jobs at fairlife® dairy facility with enhanced utilities. - Blight removal at 600 Ridge Road and $1.8M road realignment projects unlock 300 acres for development, improving logistics and downtown connectivity. - WEDA and municipal coordination streamline land sale

BNB News Today: BNB Jumps 4%—Is This a Bullish Breakout or the Start of a Bearish Trend?

- BNB surged 4% on Nov 24, 2025, driven by a break above its 50-day SMA, signaling renewed buying pressure and bullish momentum. - Key technical levels at $860 (support) and $920 (20-day EMA) highlight potential for reversal or pullback, with volume/on-chain data critical for confirmation. - Market optimism stems from BNB Chain upgrades, DeFi growth, and macro factors like BNP Paribas' $1.15B buyback, indirectly boosting investor sentiment. - Future gains depend on ecosystem scalability, cross-chain adopti

Tech Issues Compel MegaETH to Return $500M After $1B Fundraising Mishap

- MegaETH refunds $500M after technical errors in KYC system and multisig transaction caused its $1B fundraising to exceed limits. - Project admits "sloppy execution" led to premature cap increase and user exploitation during pre-deposit phase. - Crypto community reacts with criticism over preventable mistakes, while praising transparency in disclosing failures. - Parallel Berachain case highlights industry risks through unusual $25M refund clause with unverified compliance requirements. - Incidents unders

Deciphering How Municipal Infrastructure Grants Influence Real Estate Growth and Investment Prospects

- New York's FAST NY program allocated $283M to transform 7,700 acres of industrial land into "shovel-ready" sites for high-tech manufacturing and semiconductors . - Infrastructure upgrades like water/sewer systems directly increased land values by 20% in industrial zones, attracting anchor tenants like Chobani and Micron . - 2025 tax reforms (100% bonus depreciation) amplified private investment, with Q3 2025 real estate deals hitting $310B as manufacturers targeted upgraded sites. - Critics highlight rur