Ripple Wins Singapore Approval as XRP Whales Drive Market Shift

Ripple has secured expanded regulatory approval in Singapore, strengthening its payments business in Asia just as XRP whale activity surges across spot markets. The move arrives during a challenging week for XRP’s price, but on-chain data suggests institutional-scale traders remain active. Ripple Gains Wider MAS Approval for Regulated Payments Ripple announced on December 1 that

Ripple has secured expanded regulatory approval in Singapore, strengthening its payments business in Asia just as XRP whale activity surges across spot markets.

The move arrives during a challenging week for XRP’s price, but on-chain data suggests institutional-scale traders remain active.

Ripple Gains Wider MAS Approval for Regulated Payments

Ripple announced on December 1 that the Monetary Authority of Singapore (MAS) approved an expanded scope of payment activities under its Major Payment Institution (MPI) license for its subsidiary, Ripple Markets APAC Pte. Ltd.

“With this approval, Ripple can broaden its regulated payment offerings and deliver greater value to customers in Singapore,” the company said in its statement.

Monica Long, President of Ripple, praised MAS’s regulatory clarity. She explained that MAS has set a leading standard for regulatory clarity in the digital asset sector.

This expanded license, she said, would enable Ripple to continue investing in Singapore. It would also power the firm’s capacity to build the infrastructure that financial institutions need to move money efficiently, quickly, and safely.

Huge news from Singapore: The @MAS_sg has approved an expanded scope of payment activities for our Major Payment Institution license – enabling us to deliver end-to-end, fully licensed payment services to our customers in the region. 🇸🇬

— Ripple (@Ripple) December 1, 2025

The upgrade reinforces Ripple’s long-standing presence in Singapore, which has been home to its Asia-Pacific headquarters since 2017. MAS remains a global reference point for digital asset regulation, helping institutions scale adoption under clear compliance standards.

Recently, MAS delayed the implementation of Basel crypto capital rules to January 2027 or later, giving banks more time to strengthen their risk and disclosure systems.

Ripple emphasized that its payments suite, leveraging digital payment tokens (DPTs) such as RLUSD and XRP, offers fast, compliant cross-border settlement.

The company highlighted three core benefits:

- End-to-end digital payments

- Single onboarding for global flows

- Simplified access to digital assets

“The Asia Pacific region leads the world in real digital asset usage… With this expanded scope of payment activities, we can better support the institutions driving that growth,” read an excerpt in the announcement, citing Fiona Murray, Vice President & Managing Director for APAC.

RLUSD Gains Ground in the UAE as Institutional Use Accelerates

The Singapore approval follows Ripple’s recent progress in the UAE. On November 27, Abu Dhabi’s Financial Services Regulatory Authority (FSRA) greenlisted RLUSD, classifying it as an Accepted Fiat-Referenced Token.

This enables FSRA-licensed institutions to use RLUSD for:

- Collateral on exchanges

- Lending

- Prime brokerage activities

Jack McDonald, Ripple’s SVP of Stablecoins, called the recognition a signal of trust:

“The FSRA’s recognition of RLUSD… reinforces our commitment to regulatory compliance and trust,” he stated.

XRP Price Slips, but Whale Activity Tells a Different Story

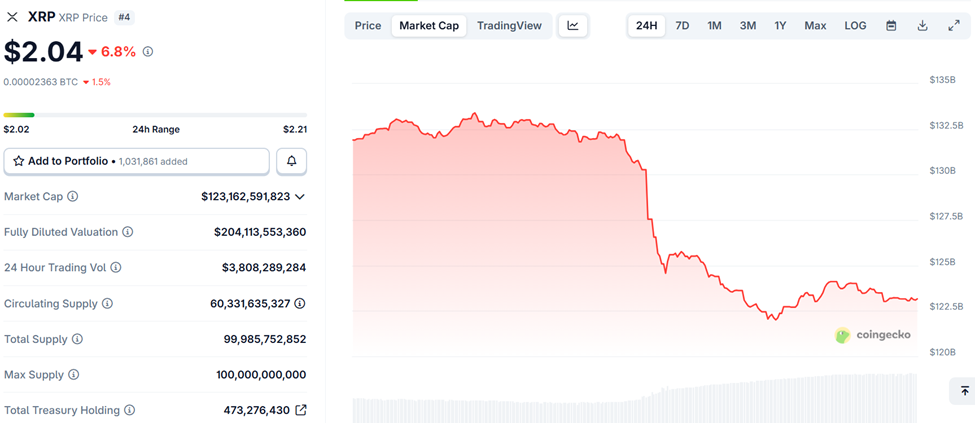

Despite the regulatory momentum, XRP fell nearly 7% in the past 24 hours, sliding toward the $2 level amid a broader market pullback.

Ripple (XRP) Price Performance. Source:

CoinGecko

Ripple (XRP) Price Performance. Source:

CoinGecko

However, on-chain data paints a contrasting picture, showing significant whale-sized orders favoring XRP.

Spot Average Order Size charts indicate that large traders have consistently led XRP activity for months, suggesting underlying accumulation even as prices soften.

💥BREAKING:$XRP LEDGER DATA SHOWS MASSIVE WHALE-SIZED ORDERS DOMINATING SINCE LATE 2024.

— STEPH IS CRYPTO (@Steph_iscrypto) November 30, 2025

Ripple’s strengthened regulatory position in Singapore and Abu Dhabi sets the stage for deeper institutional adoption across the APAC and Middle East regions.

With XRP whales still active despite market volatility, investors will watch whether expanding licensed payment corridors and rising RLUSD utility translate into renewed price momentum in December and early 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Validator Numbers Slide 68% Since 2023, Community Divided

Quick Take Summary is AI generated, newsroom reviewed. Solana's active validator count has seen a sharp decline, falling from over 2,500 in March 2023 to approximately 800, representing a 68% decrease. One perspective argues the decline is a beneficial "healthy pruning" that removes Sybil nodes and improves the genuine decentralization and quality of the network. An opposing view, supported by infrastructure teams, suggests the exits are genuine operators who were forced out by high hardware and bandwidth

A Strong Wave of Institutional Buying Reshapes the XRP Market

Quick Take Summary is AI generated, newsroom reviewed. US XRP spot ETFs purchased $38.04 million worth of XRP recently. Institutional crypto demand rises sharply as funds increase holdings. Strong inflows boost XRP market momentum and attract new investors. ETF activity strengthens confidence and prepares the market for growth.References BREAKING: 🇺🇸 XRP spot ETFs have just bought 38.04 million worth of $XRP.

Ethereum Gas Futures Plan by Vitalik Buterin Gains Attention

Quick Take Summary is AI generated, newsroom reviewed. Vitalik Buterin proposes a trustless on-chain gas futures market for Ethereum. Users could lock transaction fees in advance to avoid unexpected costs. The system is trustless, using smart contracts for fairness and security. Challenges include market liquidity, price swings, and user adoption.References Ethereum co-founder Vitalik Buterin has proposed creating a trustless onchain gas futures market that would allow users to lock in transaction fees for

NFT Market Faces Steepest Decline as Sales Plummet to Year’s Low