Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

Members of the Bitcoin community and supporters of Strategy, the largest corporate holder of BTC, are criticizing JPMorgan’s proposed Bitcoin-backed notes, accusing the bank of spreading fear, uncertainty and doubt about Strategy and other crypto treasury firms.

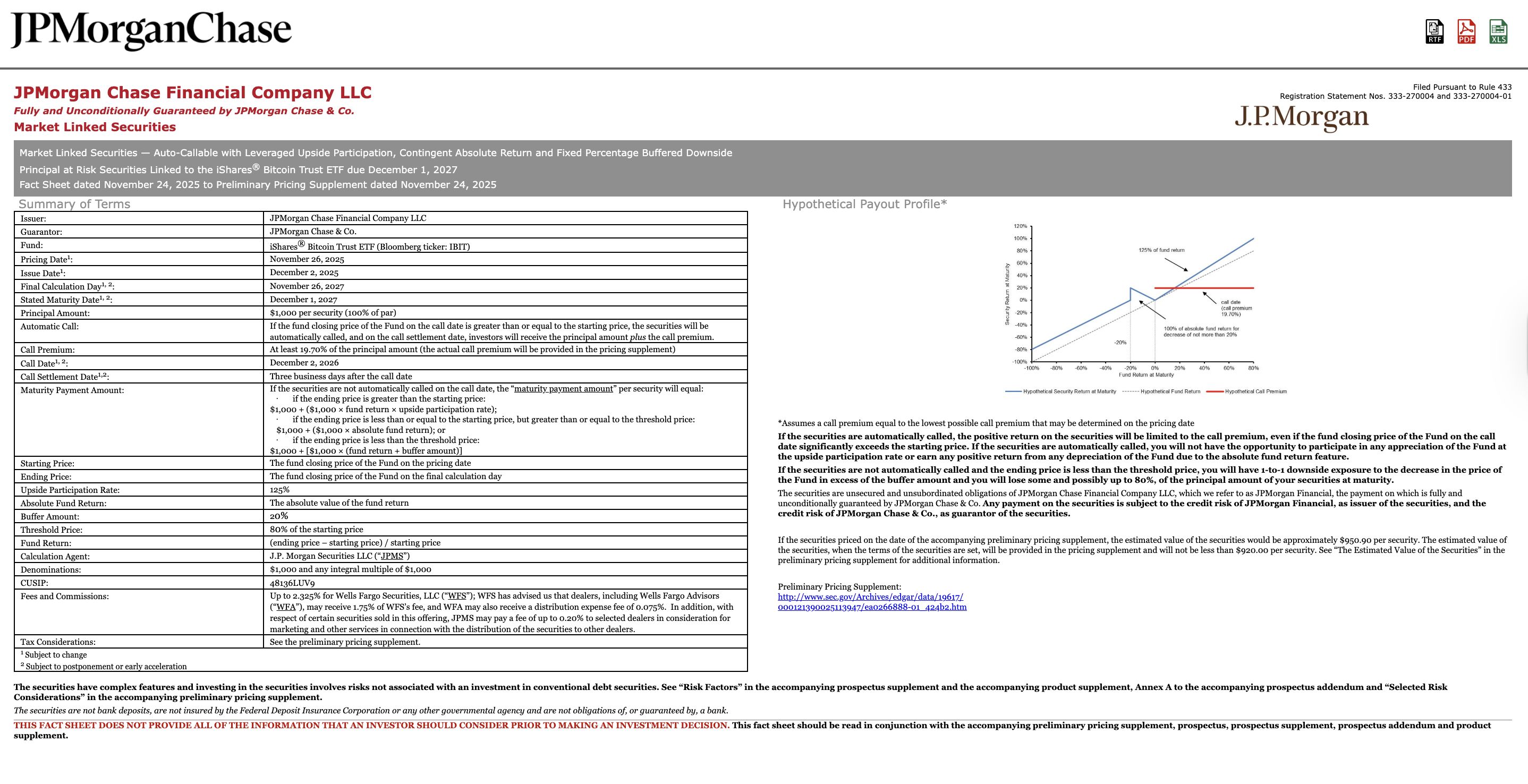

JPMorgan’s notes are a leveraged investment product tied to the price of Bitcoin (BTC). The product tracks BTC but amplifies the outcome, giving holders 1.5 times the gains — or the losses — through December 2028. The notes are slated for a December 2025 launch, according to an SEC filing.

The move drew sharp criticism from the Bitcoin community, with many saying that JPMorgan is now a direct competitor to BTC treasury companies and has an incentive to marginalize companies like Strategy to promote its own structured financial product.

“Saylor opened the door to the $300 trillion bond market and $145 trillion fixed income market. Now, JP Morgan is launching Bitcoin-backed bonds to compete,” said a Bitcoiner on X, adding that “the same institutions attacking MSTR are copying the strategy.”

Bitcoin advocate Simon Dixon also noted that JPMorgan’s upcoming product exists “to trigger margin calls on Bitcoin-backed loans,” claiming that it will “force sell pressure from Bitcoin treasury companies in down markets.”

On X, crypto enthusiasts and Strategy supporters are now calling for a boycott of JPMorgan, encouraging fellow Bitcoiners to close accounts at the financial services giant and sell any shares in the company they might own.

MSCI rule change proposal triggers clash

The backlash against JPMorgan began when MSCI, formerly Morgan Stanley Capital International, a company that manages stock indexes and sets the criteria for index inclusion, proposed a policy shift excluding treasury companies from its products.

The proposed shift, set to take effect in January, bars crypto treasury companies with 50% or more of their assets in cryptocurrencies from inclusion in the index.

JPMorgan shared the proposed policy shift in a November research note, drawing sharp criticism from the BTC community and Strategy investors.

Excluding crypto treasury companies from stock indexes deprives them of passive capital flows and could force these companies to sell off their crypto holdings to qualify for index inclusion, driving asset prices down further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: IMF Cautions That Tokenized Markets Could Face Collapse Without International Cooperation

- IMF warns tokenized markets risk destabilizing flash crashes due to rapid growth and interconnected smart contracts. - XRP highlighted as potential cross-border payment solution but not endorsed, alongside Stellar and Bitcoin-Lightning hybrid models. - Global regulators intensify oversight of tokenized assets, with ESMA, SEC, and central banks addressing governance and liquidity risks. - IMF stresses urgent need for coordinated policy frameworks to prevent fragmentation and systemic vulnerabilities in ev

Solana News Today: Avail's Nexus Mainnet: A Borderless Blockchain Ecosystem

- Avail launches Nexus Mainnet, a cross-chain infrastructure unifying liquidity across Ethereum , Solana , and EVM-compatible chains. - The platform uses intent-solver architecture and Avail DA verification to replace bridges, enabling seamless asset movement and shared liquidity. - Integrations with major chains and partners like Lens Protocol aim to streamline DeFi and trading, while $AVAIL token coordinates cross-chain transactions. - With Infinity Blocks targeting 10 GB blocks, Nexus addresses liquidit

Cardano News Today: ETFs Turn to Alternative Coins While ADA Stumbles and XLM Gains Momentum with ISO Compliance

- Franklin ETF expands holdings to include ADA , XLM, XRP , and others, reflecting institutional altcoin diversification driven by ISO 20022 compliance and SEC-approved rules. - Cardano faces short-term bearish pressure with 31% monthly decline, contrasting Stellar's bullish 2025/2030 price projections ($1.29–$6.19) fueled by RWA and cross-border payment demand. - ISO 20022 adoption (97% payment instructions) positions ADA/XLM as bridges between DeFi and traditional finance, with Ripple's ILP enhancing XLM

AI Crypto Faces a Pivotal Turn: Regulatory Demands Surpass Aspirations in 2025