BitMine’s Tom Lee and On-Chain Data Signal a Big December Move for Bitcoin

Bitcoin may be approaching a decisive December as liquidity conditions tighten and on-chain metrics shift. BitMine Chairman Tom Lee says the market has been “limping” since the October 10 liquidation shock, but argues the setup now supports a major move before year-end. Recent on-chain trends and exchange-collateral data point to similar pressure building beneath the

Bitcoin may be approaching a decisive December as liquidity conditions tighten and on-chain metrics shift. BitMine Chairman Tom Lee says the market has been “limping” since the October 10 liquidation shock, but argues the setup now supports a major move before year-end.

Recent on-chain trends and exchange-collateral data point to similar pressure building beneath the surface.

Liquidity Damage Still Defines the Market

Lee told CNBC that the October event severely damaged market-maker balance sheets.

He described these firms as the “central banks” of crypto, responsible for depth, spreads, and inventory. When their balance sheets shrink, liquidity contracts for weeks.

WATCH: Tom Lee says “Bitcoin could hit a new all-time high before year-end”

— BeInCrypto (@beincrypto) November 27, 2025

This matches market performance since early October. Bitcoin has dropped almost 30% from its $126,000 peak.

Meanwhile, November has delivered one of the worst monthly performances for both price and ETF flows in years.

Market makers withdrew risk capital after the liquidation wave erased roughly $19 billion of leveraged positions.

Order-book depth fell sharply across major exchanges, creating air pockets that amplified downside moves. Under such conditions, Bitcoin and Ethereum tend to react earlier to macro stress than equities.

Despite this damage, Lee expects a strong December rally, citing a potential dovish shift from the Federal Reserve.

“Bitcoin makes its best moves in 10 days every year, I think some of those days are still gonna happen before year end,” said Tom Lee.

On-Chain Metrics Show Sellers Losing Control

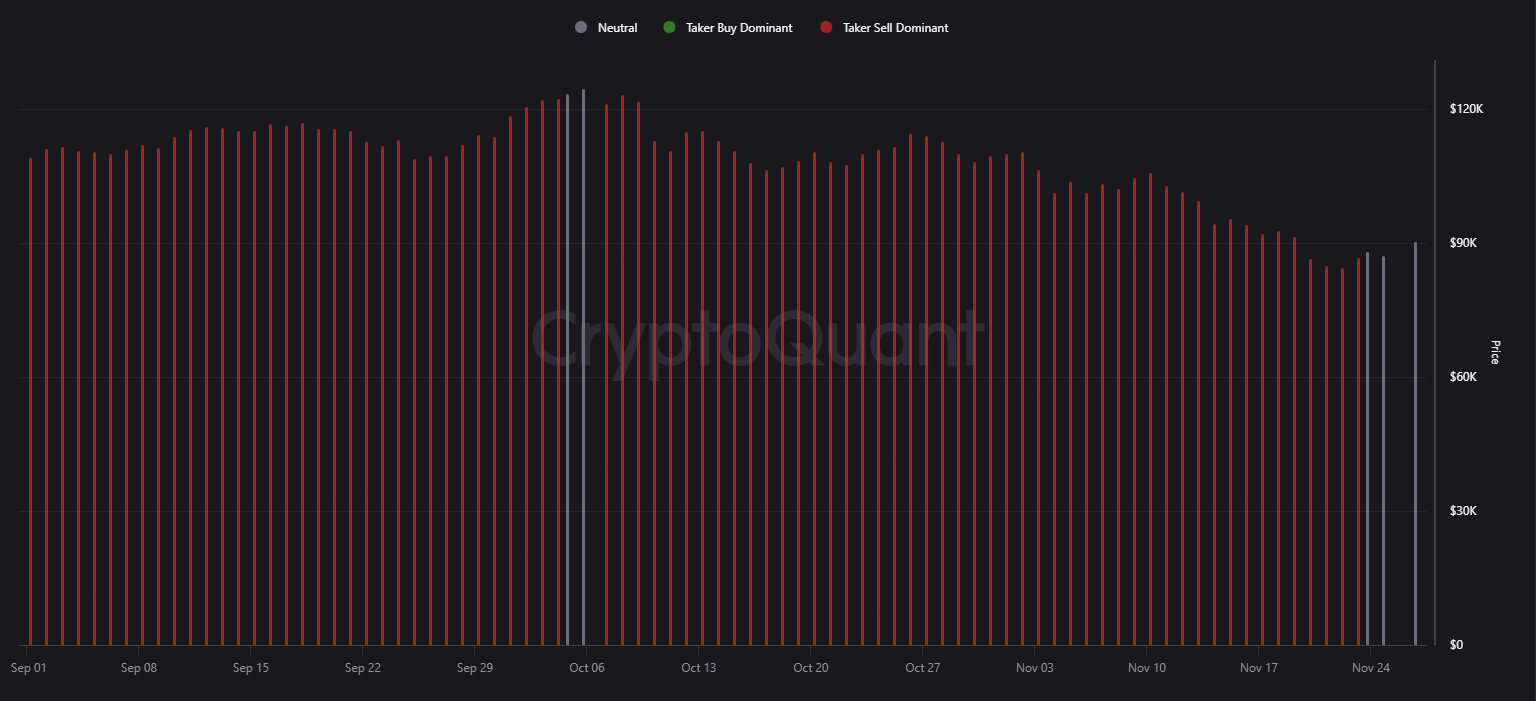

Bitcoin’s 90-day Spot Taker CVD has shifted from persistent sell dominance to a neutral stance. The indicator tracks aggressive market orders on spot exchanges.

Bitcoin Spot Taker CVD(Cumulative Volume Delta, 90-day). Source:

Bitcoin Spot Taker CVD(Cumulative Volume Delta, 90-day). Source:

Red bars dominated from early September through mid-November, showing sustained taker-sell pressure.

The recent move to neutral marks a break in that pattern. It suggests the aggressive selling phase has exhausted.

However, it does not show strong buyer dominance. Instead, the market has entered a balanced phase typical of late-cycle bear markets.

Price remains well below October levels, but the absence of persistent taker-sell pressure signals improved stability.

The shift aligns with the broader leverage reset seen in futures markets, where funding rates have moved near zero.

Borrowing Trends Point to Strong Hands, but Fragile Leverage

CryptoQuant data shows Nexo users prefer borrowing against Bitcoin rather than selling it. BTC accounts for 53% to 57% of all collateral on the platform. That range has held for months despite the drawdown.

' Nexo users aren’t selling their Bitcoin, they’re borrowing against it.BTC now accounts for 54.3% of all collateral on the platform, holding a steady 53–57% range for months.It confirms Bitcoin is the dominant asset users leverage when they need liquidity.

— CryptoQuant.com (@cryptoquant_com) November 27, 2025

This behavior reduces immediate selling pressure. It also confirms that long-term holders continue to treat Bitcoin as their primary liquidity source.

Yet it adds another layer of vulnerability. If Bitcoin drops further, collateralized positions face liquidation risk.

Combined with thin order books, any forced selling could produce outsized volatility. This dynamic reflects late-bear fragility rather than early-bull strength.

A Market Caught Between Exhaustion and Low Liquidity

Current market structure reflects a transition rather than a clean reversal. ETF outflows, damaged liquidity, and macro uncertainty keep pressure on prices.

However, on-chain selling has cooled, and structural holders continue to defend positions.

The result is an environment where small catalysts can produce large moves.

🚨TOM LEE: YEAR-END RALLY IS COMINGDespite a brutal six weeks, Tom Lee says a STRONG December rally is on deck, backed by by a dovish incoming Fed pivot.

— Coin Bureau (@coinbureau) November 27, 2025

A dovish Fed pivot would likely hit thin order books and accelerate a rebound. Another macro shock could trigger renewed deleveraging.

Lee’s view aligns with this setup. The market has stopped bleeding, but it remains fragile. Bitcoin has a history of delivering double-digit moves in compressed periods, especially after aggressive liquidations.

As December approaches, both liquidity conditions and on-chain data suggest the next large move is near.

The direction will depend on macro signals and ETF flows rather than sentiment alone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.