Bitcoin jumps back above $93K as short liquidations and fresh institutional interest help fuel rebound ahead of Fed meeting

Quick Take Bitcoin has rallied to trade over $93,000 as short liquidations and steady ETF inflows have fueled a sharp rebound. However, analysts warn that miner stress, mixed whale behaviour, and macro uncertainty leave recent gains vulnerable if ETF flows or liquidity weaken.

Bitcoin has snapped back above $93,000 as a wave of institutional headlines and a fresh short squeeze lifted sentiment ahead of next week’s Federal Reserve meeting — but traders and analysts say the market is still in “wait-and-see” mode rather than starting a new leg higher.

According to The Block’s price page , BTC has jumped roughly 8% since Monday's lows to trade at its highest level in two weeks. Ether also reclaimed the $3,000 area, helped by optimism around the upcoming Fusaka upgrade , with the total crypto market capitalization climbing to around $3.2 trillion, supported by broad gains across major altcoins like SOL and BNB.

BRN Head of Research Timothy Misir said the move has been driven in part by forced buying as crowded shorts were squeezed out above $93,000. He added that exchange order books showed dense clusters of liquidation levels around that price.

“Short-liquidation clusters are active; forced covering is amplifying the move and increasing near-term volatility,” Misir said, adding that bitcoin has drawn roughly $732 billion in new capital this cycle — more than double the prior cycle’s increase.

Spot ETF flows have also provided an additional tailwind. U.S. bitcoin spot ETFs recorded about $58.5 million in net inflows on Dec. 2, marking a fifth straight day of positive flows, according to The Block’s data.

Solana products have taken in roughly $45.8 million over the same window, while Ethereum ETFs saw a modest $9.9 million outflow.

Wall Street widens crypto access

Those flows land just as large traditional firms begin to lower structural barriers around digital assets.

Vanguard has moved to allow clients to trade funds holding crypto such as bitcoin, XRP, and Solana on its platform, after years of shunning the sector.

Bank of America reportedly issued internal guidance for Merrill and Private Bank clients that calls for a crypto allocation of 1% to 4%. The second-largest bank in the U.S. by total assets will also start CIO coverage of four spot bitcoin ETFs, including BlackRock’s IBIT, early next year.

Misir said those steps “reduce structural capital frictions” and make it easier for large pools of money to add or maintain exposure to bitcoin.

Macro anchor remains crucial

Under the surface, the macro backdrop still dominates positioning.

In a Wednesday note , QCP Capital described markets as “calm on the surface, tense underneath,” with bitcoin consolidating in the mid-$90,000s after the recent rebound and ahead of the Federal Open Market Committee meeting on Dec. 10.

Futures markets now imply about a 90% chance of a 25-basis-point “insurance cut” from the Fed next week. Prediction markets Kalshi and Polymarket showed similar probabilities for lower interest rates.

However, QCP said the larger story is uncertainty around future leadership at the central bank and how a reshaped committee might react to economic data.

Betting markets have increasingly priced Kevin Hassett as the next Fed chair, with his potential appointment, alongside upcoming Fed exits, viewed as potentially dovish.

The next decision will also come without fresh CPI or nonfarm payrolls data, leaving policymakers with less visibility than usual and raising the risk that any surprise in tone or projections could jolt cross-asset volatility.

Structural risks linger despite improved onchain picture

Onchain signals mirror the split tone. Misir flagged a fresh $1 billion Tether mint on Tron as evidence of improving stablecoin liquidity, alongside large strategic purchases, such as Tom Lee’s BitMine, which added nearly 97,000 ether ahead of Fusaka.

At the same time, miner margins remain compressed amid a profitability crunch , leaving supply-side risk in place if prices stumble, and whale accumulation has stalled .

Still, QCP analysts added that one major overhang has eased after Strategy established a $1.4 billion dividend reserve fund , extending its runway and reducing near-term pressure to sell down its bitcoin reserves.

Even so, the firm pointed to events such as January’s MSCI index review and future Fed decisions as likely flashpoints for renewed volatility.

A confidence boost, not a structural turn

For now, analysts frame the latest move as a confidence-builder rather than a regime change.

“Today’s move matters because it restores confidence and proves how quickly forced liquidations can feed momentum,” Misir said. “But it did not fix the structural issues: miner profitability is strained, large-holder behaviour is mixed, and macro uncertainty persists.”

Both Misir and QCP argue that rallies should still be treated as tactical opportunities, while investors watch ETF flows, onchain supply shifts, and the Fed’s next steps for confirmation that a more durable trend might be taking shape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

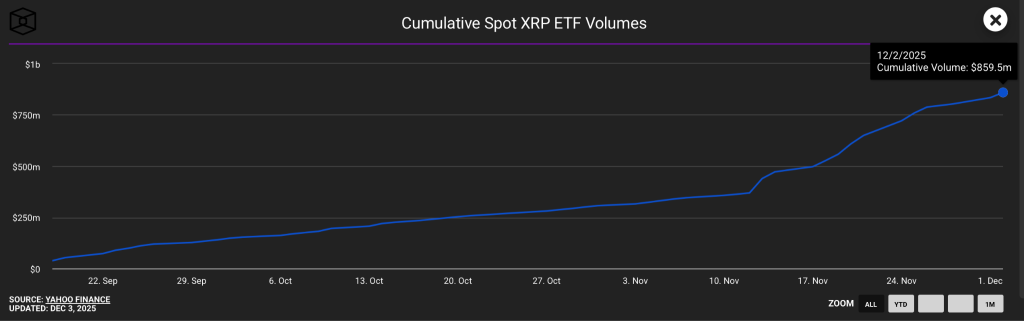

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts