Analyst Forecasts Major Solana Breakout in 2026, Updates Outlook on Bitcoin, Ethereum and BONK

A widely followed trader believes Solana ( SOL ) may be gearing up for massive rallies after retesting the $120 level.

The pseudonymous analyst Inmortal tells his 235,200 followers on X that Solana may experience a parabolic rally similar to what Ethereum ( ETH ) did earlier this year.

“Different structure, similar vibes.”

Source: Inmortal/X

Source: Inmortal/X

ETH went from about $1,550 in April to about $4,900 in September, a more than 216% gain.

The analyst also says that Solana’s $120 level has consistently acted as a support level during market corrections.

“This level has provided support for more than 600 days.”

Source: Inmorta/X

Source: Inmorta/X

Solana is trading for $138 at time of writing, up 1.2% on the day.

Next up, the trader says that Bitcoin ( BTC ) may chop around for months before having an explosive move to new all-time highs around $150,000.

“Imagine.”

Source: Inmortal/X

Source: Inmortal/X

Bitcoin is trading for $88,679 at time of writing, up 1.3% in the last 24 hours.

The trader also says that the meme token Bonk ( BONK ) may be forming a local bottom at a key level around $0.00000900, indicating a potential bullish reversal.

“You only see this type of charts one to two times per year.”

Source: Inmortal/X

Source: Inmortal/X

BONK is trading for $0.000009555 at time of writing, down 1.9% in the last 24 hours.

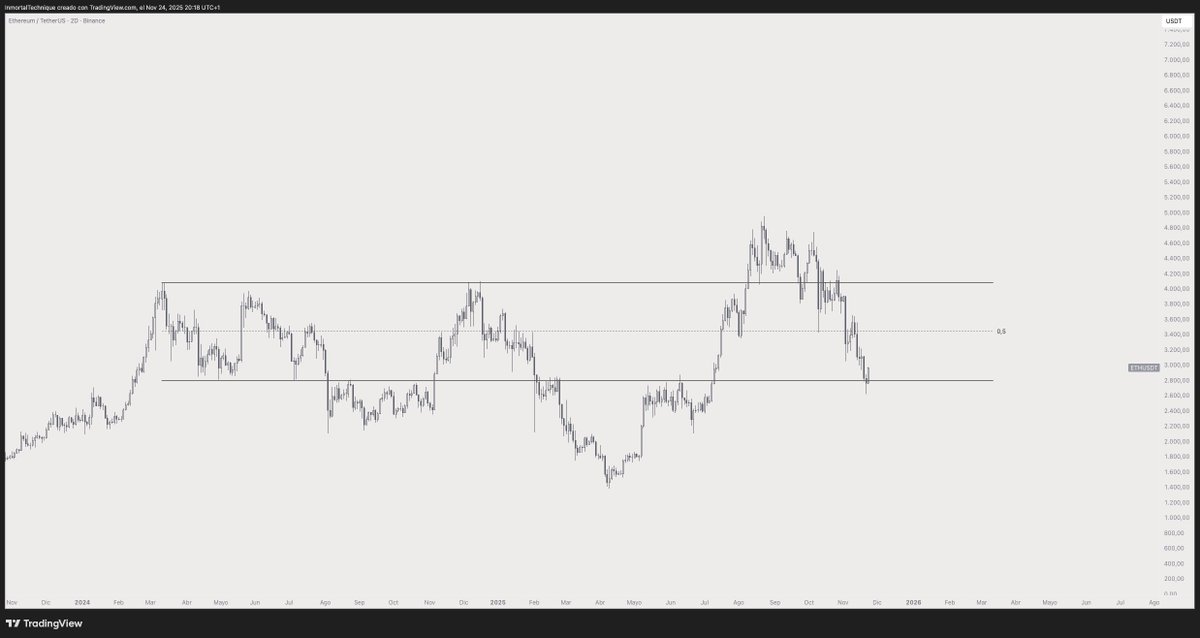

Lastly, the trader predicts that Ethereum ( ETH ) will soon surge more than 18% from its current value, after bouncing off the lower bound of a trading range at around $2,800.

“$3,500: ETH.”

Source: Inmortal/X

Source: Inmortal/X

ETH is trading at $2,963 at time of writing, up about 1% on the day.

Featured Image: Shutterstock/Vink Fan/Natalia Siiatovskaia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dovish Hints Meet Fed Prudence: Prediction Markets Reflect 87% Probability of Rate Reduction

- Polymarket's prediction markets show 87% odds of a December Fed rate cut, driven by rising crypto and stock market optimism. - Fed officials like Waller and Williams signal potential easing, while Goldman Sachs and Bill Gross endorse the cut likelihood. - Rate-cut expectations surged as maintaining current rates dropped to 18%, with CME FedWatch and Kalshi aligning at ~84% probability. - Lower rates could boost economic activity and crypto adoption, though inflation risks and delayed jobs data remain key

ADGM's Endorsement of Animoca Establishes It as a Center for Web3 Innovation

- Animoca Brands secures in-principle approval from ADGM to operate as a virtual asset service provider, marking a key regulatory milestone. - The approval aligns with ADGM's strategy to position itself as a global fintech and blockchain innovation hub with flexible regulatory frameworks. - This endorsement enhances Animoca's credibility for institutional partnerships while reflecting growing mainstream acceptance of Web3 assets. - ADGM's balanced regulatory approach supports innovation in virtual economie

Hyperliquid (HYPE) Price Rally: How Infrastructure and Institutional Support Drive DeFi Expansion

- Hyperliquid (HYPE) gains DeFi traction with 70-80% market share via HyperEVM/Unit innovations and 78% user growth by Q4 2025. - SEC S-1 compliance and USDH stablecoin (backed by BlackRock/Stripe) strengthen institutional trust and $1B treasury partnerships. - $50 price target depends on absorbing $314M token unlock risks, maintaining technical resilience, and resolving governance controversies. - Macroeconomic factors including Bitcoin performance and Fibonacci level retests will determine HYPE's Decembe

The Transformation of the Xerox Campus and Its Impact on Property and Industrial Investments in Webster, NY

- Webster , NY, redevelops 300-acre Xerox brownfield with $9.8M FAST NY grant to create industrial hub by 2025. - EPA-compliant remediation and infrastructure upgrades align with tech-enabled manufacturing and renewable energy goals. - Project includes fairlife® dairy plant (250 jobs) and leverages low 2% vacancy rates to attract high-value industrial tenants. - State partnerships and zoning reforms position site as scalable platform for semiconductors , logistics, and mixed-use growth. - Initiative exempl