The Zcash ETF Nobody Asked For: Why Critics Fear a Wall Street Takeover

Grayscale’s decision to convert its Zcash Trust into an ETF has ignited one of the most polarizing debates in the privacy-coin ecosystem. For Zcash advocates and decentralization purists, the move represents something far more consequential than a new investment product. To them, it signals a potential takeover of a privacy-focused cryptocurrency by the very institutions

Grayscale’s decision to convert its Zcash Trust into an ETF has ignited one of the most polarizing debates in the privacy-coin ecosystem.

For Zcash advocates and decentralization purists, the move represents something far more consequential than a new investment product. To them, it signals a potential takeover of a privacy-focused cryptocurrency by the very institutions it was designed to avoid.

A Privacy Coin in an ETF? Critics Say It Breaks the Mission

The filing, submitted on November 26, 2025, seeks to transform a trust holding over 394,000 ZEC, valued at roughly $197 million, into a fully regulated exchange-traded fund (ETF).

$ZEC is Encrypted Electronic Cash 🛡️ $ZEC helps make private, on-chain transactions possible.Grayscale Zcash Trust (Ticker: $ZCSH) is the only U.S publicly listed fund providing exposure solely to $ZEC through certain brokerage accounts.See important… pic.twitter.com/b29J7CE0iO

— Grayscale (@Grayscale) November 26, 2025

Eric Van Tassel, a user on X (Twitter), argues that a ZEC ETF is fundamentally incompatible with Zcash’s purpose.

“I hope ZEC never gets one, as once that happens, an asset is no longer decentralized,”Eric said, calling ETFs “a Trojan horse.”

Eric’s critique is not about ETFs as financial instruments; it is about the control structures they create. Unlike spot trading on crypto exchanges, ETFs concentrate influence among Wall Street firms that make trading, market-making, and custodial decisions.

For a privacy coin, that concentration is existential.

“An ETF effectively means that an asset value will be highly influenced and controlled by Wall Street,” Eric warned.

SEC filings show the Grayscale Zcash Trust controls about 2.4% of ZEC’s circulating supply, already giving the asset one of the highest institutional concentrations among privacy coins. Converting the trust to an ETF would further expand its influence.

The crypto industry has already seen the downside. When the Grayscale Bitcoin Trust (GBTC) converted to an ETF in January 2024, redemptions created intense sell-side pressure. The general sentiment is that a similar redemption wave could hit Zcash.

Data reinforces this concern, showing markets still remember the days when GBTC outflows repeatedly pushed Bitcoin lower. Eric argues those dynamics are no accident.

“The recent dump was influenced by these giant institutions that now control many of these assets… Their ultimate goal is to either destroy crypto or completely control it as a part of their CBDC agenda,” he added.

Meanwhile, the Grayscale Zcash Trust is already flashing warning signs.

- NAV/Share: $42.59

- Market Price: $35.05

- Discount: approximately 18%

Such a steep discount shows shareholders may be anticipating further price pressure, or at least are unwilling to pay full value for assets that may soon face ETF-linked selling pressure.

The trust currently manages $205.7 million, charges a 2.5% expense ratio, and has 4.83 million shares outstanding. High fees and regulatory ambiguity may explain why investors expect turbulence ahead.

Why Zcash Has Outperformed, And Why That Might End

Despite regulatory headwinds, ZEC has significantly outperformed several major altcoins in recent months. Critics argue this is precisely because it is not yet under ETF control, leaving its price action more organic and less susceptible to institutional flows.

“The fact that Zcash does not currently have an ETF might be a good reason why Zcash has been moving so well,” Erin noted.

He even speculates that Bitcoin’s ETF-driven structure has capped its upside:

“I see $140,000 to $150,000 max out of Bitcoin this cycle… Money will roll into the assets that these ETFs don’t control,” he indicated.

The SEC, not the Electric Coin Company (which develops Zcash), will determine the fate of the Zcash ETF. If approved, it would mark the first-ever ETF tied to a major privacy coin, potentially rewriting the regulatory path for similar assets.

But the implications go beyond policy. Zcash was built for financial privacy amid a surveillance era.

The question now is whether that mission can withstand the gravitational pull of Wall Street, or whether, as critics warn, an ETF would transform ZEC from a decentralized, privacy-focused tool into a tightly managed institutional asset.

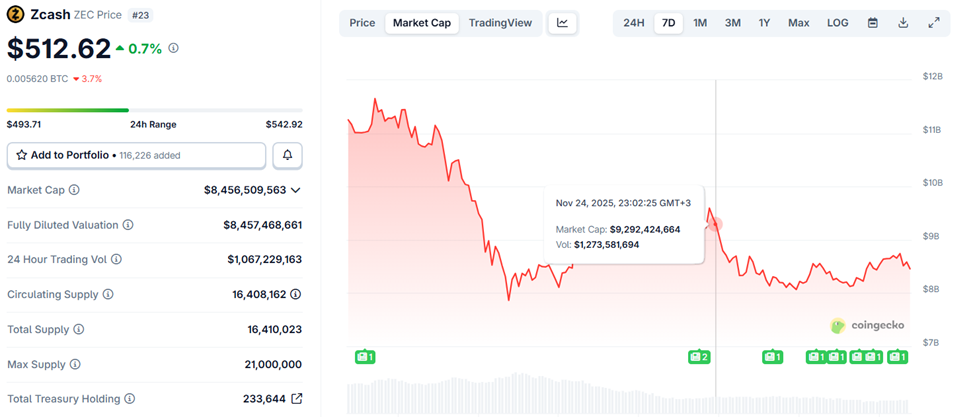

Zcash (ZEC) Price Performance. Source:

CoinGecko

Zcash (ZEC) Price Performance. Source:

CoinGecko

Perhaps, these fears explain why Zcash’s ZEC token is only up by a modest 0.7% in the last 24 hours despite Grayscale’s expressed interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Infrastructure-Focused Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to upgrade infrastructure, targeting industrial growth via Xerox campus redevelopment and blight removal. - Xerox's 300-acre brownfield site transforms into a $650M industrial hub by 2025, creating 250 jobs at fairlife® dairy facility with enhanced utilities. - Blight removal at 600 Ridge Road and $1.8M road realignment projects unlock 300 acres for development, improving logistics and downtown connectivity. - WEDA and municipal coordination streamline land sale

BNB News Today: BNB Jumps 4%—Is This a Bullish Breakout or the Start of a Bearish Trend?

- BNB surged 4% on Nov 24, 2025, driven by a break above its 50-day SMA, signaling renewed buying pressure and bullish momentum. - Key technical levels at $860 (support) and $920 (20-day EMA) highlight potential for reversal or pullback, with volume/on-chain data critical for confirmation. - Market optimism stems from BNB Chain upgrades, DeFi growth, and macro factors like BNP Paribas' $1.15B buyback, indirectly boosting investor sentiment. - Future gains depend on ecosystem scalability, cross-chain adopti

Tech Issues Compel MegaETH to Return $500M After $1B Fundraising Mishap

- MegaETH refunds $500M after technical errors in KYC system and multisig transaction caused its $1B fundraising to exceed limits. - Project admits "sloppy execution" led to premature cap increase and user exploitation during pre-deposit phase. - Crypto community reacts with criticism over preventable mistakes, while praising transparency in disclosing failures. - Parallel Berachain case highlights industry risks through unusual $25M refund clause with unverified compliance requirements. - Incidents unders

Deciphering How Municipal Infrastructure Grants Influence Real Estate Growth and Investment Prospects

- New York's FAST NY program allocated $283M to transform 7,700 acres of industrial land into "shovel-ready" sites for high-tech manufacturing and semiconductors . - Infrastructure upgrades like water/sewer systems directly increased land values by 20% in industrial zones, attracting anchor tenants like Chobani and Micron . - 2025 tax reforms (100% bonus depreciation) amplified private investment, with Q3 2025 real estate deals hitting $310B as manufacturers targeted upgraded sites. - Critics highlight rur