Bears To Crash the PENGU’in Party? The Early December Rally Now Risks a Pullback

PENGU price jumped almost 37% between December 1 and December 2, making it one of the strongest movers in the memecoin group. The move pushed the price back above short-term levels and helped PENGU retain about 26% of its 24-hour gains even after a small dip. But this early December burst may not continue without

PENGU price jumped almost 37% between December 1 and December 2, making it one of the strongest movers in the memecoin group. The move pushed the price back above short-term levels and helped PENGU retain about 26% of its 24-hour gains even after a small dip.

But this early December burst may not continue without resistance. A few key signals now indicate the rally is at risk of slowing due to a “bear attack.”

Rally Risks Cooling as Momentum Weakens and Traders Turn Cautious

PENGU has been one of the meme coins to watch this month because its recent setup was bullish. That early December bounce confirmed that buyers were active again.

But the chart shows the first warning sign.

RSI (Relative Strength Index), which measures momentum on a 0–100 scale, made a higher high between November 10 and December 1, while the PENGU price made a lower high. This is a hidden bearish divergence. It usually means buyers are pushing hard, but the price is not reacting with equal strength.

That type of mismatch can slow rallies during broader downtrends, and PENGU is still down almost 25% over the past month.

PENGU RSI Shows Weakness:

PENGU RSI Shows Weakness:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain positioning supports this risk.

Whales on spot have reduced their holdings by 3.62%, now holding about 1.19 billion PENGU. That reduction is worth roughly 43 million PENGU, showing that large holders used the bounce to trim exposure by possibly profit booking. This hints at weaker conviction.

PENGU Whales Selling:

PENGU Whales Selling:

Perpetual traders are not helping the trend either.

Top 100 addresses (mega whales) have shifted heavily toward shorts, cutting long exposure by more than 17% in 24 hours. Even though consistent PERP winners slightly increased long activity, the entire group still leans net-short. That means they expect the prices to go down.

Perp Traders Lean Bearish:

Perp Traders Lean Bearish:

Together, the momentum mismatch and the shift in bearish behavior show why the rally now faces its first real test.

PENGU Price Levels: Where the Supposed Pullback Might Stop?

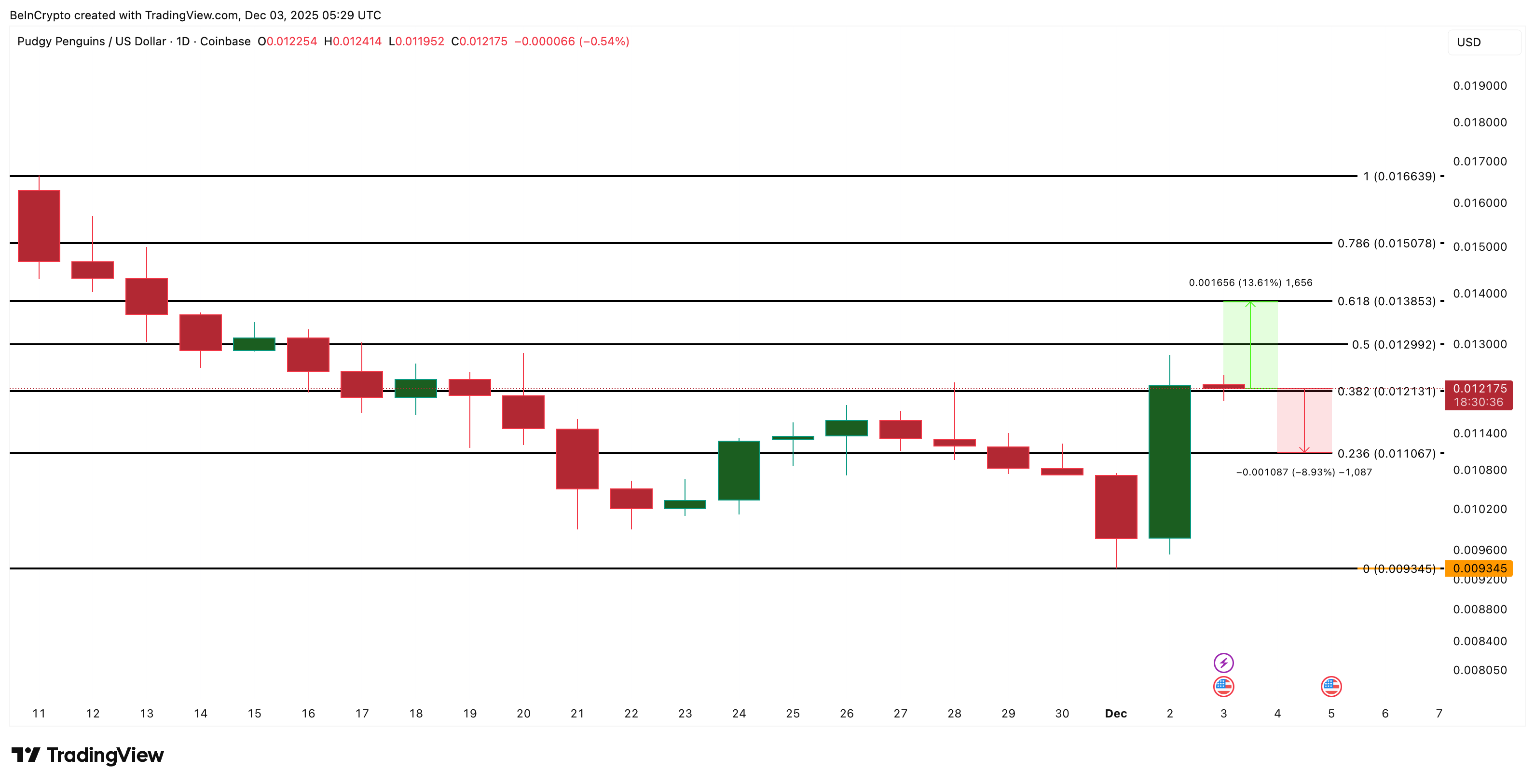

PENGU trades near $0.0121 and faces a ceiling at $0.0129, under which its latest rally attempt stalled.

To regain strength, the chart needs a break above $0.0129 first, followed by $0.0138. But the hidden bearish divergence does not get invalidated until PENGU crosses $0.0166, which marks the early November peak.

If today’s minor pullback extends, the first level to watch is $0.0110. A daily close below that could open a deeper move toward $0.0093, which was the previous reaction area before the December rebound.

PENGU Price Analysis:

PENGU Price Analysis:

For now, the early December PENGU price rally is not broken, but it is at risk.

RSI warns of slowing momentum, whales are reducing their stake, and PERP traders are positioning against the move. To keep the Pudgy Penguins’ party alive, the price must hold above $0.0110 and push cleanly through $0.0138.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid's HIP-3 market sees trading volume exceed $5 billion

The Influence of Zero-Knowledge Solutions on Tomorrow’s Financial Landscape: Preparing for Strategic Investments in Next-Generation Blockchain Frameworks

- Zero-knowledge (ZK) technologies are reshaping blockchain scalability, privacy, and institutional adoption, driven by innovations like Vitalik Buterin's GKR protocol. - Buterin's GKR protocol cuts ZK verification times by 50%, enabling 43,000 TPS on Ethereum Layer 2, while ZK-based DeFi solutions reduce front-running losses by 67%. - Institutional adoption accelerates with Nike , Sony , and UBS leveraging ZK for NFTs and private credit tokenization, as ZKP market projects $8.52B valuation by 2033. - Priv

BlackRock views rising US national debt as catalyst for crypto adoption

Gold rises on expectations of Fed rate cut