Solana News Update: Institutional Investments Boost Solana Despite Security Concerns and Negative Market Trends

- Analysts predict Solana (SOL) will likely stay below $150 due to bear flag patterns and weak momentum, with key support at $140 potentially triggering a 30% drop to $99 if breached. - Despite technical headwinds, Solana's ETF inflows ($531M in first week) outpace Bitcoin and Ethereum , driven by 7% staking yields and lower fees compared to Bitcoin's $900M outflows. - Security risks persist after Upbit halted Solana withdrawals following a $37M hack, exposing vulnerabilities in hot wallet storage while CM

Solana Faces Technical and Market Challenges

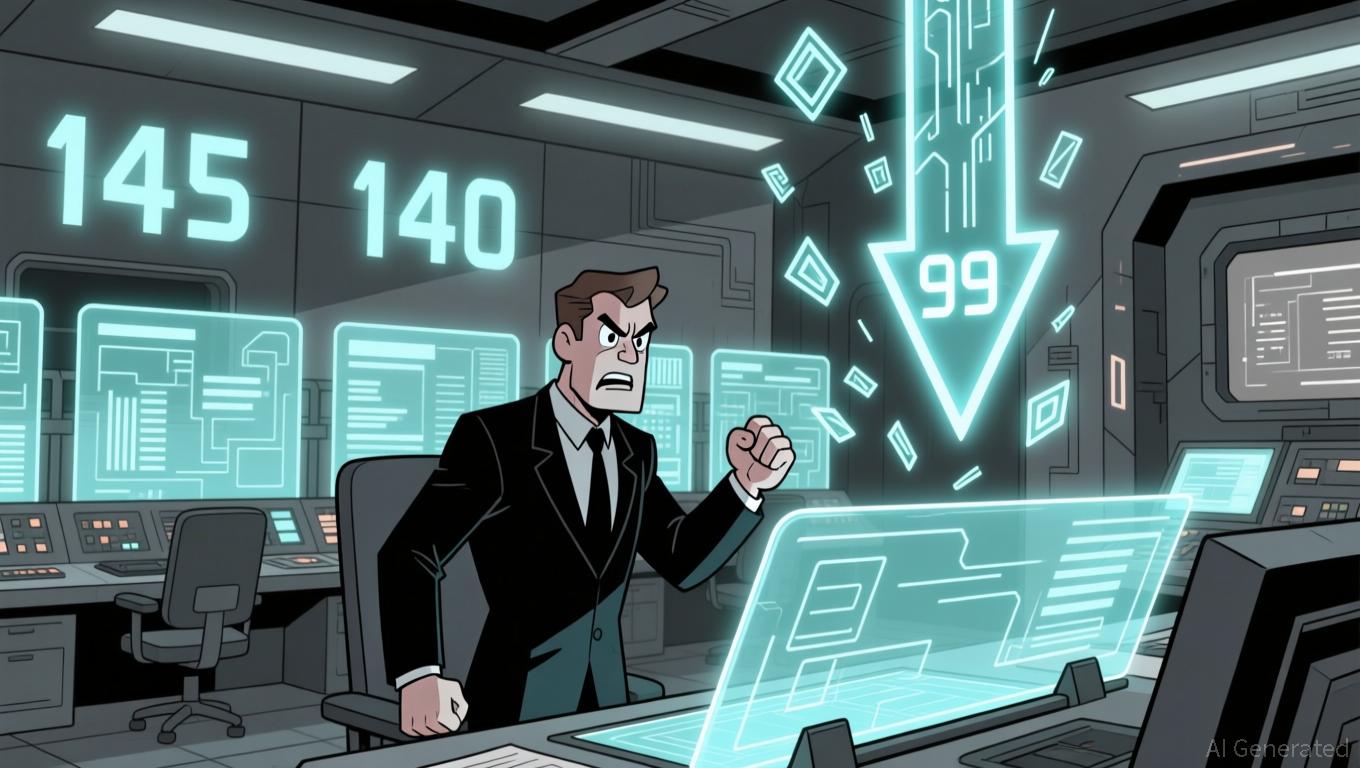

Solana (SOL) is currently struggling to break free from a period of restricted price movement, with experts predicting that it is unlikely to climb above $150 in the short term. The six-hour chart reveals a bear flag pattern, which emerged after SOL fell sharply from $170 in November. This pattern suggests that the downward trend may continue, especially as the price has repeatedly tested crucial support near $140. Should SOL fall below this level, analysts warn that it could trigger a significant decline, potentially dropping as low as $99—a correction of about 30% from recent peaks.

Trader MR Ape has highlighted the importance of the $145 resistance level, pointing out that previous attempts to break above it have failed and that momentum appears to be fading. According to him, SOL is at a pivotal moment, and the market’s next move will be determined soon. This underscores the current fragility of bullish sentiment, particularly as volatility remains high.

Institutional Investment Grows Despite Obstacles

Despite these technical hurdles, institutional interest in Solana has been on the rise. Inflows into Solana-based ETFs have surpassed those of Bitcoin and Ethereum, with net inflows reaching $531 million during the first week of its spot ETF debut and additional weekly increases of over $58 million. This surge is partly due to Solana’s attractive staking rewards of 7% and its lower transaction fees compared to Bitcoin, which, by contrast, experienced $900 million in outflows in a single day in November as its price dipped below $95,000.

Further evidence of institutional demand comes from CME Group’s upcoming launch of spot-quoted futures for both XRP and SOL, scheduled for December 15. These new contracts are designed to track real-time spot prices and offer lower margin requirements, making them more accessible to large investors, according to industry experts.

Security Incidents Raise Concerns

Security remains a significant concern for Solana. South Korea’s leading crypto exchange, Upbit, temporarily halted all Solana-related withdrawals following a $37 million hack on November 27. The attack targeted SOL, USDC, and various DeFi tokens, prompting the exchange to freeze deposits and withdrawals and move assets to cold storage. Upbit has promised to reimburse all affected users from its reserves, which helped calm fears but also highlighted ongoing vulnerabilities in hot wallet security. This incident occurred as Dunamu, Upbit’s parent company, was finalizing a $10.3 billion merger with Naver, drawing further attention to the exchange’s ability to withstand operational shocks.

Outlook: Uncertainty Ahead for Solana

The outlook for Solana remains mixed. While strong ETF inflows and the introduction of new CME products point to increasing institutional adoption, technical signals and security issues continue to weigh on sentiment. If SOL fails to hold above $140, it could trigger renewed selling pressure, potentially aligning with the bear flag’s target of $99. On the other hand, a decisive move above $145 might restore some optimism, though analysts caution that upward momentum is currently lacking. The next few weeks will be crucial in determining whether Solana can balance the excitement of innovation with the realities of a rapidly evolving market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Infrastructure-Focused Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to upgrade infrastructure, targeting industrial growth via Xerox campus redevelopment and blight removal. - Xerox's 300-acre brownfield site transforms into a $650M industrial hub by 2025, creating 250 jobs at fairlife® dairy facility with enhanced utilities. - Blight removal at 600 Ridge Road and $1.8M road realignment projects unlock 300 acres for development, improving logistics and downtown connectivity. - WEDA and municipal coordination streamline land sale

BNB News Today: BNB Jumps 4%—Is This a Bullish Breakout or the Start of a Bearish Trend?

- BNB surged 4% on Nov 24, 2025, driven by a break above its 50-day SMA, signaling renewed buying pressure and bullish momentum. - Key technical levels at $860 (support) and $920 (20-day EMA) highlight potential for reversal or pullback, with volume/on-chain data critical for confirmation. - Market optimism stems from BNB Chain upgrades, DeFi growth, and macro factors like BNP Paribas' $1.15B buyback, indirectly boosting investor sentiment. - Future gains depend on ecosystem scalability, cross-chain adopti

Tech Issues Compel MegaETH to Return $500M After $1B Fundraising Mishap

- MegaETH refunds $500M after technical errors in KYC system and multisig transaction caused its $1B fundraising to exceed limits. - Project admits "sloppy execution" led to premature cap increase and user exploitation during pre-deposit phase. - Crypto community reacts with criticism over preventable mistakes, while praising transparency in disclosing failures. - Parallel Berachain case highlights industry risks through unusual $25M refund clause with unverified compliance requirements. - Incidents unders

Deciphering How Municipal Infrastructure Grants Influence Real Estate Growth and Investment Prospects

- New York's FAST NY program allocated $283M to transform 7,700 acres of industrial land into "shovel-ready" sites for high-tech manufacturing and semiconductors . - Infrastructure upgrades like water/sewer systems directly increased land values by 20% in industrial zones, attracting anchor tenants like Chobani and Micron . - 2025 tax reforms (100% bonus depreciation) amplified private investment, with Q3 2025 real estate deals hitting $310B as manufacturers targeted upgraded sites. - Critics highlight rur