November Was Bitcoin’s Second Worst Month In 2025

Bitcoin decline was driven by heavy ETF outflows, macroeconomic pressure from tariffs and the US government shutdown, and a spike in short-term holder losses.

Bitcoin is on track to post its second-worst monthly performance of the year after falling 17.28% in November. According to CoinGlass data, that places it just behind February’s 17.39% decline.

Notably, the drop also marks Bitcoin’s steepest November slide since 2022, when it lost 16.23% of its value.

Why Bitcoin Price Struggled This November

According to BeInCrypto data, Bitcoin opened November near $110,000 after a volatile October that delivered a record high of $126,000 but also erased about $20 billion in market value.

The selloff had begun after Donald Trump expanded tariffs on China on October 10, prompting a broad reassessment of risk across global markets.

The choppiness persisted into November, and the record US government shutdown further exacerbated it by tightening liquidity across traditional markets.

Apart from the macroeconomic conditions, BTC was also affected by weakening institutional flows.

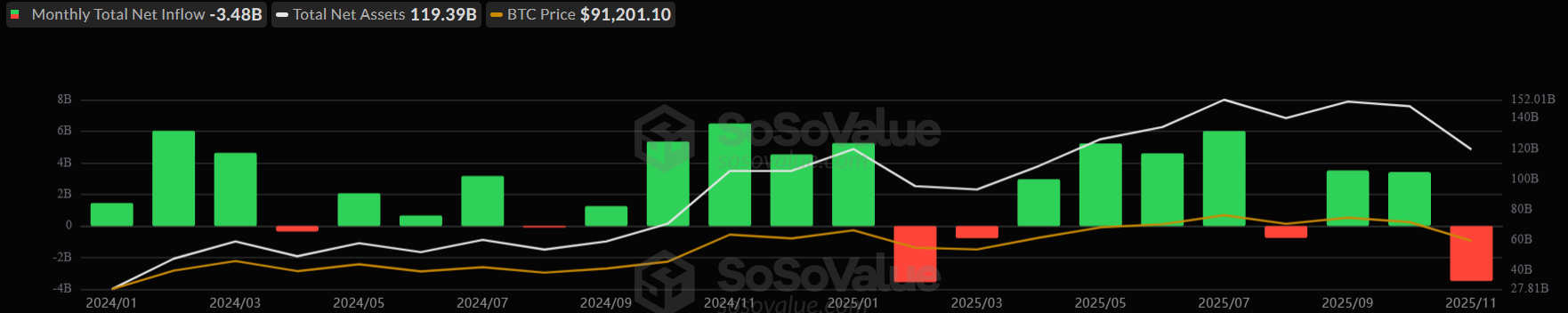

According to SoSo Value data, Bitcoin ETFs recorded $3.48 billion in outflows in November. This marks the second-largest monthly outflow since the products launched in 2024.

US Bitcoin ETFs Monthly Flows Since Launch. Source:

SoSo Value

US Bitcoin ETFs Monthly Flows Since Launch. Source:

SoSo Value

This outflow trend began quietly in the second half of October. However, it accelerated in November as global markets digested the broader macroeconomic conditions, reducing one of the asset’s most reliable sources of demand.

At the same time, the market stress was amplified by short-term investor capitulation.

According to Glassnode, the realized loss of short-term holders surged, with the 7-day EMA rising to $427 million per day. That level is the highest recorded since November 2022.

The realized loss of short-term holders has surged, with the 7D-EMA reaching $427M/day, the highest level since Nov 2022.Panic selling is elevated & clearly rising, now exceeding the loss levels seen at the last two major lows of this cycle.📉

— glassnode (@glassnode) November 18, 2025

At the time, BTC panic selling was rife, resulting in losses similar to those observed at the previous two major lows of this cycle.

The data suggests that reactive selling, rather than long-term distribution, was the defining pressure point for Bitcoin’s recent decline.

Due to the convergence of these points, BTC’s price briefly fell to a seven-month low of under $80,000 during the month, before rebounding to $90,773 at press time.

This price performance reflected both external pressures and the accumulation of structural stress in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of Tokens Supported by MMT and Their Influence on Financial Systems in Developing Markets

- MMT-backed tokens leverage blockchain to tokenize sovereign debt, real estate , and carbon credits, reshaping emerging market fiscal strategies. - Tokenized bonds enable local-currency issuance with smaller denominations, as demonstrated by Hong Kong's 2025 digital green bonds and OCBC's commercial paper program. - Central banks integrate blockchain tools for real-time liquidity adjustments, while programmable features like inflation-linked coupons enhance fiscal flexibility in volatile economies. - Chal

KITE Price Forecast Post-Listing: Understanding Market Reactions and Institutional Strategies Amidst a Fluctuating IPO Environment

- Vyome Holdings (KITE) adopts a dual-listing strategy on Nasdaq and SGX-Nasdaq bridge to diversify investors and liquidity, aligning with high-growth tech IPO trends. - Institutional ownership remains fragmented (0.43% held by major banks as of Nov 2025), reflecting cautious hedging amid regulatory and economic uncertainties. - While tech IPOs thrive on AI-driven narratives, KITE faces retail real estate sector challenges including $0.07/share Q3 losses and anchor tenant bankruptcies. - Clinical progress

Sony launches USDSC stablecoin for Soneium blockchain

XRP Compresses in a Tight Range as Major Liquidity Builds Above $2.10