Key Notes

- Intel TDX and NVIDIA Confidential Computing provide cryptographic attestation for every AI request processed through the platform.

- Private Chat offers ChatGPT-like functionality without corporate data harvesting, protecting user information in isolated environments.

- NEAR token trades near year-long support at $1.81 while protocol metrics show exponential growth with $7B in volume processed.

The NEAR Foundation announced the launch of two new and interconnected projects: NEAR AI Cloud and Private Chat. These solutions are already implemented by Brave Nightly, OpenMind AGI, and Phala Network, reaching over 100 million users.

According to the announcement via an X thread on Dec. 3, these products are built around the principle that “users should own their AI” by offering “hardware-backed, verifiable privacy.”

✦ NEW PRODUCT LAUNCH ✦

Introducing NEAR AI Cloud and Private Chat—two products that offer hardware-backed, verifiable privacy and are built around one simple yet powerful principle:

Users should own their AI 🧵 pic.twitter.com/HWwcHKbHBs

— NEAR Protocol (@NEARProtocol) December 3, 2025

For NEAR AI Cloud, every request is processed by Intel TDX and NVIDIA Confidential Computing hardware—two industry-respected trusted execution environment (TEE) solutions. This is important to keep every piece of data sealed and isolated from external participants, securing data privacy.

Users can also verify that their data was really protected by accessing “a cryptographic attestation proving the model ran the expected code” in the expected privacy environment.

The Privacy Chat leverages NEAR AI Cloud, running on top of it, and “introduces verifiable privacy to your everyday questions and research.” Essentially, it is an application similar to OpenAI’s ChatGPT, Google’s Gemini, or xAI’s Grok, but without the data-harvesting part by the controlling company.

Brave announced NEAR AI Cloud integration to its test implementation, Brave Nightly, on Nov. 20. Together with the leading privacy-enhancing browser integration, NEAR Protocol communicated that OpenMind AGI and Phala Network are also using its solutions for verifiable privacy, reaching more than 100 million users.

“NEAR AI’s confidential computing has been validated under real operational conditions: high-volume traffic, deterministic latency, strict compliance requirements,” the NEAR Foundation account posted. “NEAR AI is proven at launch, stress-tested with partners handling sensitive workloads at scale.”

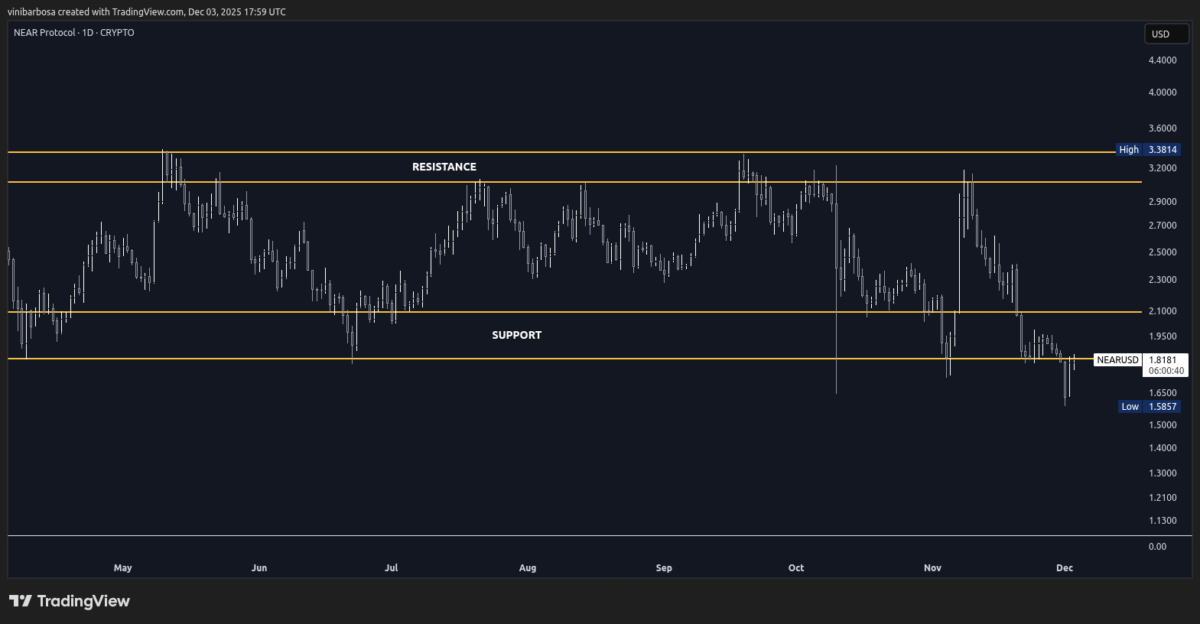

NEAR Price Analysis

NEAR NEAR $1.82 24h volatility: 1.4% Market cap: $2.33 B Vol. 24h: $229.43 M is currently changing hands between $1.81 and $1.82, testing a reentry to a year-long support zone that the asset briefly lost during Bitcoin’s crash down to $84,000 on Dec. 1. This area has seen significant buying pressure since early 2025.

NEAR 1D price chart, as of Dec. 3, 2025 | Source: TradingView

Retrieving the price levels within the historical support is an important step for price recovery, while keeping trading below that zone could indicate NEAR has entered bear territory and could trend downward in the following days.

Michaël van de Poppe, CIO and founder of MN Fund and MN Capital, is looking at similar levels. NEAR needs to break through the $1.80 and $1.95 price levels for it to “be good to go upward from here,” according to his analysis.

$NEAR hit a new low yesterday.

Not great, I can say that for sure.

However, it's probably reversing fastly.

What does it need to do?

Exactly: break through $1.80 & $1.95 and then we should be good to go upwards from here. pic.twitter.com/t6N5CvZZgB

— Michaël van de Poppe (@CryptoMichNL) December 2, 2025

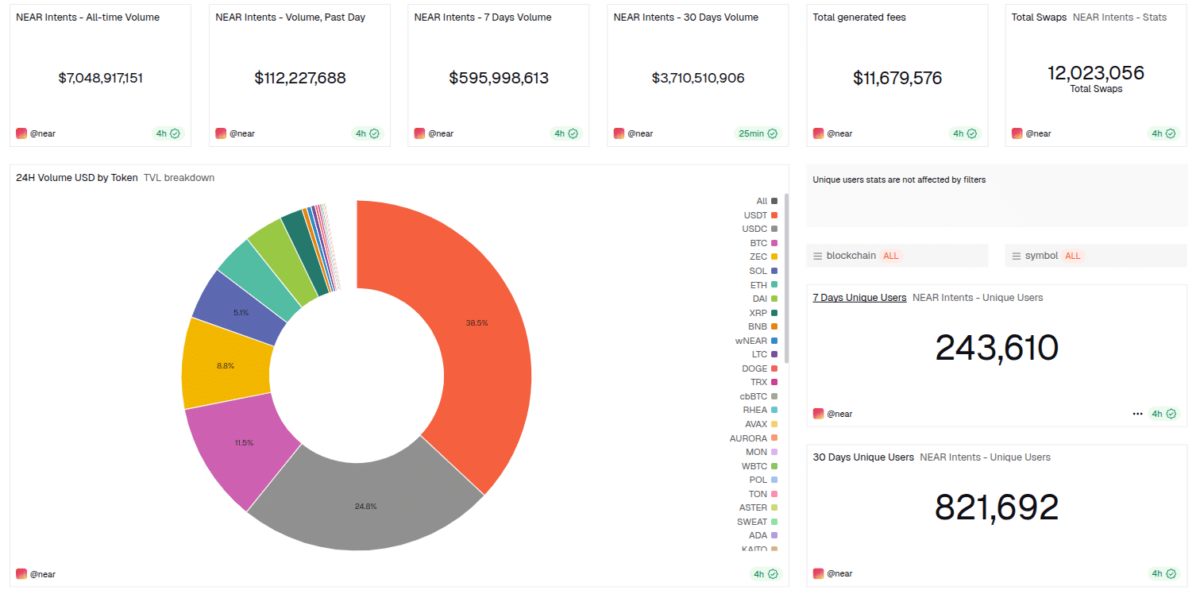

From a fundamental perspective, the project is accumulating relevant momentum with NEAR Intents metrics ramping up exponentially—now with over $7 billion in all-time volume and $11.68 million in total generated fees across 12 million cross-chain swaps and with over 800,000 unique addresses in the last 30 days, per Dune Analytics data . The all-time volume was at $3 billion when Coinspeaker covered this data on Oct. 30 .

NEAR Intents dashboard as of Dec. 3, 2025 | Source: Dune Analytics

The leading US-based prediction market, Kalshi, has added support for the NEAR token on Nov. 25, as Coinspeaker reported , making another relevant development for the project. Moreover, the NEAR validator’s community approved an inflation halving on Oct. 28 that reduced the NEAR token’s annual tail emission from 5% to 2.5% , which can have a future economic impact by diminishing the available supply pressure for token sales.