Chainlink rallies 12% after Grayscale drops first LINK ETF

Chainlink finally got the Wall Street makeover it’s been hinting at for years.

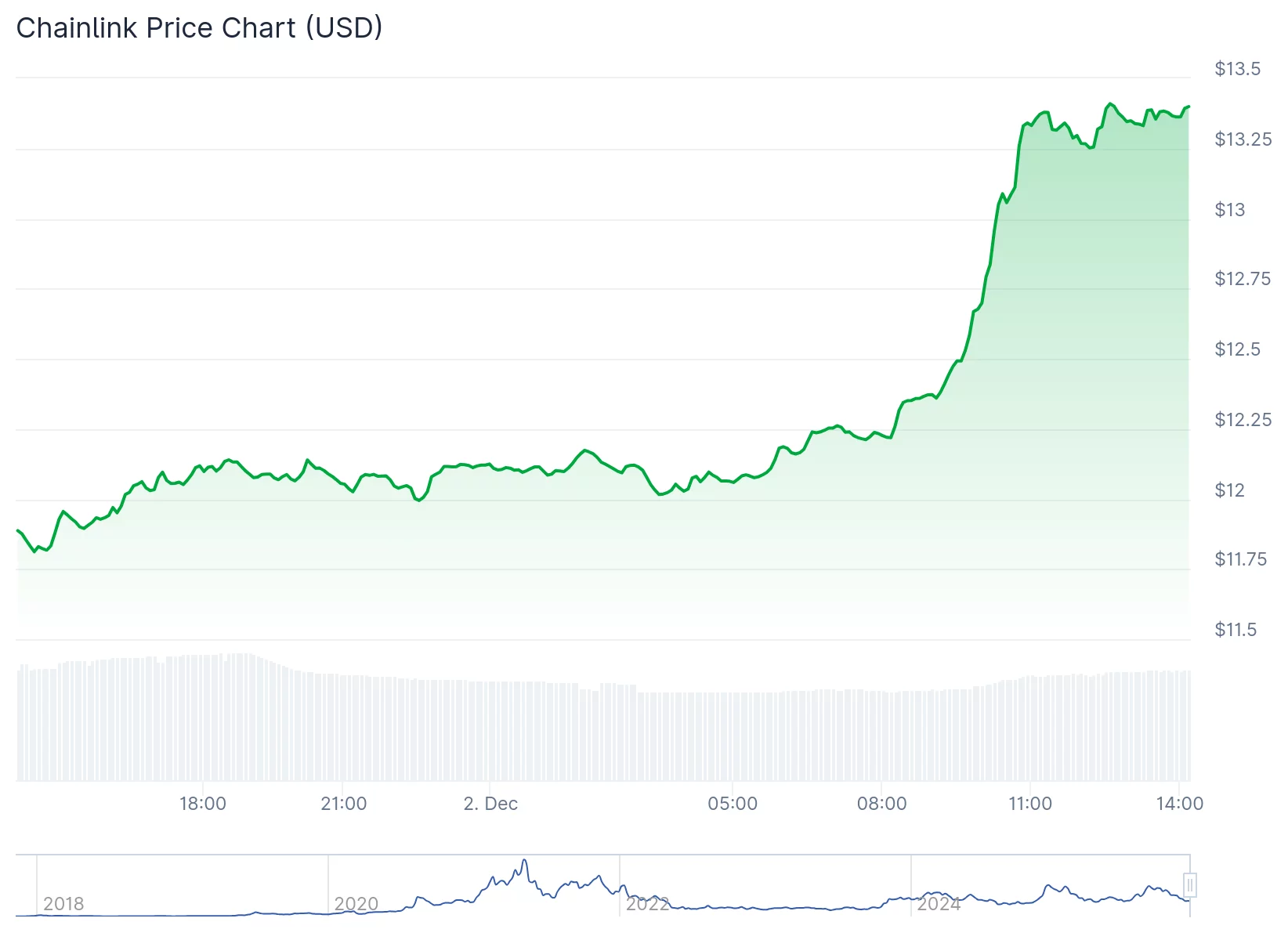

Once Grayscale rolled out the exchange-traded fund tied to LINK, the token rallied. At last check on Tuesday, it was up 12.7% to $13.40 — a welcome bounce for an asset that’s been slogging through a rough year.

- LINK jumps 8% after Grayscale launches the first U.S. ETF dedicated to the Chainlink token.

- GLNK offers regulated exposure to LINK but isn’t a traditional 1940 Act ETF.

- The debut comes as LINK remains down nearly 40% on the year.

LINK technicals

Source: CoinGecko

Source: CoinGecko

Trading under the ticker GLNK, the new Grayscale fund gives investors an easy, brokerage-friendly way to get exposure to Chainlink without having to explain private keys to their financial advisor.

It’s the first U.S. ETF dedicated to tracking LINK, the engine behind Chainlink’s decentralized oracle network — the tech that feeds smart contracts everything from weather alerts to price feeds to who won last night’s election.

Chainlink superpower

Since Chainlink was founded in 2014 by Sergey Nazarov and Steve Elli, it has made it indispensable across DeFi, gaming, NFTs, and a slew of onchain markets, where it helps secure tens of billions of dollars in value, according to Grayscale.

One caveat for eager buyers: GLNK isn’t a traditional Investment Company Act ETF, CoinDesk reports . It simply holds LINK on behalf of shareholders and doesn’t come with all the consumer protections of more buttoned-up funds.

Still, the NYSE Arca listing marks a big leap from its days as a 2021 private placement and later as an OTC Markets product. For both institutions and retail traders, LINK just became a whole lot easier to access — which, given its 39% slide this year, might feel like the confidence boost it needed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ramp Network Secures EU-Wide Crypto Licence Under MiCAR

Hyperliquid (HYPE) Price Spike Expected in Late 2025: Transforming DeFi Liquidity and Market Dynamics

- Hyperliquid (HYPE) dominates 75% of decentralized perpetual contracts with $95.63M 30-day revenue, driving a 23% weekly token surge. - Its CLOB model on HyperBFT blockchain achieves 200k orders/second, bridging DEX-CEX gaps with $15B open interest and $47B weekly volumes. - Institutional adoption via $888M Hyperliquid Strategies and $3.5B TVL growth redefines altcoin valuations through on-chain liquidity metrics. - Challenges include 3 market manipulation attacks and $89.2M HYPE unstaking, countered by H

UK Law Confirms Crypto as Personal Property