Hedera Price Stays Weak While Its Fate Remains Tied to Bitcoin

Hedera’s price has struggled to recover over the past week, even as broader market conditions briefly improved before turning bearish again. HBAR attempted to climb back toward recent highs, but the market-wide pullback dragged it down, revealing how heavily the altcoin relies on Bitcoin’s movement. Hedera Has A Problem Named Bitcoin HBAR’s correlation with Bitcoin

Hedera’s price has struggled to recover over the past week, even as broader market conditions briefly improved before turning bearish again.

HBAR attempted to climb back toward recent highs, but the market-wide pullback dragged it down, revealing how heavily the altcoin relies on Bitcoin’s movement.

Hedera Has A Problem Named Bitcoin

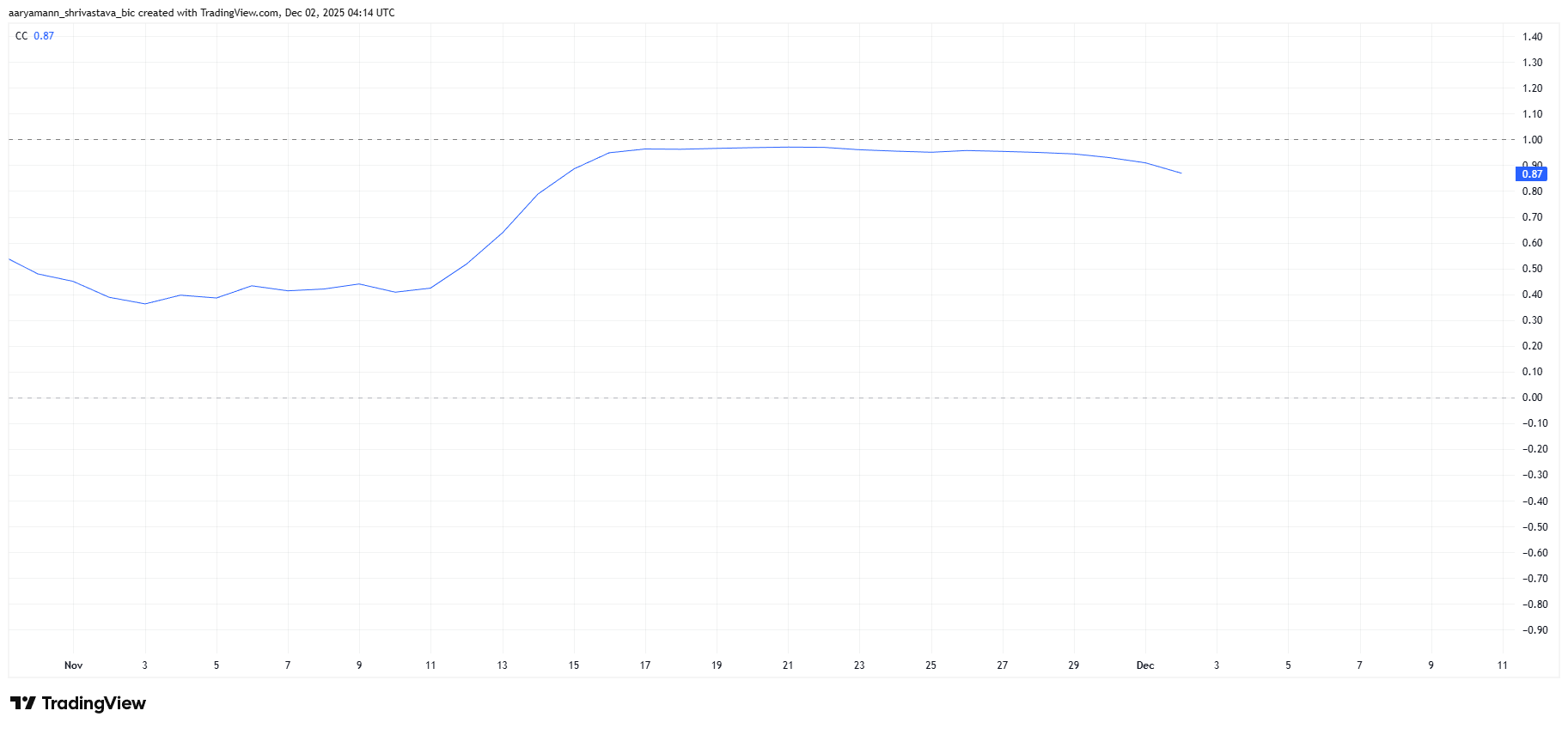

HBAR’s correlation with Bitcoin remains extremely strong at 0.87, dipping only slightly from last week’s peak. This tight correlation means Hedera is closely shadowing BTC’s price action, which is not ideal at a time when Bitcoin itself is stuck near $86,000.

Bitcoin’s struggle to reclaim bullish momentum has directly impacted Hedera, preventing any meaningful rebound. The lack of independent strength makes HBAR more vulnerable to Bitcoin-led volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Correlation To Bitcoin. Source:

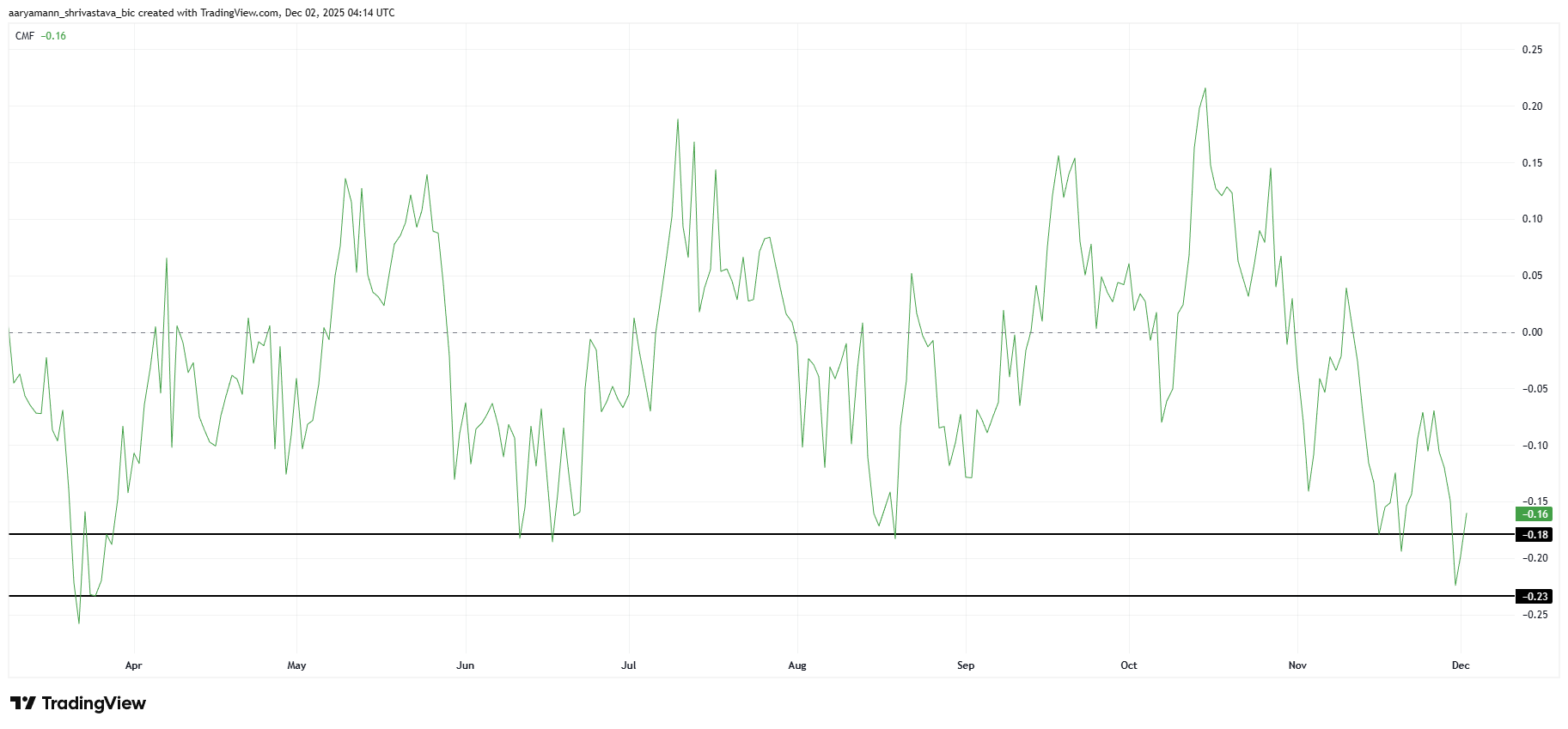

HBAR’s macro momentum shows further weakness, particularly in the Chaikin Money Flow (CMF), which recently dropped to a seven-month low. The indicator slipped into the 0.18 to 0.23 range, typically an area where outflows slow and inflows begin, offering altcoins a chance to stabilize.

HBAR Correlation To Bitcoin. Source:

HBAR’s macro momentum shows further weakness, particularly in the Chaikin Money Flow (CMF), which recently dropped to a seven-month low. The indicator slipped into the 0.18 to 0.23 range, typically an area where outflows slow and inflows begin, offering altcoins a chance to stabilize.

However, this cycle has been different. Broader market bearishness appears to be overriding usual reversal signals as CMF dipped below 0.18 before climbing only slightly. This demonstrates that investors are still pulling capital from HBAR despite historically favorable conditions for a bounce.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Needs A Push

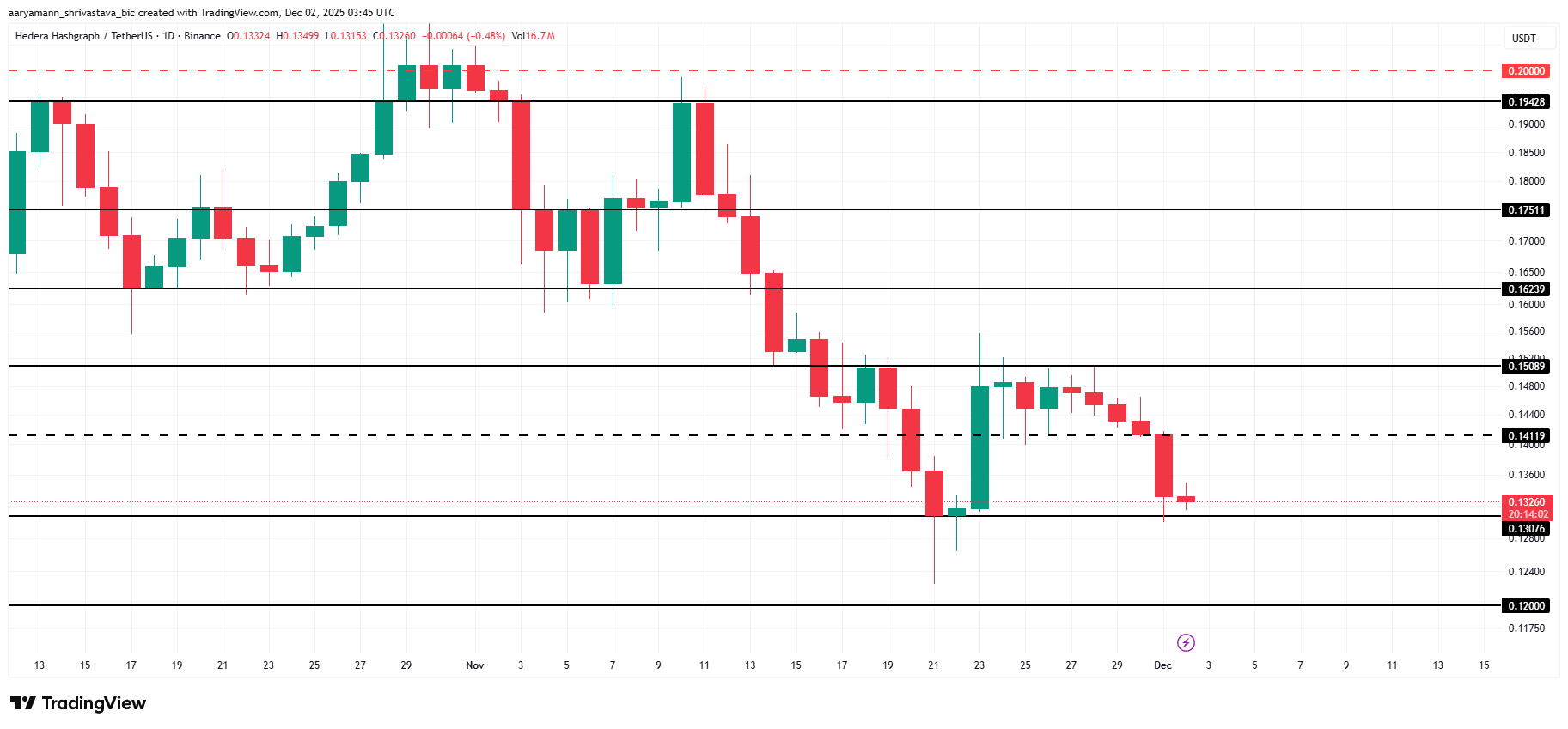

HBAR is trading at $0.132 at the time of writing, holding slightly above the $0.130 support level. This level has acted as a critical floor and remains essential in preventing a deeper decline.

If market weakness persists — especially if Bitcoin drops further — HBAR could continue consolidating between $0.130 and $0.150. A breakdown below $0.130 would likely send the price toward $0.120, extending the bearish trend.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if Bitcoin manages to recover, HBAR could rebound as well. A bounce off $0.130 may send the altcoin back to $0.150. Flipping this resistance into support would open the path toward $0.162, invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategic Property Investment in the Revitalization of the Former Xerox Campus: Infrastructure-Led Renewal in Webster, NY

- Webster , NY, is transforming its post-Xerox campus via $14.3M in state infrastructure grants for industrial upgrades and public-private partnerships. - Road, sewer, and electrical improvements reduced industrial vacancy to 2%, attracting $650M fairlife® dairy plant and 250 jobs. - Residential values rose 10.1% annually as NEAT corridor targets $1B in development by 2026 with $283M public-private investment. - Strategic infrastructure funding de-risks development, creating a scalable model for post-indus

3 Key Signals That Hint at a Near-Term Shiba Inu Upswing

BONK Poised for 200% Jump Amid ETF Listings and Utility Teasers

Crypto Market Pumps as Fed Injects $13.5 Billion Into the Banking System Overnight