Global Easing Hits 35-Year High—So Why Is Bitcoin Still Flat?

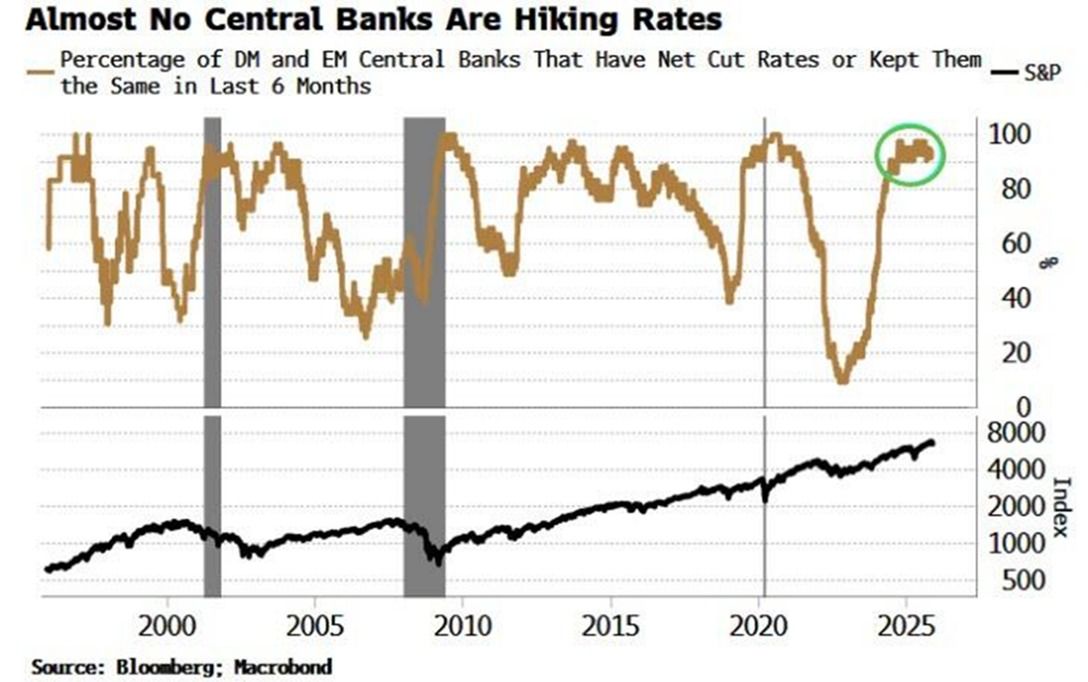

More than 90% of the world’s central banks have cut rates or held them steady for 12 straight months, a pattern rarely seen in the past 35 years. This easing cycle has produced 316 rate cuts over two years, topping even the 313 seen during the 2008–2010 financial crisis. Despite this global expansion of liquidity,

More than 90% of the world’s central banks have cut rates or held them steady for 12 straight months, a pattern rarely seen in the past 35 years. This easing cycle has produced 316 rate cuts over two years, topping even the 313 seen during the 2008–2010 financial crisis.

Despite this global expansion of liquidity, Bitcoin has decoupled from growth in the money supply since mid-2025. This trend prompts questions about when the leading cryptocurrency will respond to the influx of capital.

Unprecedented Monetary Easing Since the Pandemic

Global monetary policy has entered its most aggressive easing phase since the COVID-19 pandemic, based on data from The Kobeissi Letter. Fewer than 10% of central banks have increased rates, with most cutting or maintaining policy. This trend has persisted for a year, marking a rare global monetary pivot.

The extent of this easing is clear when looking at cumulative rate cuts. From 2023 through early 2025, central banks in both developed and emerging markets have cut rates 316 times—surpassing the 313 cuts between 2008 and 2010, when the global financial system was under severe duress.

Chart showing the percentage of central banks that have cut or held rates over the last 6 months. Source: The Kobeissi Letter

Chart showing the percentage of central banks that have cut or held rates over the last 6 months. Source: The Kobeissi Letter

Historically, coordinated monetary easing has preceded notable increases in asset prices, especially in risk assets such as stocks and cryptocurrencies. Yet Bitcoin’s response to this liquidity wave has been much more muted than in previous cycles. While earlier research found a 0.94 correlation between Bitcoin’s price and the global M2 money supply (from May 2013 to July 2024), that connection appears temporarily weakened now.

This decoupling raises questions about timing and market drivers. Analysts observe that Bitcoin often lags global liquidity increases by 60 to 70 days. Should this historical pattern persist, the ongoing monetary expansion could delay a Bitcoin rally until late 2025 or 2026.

2026 Financial Shock Scenario

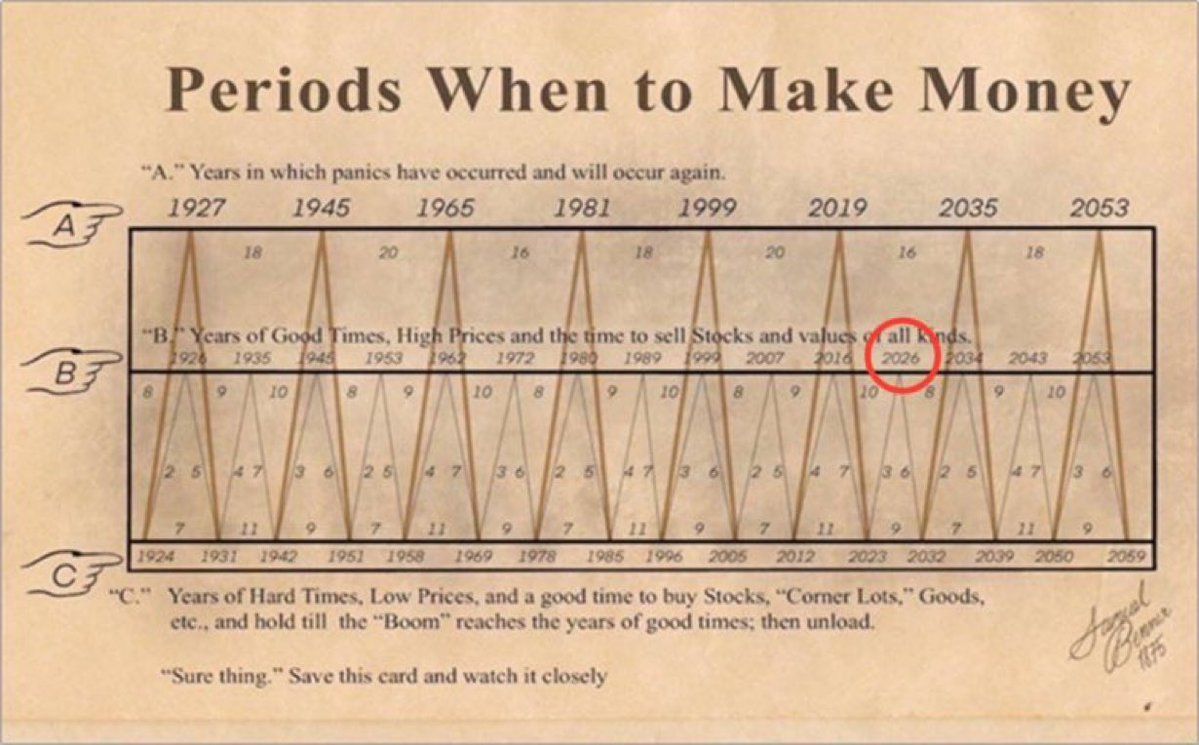

Market watchers outline a possible scenario unfolding through 2028, with 2026 as a turning point. This matches the historical cycles described by the Benner Cycle, a 19th-century market timing model that has surprisingly forecast many financial pivots.

The Benner Cycle chart highlights 2026 as a year of ‘good times’ and a potential market peak. Source: Quinten François

The Benner Cycle chart highlights 2026 as a year of ‘good times’ and a potential market peak. Source: Quinten François

According to market analyst NoLimitGains, several global stress points are converging toward 2026. Fault lines include US Treasury funding issues, Japan’s yen carry-trade risk, and China’s heavy credit leverage. Disruption along any of these would create global shocks, but simultaneous problems could drive a systemic crisis.

Phase one is defined by a Treasury funding shock, possibly triggered by weak US bond auctions. The US faces record debt issuance in 2026 as deficits grow and foreign demand declines. Weak auctions and fading indirect bids echo the UK’s 2022 gilt crisis. Dollar surges, liquidity disappears, Japan intervenes, yuan drops, credit spreads widen, risk assets sell off, etc.

🚨 HEAR ME OUT NOW!!!!A Major Financial Shock Is Lining Up for 2026 and the Warning Signs Are Already Here.Something big is coming for 2026. And no, it’s not another banking meltdown or a typical recession cycle. This time, the pressure is sitting right at the core of the… pic.twitter.com/4fc5FVbe1z

— NoLimit (@NoLimitGains) November 27, 2025

Phase two follows with central banks acting through liquidity injections, swap lines, and Treasury buybacks. This governmental response would inject capital, setting the stage for the inflation wave many analysts expect for 2026 to 2028. During this phase, real yields should collapse, gold and silver may surge, Bitcoin could recover, and commodities might rally as the dollar peaks.

The MOVE Index, which tracks bond market volatility, is already rising. When MOVE, USD/JPY, the Chinese yuan, and 10-year Treasury yields shift in the same direction, analysts see it as a warning sign that a significant event could arrive in one to three months.

Bitcoin’s Lag Presents a Potential Opportunity

Bitcoin’s recent performance highlights its unusual decoupling from global liquidity expansion in mid-2025. Despite central banks boosting the money supply, the cryptocurrency has traded sideways, disappointing those who expected an immediate rally.

An optimistic view is that this lag provides a buying opportunity while Bitcoin remains undervalued relative to global liquidity. Historically, Bitcoin has often rallied 60-70 days after major increases in global M2 supply.

Some analysts think participants are awaiting more clarity on inflation and central bank policy. Others cite unresolved issues, such as regulatory developments, institutional activity, and strong technical resistance, that may be holding back the price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: IMF Cautions That Tokenized Markets Could Face Collapse Without International Cooperation

- IMF warns tokenized markets risk destabilizing flash crashes due to rapid growth and interconnected smart contracts. - XRP highlighted as potential cross-border payment solution but not endorsed, alongside Stellar and Bitcoin-Lightning hybrid models. - Global regulators intensify oversight of tokenized assets, with ESMA, SEC, and central banks addressing governance and liquidity risks. - IMF stresses urgent need for coordinated policy frameworks to prevent fragmentation and systemic vulnerabilities in ev

Solana News Today: Avail's Nexus Mainnet: A Borderless Blockchain Ecosystem

- Avail launches Nexus Mainnet, a cross-chain infrastructure unifying liquidity across Ethereum , Solana , and EVM-compatible chains. - The platform uses intent-solver architecture and Avail DA verification to replace bridges, enabling seamless asset movement and shared liquidity. - Integrations with major chains and partners like Lens Protocol aim to streamline DeFi and trading, while $AVAIL token coordinates cross-chain transactions. - With Infinity Blocks targeting 10 GB blocks, Nexus addresses liquidit

Cardano News Today: ETFs Turn to Alternative Coins While ADA Stumbles and XLM Gains Momentum with ISO Compliance

- Franklin ETF expands holdings to include ADA , XLM, XRP , and others, reflecting institutional altcoin diversification driven by ISO 20022 compliance and SEC-approved rules. - Cardano faces short-term bearish pressure with 31% monthly decline, contrasting Stellar's bullish 2025/2030 price projections ($1.29–$6.19) fueled by RWA and cross-border payment demand. - ISO 20022 adoption (97% payment instructions) positions ADA/XLM as bridges between DeFi and traditional finance, with Ripple's ILP enhancing XLM

AI Crypto Faces a Pivotal Turn: Regulatory Demands Surpass Aspirations in 2025