Crypto Market Hints at a Two-Year Post-Thanksgiving Pattern Returning

The crypto market is recovering ahead of Thanksgiving, with momentum and on-chain data echoing the same year-end pattern seen in 2022 and 2023.

The crypto market is showing its first meaningful recovery after a harsh November sell-off, and several metrics now resemble the same conditions seen around Thanksgiving in both 2022 and 2023.

Bitcoin has reclaimed the $91,000 level, ETH is back above $3,000, and the wider market has returned to a cautious green. This bounce comes as traders enter a long US holiday weekend that has historically set the tone for December.

Market Indicators Turn Positive After Weeks of Fear

Fear and Greed Index data shows sentiment improving from 11 last week to 22 today, although it remains in “Extreme Fear.”

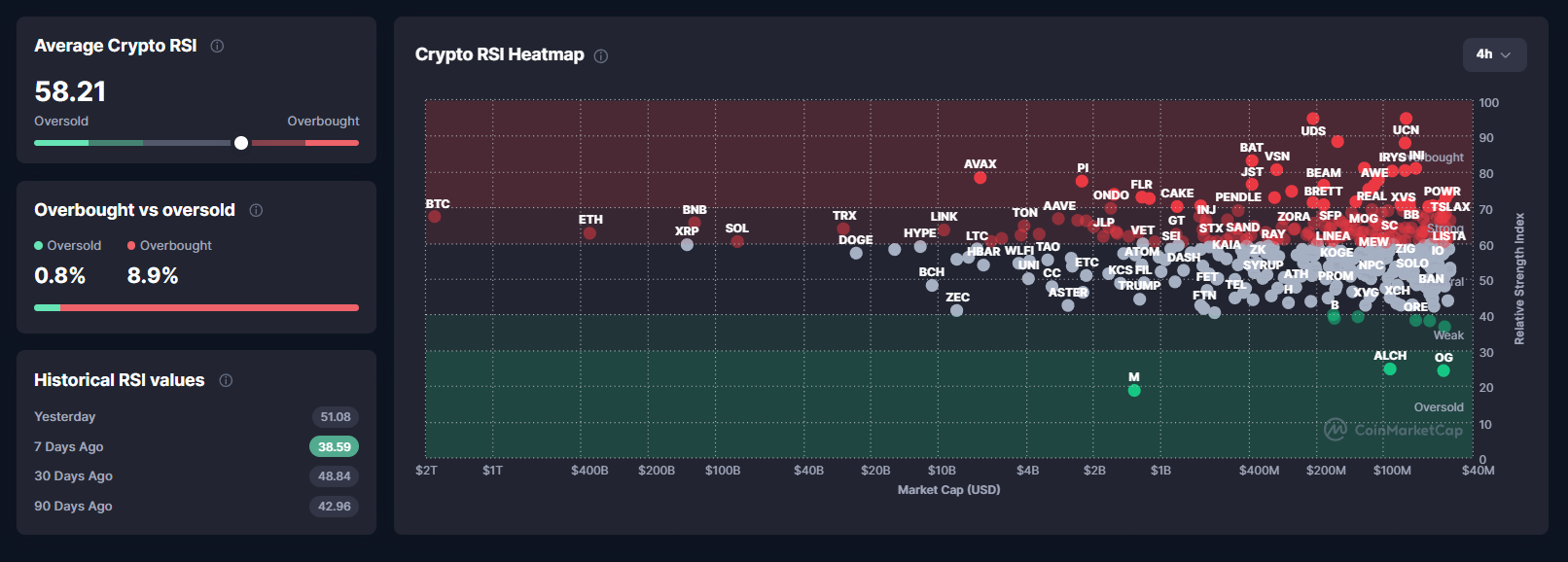

This shift aligns with a steady rise in average crypto RSI, which climbed from 38.5 seven days ago to 58.3 today. The reading signals growing strength after deep oversold conditions earlier in the month.

Average Crypto RSI On Thanksgiving 2025. Source: CoinMarketCap

Average Crypto RSI On Thanksgiving 2025. Source: CoinMarketCap

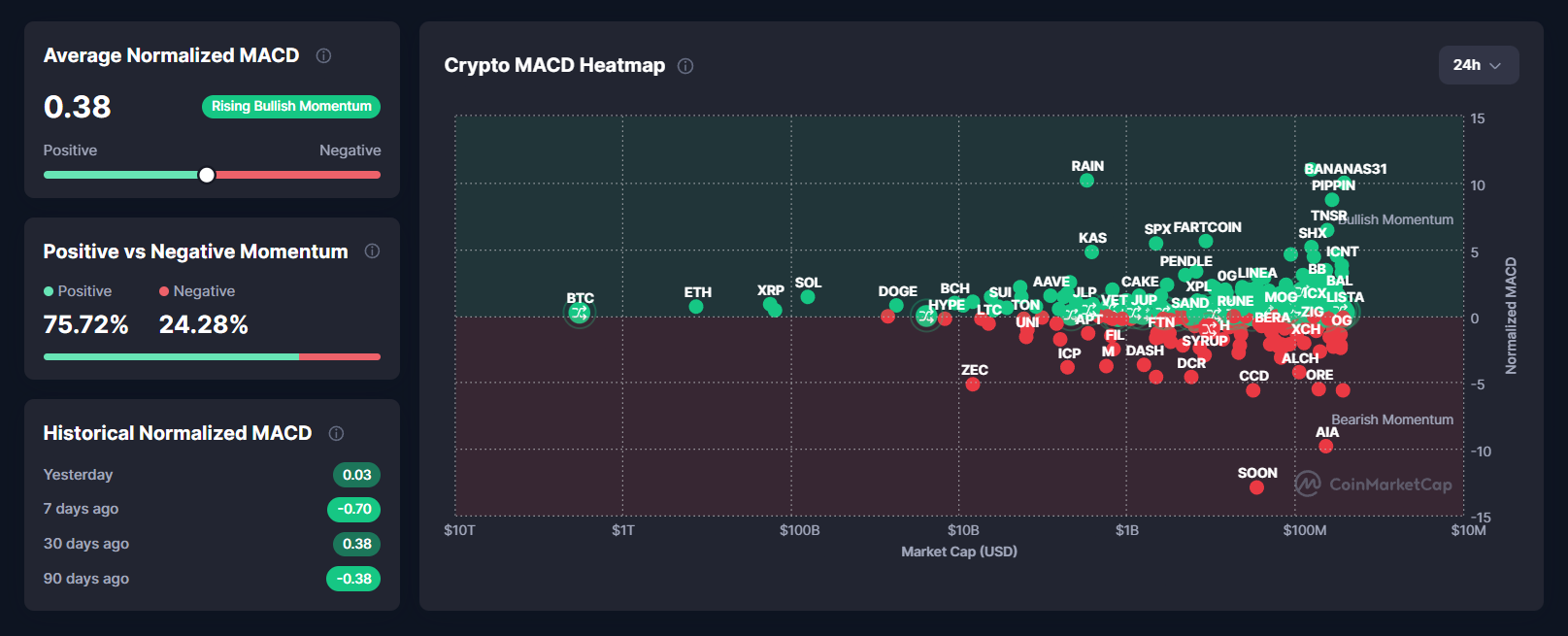

Momentum also flipped. The normalized MACD across major assets has turned positive for the first time since early November.

About 82% of tracked cryptocurrencies now show positive trend momentum. Bitcoin, Ethereum, and Solana appear in the bullish zone of CoinMarketCap’s MACD heatmap.

Price action supports this shift. Bitcoin is up 6% on the week. Ethereum has gained nearly 8%. Solana climbed almost 8% in the same period.

The market cap has grown to $3.21 trillion, rising 1.1% over the last 24 hours.

Average Crypto MACD On Thanksgiving 2025. Source: CoinMarketCap

Average Crypto MACD On Thanksgiving 2025. Source: CoinMarketCap

A Familiar Post-Thanksgiving Setup Has Emerged

The current recovery mirrors a structure seen twice before. In both 2022 and 2023, the market entered Thanksgiving after a sharp drawdown and then stabilized into December.

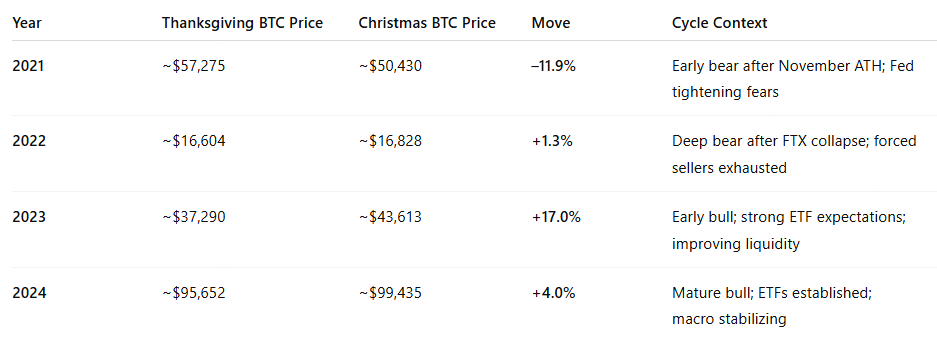

In 2022, Bitcoin fell to near $16,000 following the FTX collapse. By Thanksgiving, selling pressure had exhausted, and the market traded sideways into Christmas.

It was a deep bear consolidation phase rather than a rally.

In 2023, Bitcoin entered Thanksgiving at $37,000 after a steep September-October correction. Strong ETF expectations and improving liquidity conditions pushed BTC to $43,600 by Christmas. It was a classic early-bull December rally.

Bitcoin Performance Between Thanksgiving and Christmas (2021–2024)

Bitcoin Performance Between Thanksgiving and Christmas (2021–2024)

This year, the pattern again repeats one familiar element: the November crash came early, and by Thanksgiving, selling momentum had eased.

Bitcoin’s 90-day Taker CVD has shifted from persistent sell dominance to neutral, signalling that aggressive sellers have stepped back. Funding rates and leverage data support the same interpretation.

Liquidity Damage Still Shapes the Current Cycle

BitMine chairman Tom Lee described the market as “limping” after the October 10 liquidation shock.

He said market makers were forced to shrink their balance sheets, weakening market depth across exchanges. That fragility persisted through November.

However, Lee also argued that Bitcoin tends to make its biggest moves in short bursts when liquidity recovers. He expects a strong December rally if the Federal Reserve signals a softer stance.

On-chain data aligns with this view. Nexo collateral figures show users still prefer borrowing against Bitcoin rather than selling it.

BTC makes up more than 53% of all collateral on the platform. This behavior suppresses immediate sell pressure, helping stabilize spot markets. But it also adds hidden leverage that could amplify future volatility.

We May Be Entering a Two-Year Holiday Pattern

Three factors now look similar to the post-Thanksgiving conditions of 2022 and 2023:

- Seller exhaustion: Taker CVD shifting to neutral signals the end of forced selling for now.

- Momentum recovery: MACD and RSI metrics have reversed sharply after bottoming earlier in November.

- Liquidity stabilization: Market makers are still wounded, but volatility has cooled, and ETF outflows have slowed.

If this pattern continues, December could produce one of two outcomes based on the last two years:

- A sideways consolidation like 2022 if liquidity remains thin.

- A short, sharp rally like 2023 if macro conditions turn supportive.

The deciding factor will likely be the Federal Reserve’s tone in early December and the behavior of Bitcoin ETF flows. Thin liquidity means even moderate inflows could move prices quickly.

December May Deliver a Large Move in Either Direction

The market has entered a transition phase rather than a clear trend. Sentiment is still extremely fearful, but price and momentum indicators show recovery.

Bitcoin’s position above $91,000 suggests buyers are willing to defend key levels, yet order-book depth remains weak.

With selling pressure fading and technical momentum rising, the environment now resembles the same post-Thanksgiving setups that marked the last two end-of-year cycles.

If the pattern holds, December will not be flat. It will likely bring a decisive move as liquidity conditions shift.

The direction, however, will depend less on crypto narratives and more on macro signals and ETF demand in the coming weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Webster, NY: A Center for Revitalization and Growth Fueled by Infrastructure

- Webster , NY, leverages public-private partnerships to drive real estate and industrial growth through $4.5M downtown revitalization and $9.8M infrastructure upgrades. - Brownfield Opportunity Area designations and waterfront projects unlock underused land, attracting $650M fairlife® facility and mixed-use developments with state-funded remediation. - Strategic infrastructure investments at Xerox campus and Sandbar Waterfront enhance industrial readiness and property values, creating scalable opportuniti

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar