Kevin Hassett Sparks a Crypto–Bond Market Split as Fed Race Heats Up

Kevin Hassett’s rise as the leading contender to replace Jerome Powell in 2026 has triggered an unusual divide across financial markets: crypto traders are cheering, while bond investors are warning of destabilizing rate cuts. The split is sharpening as new reports detail private concerns raised to the US Treasury. Bond Markets Warn of Aggressive Cuts

Kevin Hassett’s rise as the leading contender to replace Jerome Powell in 2026 has triggered an unusual divide across financial markets: crypto traders are cheering, while bond investors are warning of destabilizing rate cuts.

The split is sharpening as new reports detail private concerns raised to the US Treasury.

Bond Markets Warn of Aggressive Cuts

Bond investors have privately told the Treasury Department that they are concerned Hassett would push for rapid, politically aligned rate cuts, according to the Financial Times.

The discussions, held in November with Wall Street banks, major asset managers, and members of the Treasury Borrowing Advisory Committee, revealed a consistent fear: a Hassett-led Fed may prioritize the administration’s preferences over inflation control.

The report indicates that investors worry that Hassett could advocate indiscriminate rate cuts even if inflation remains above the 2% target.

Participants in the meetings also pointed to earlier briefings where Hassett had focused on non-market political topics, raising questions about the Fed’s independence.

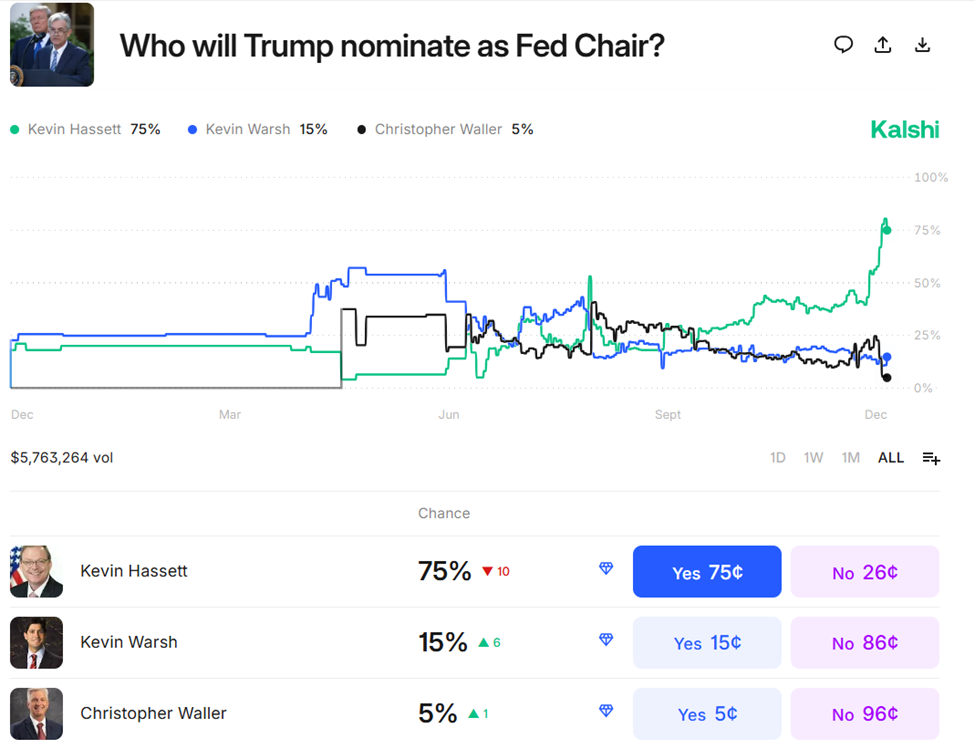

Prediction markets now give Hassett around 75% probability of becoming the next Fed Chair, far above rivals Christopher Waller and Kevin Warsh.

Next Fed Chair Probabilities. Source:

Kalshi

Next Fed Chair Probabilities. Source:

Kalshi

Crypto Markets See a Dovish Tailwind

Crypto markets are taking the opposite view. Traders interpret Hassett’s stance as a green light for faster easing, more liquidity, and a weaker dollar, a combination that historically supports Bitcoin, Ethereum, and high-beta altcoins.

Hassett has publicly said he would cut rates immediately if he led the Fed. That dovish posture contrasts sharply with Powell’s cautious, data-anchored approach, which has kept real yields elevated and risk appetite subdued.

His background also fuels optimism in digital-asset circles. Hassett previously served as an advisor to Coinbase and holds over $1 million in COIN stock, creating both conflict-of-interest questions and expectations of a more crypto-friendly regulatory environment.

Who is Kevin Hassett?Trump's Frontrunner for Next Fed Chair? Longtime Trump ally: CEA Chair (2017-2019), now NEC Director in Trump 2.0Ultra-dovish: repeatedly calls for aggressive rate cuts, prioritizes growth & jobs over inflation fightingWould execute Trump's dream of… pic.twitter.com/ePpeAaXkOx

— 0xMarioNawfal (@RoundtableSpace) November 30, 2025

Bitwise strategist Juan Leon recently argued that a Hassett-led Fed would be “strongly bullish,” citing his pro-crypto regulatory work and his history of criticizing current rates as “too high.”

If Kevin Hassett becomes Fed Chair, the implications for crypto are strongly bullish. 1. Aggressive "dove" who has publicly criticized current rates for being too high and advocated for deeper, faster cuts.2. Led the White House digital asset working group to shape pro-crypto…

— Juan Leon (@singularity7x) November 25, 2025

Political Pressure Intensifies the Divide

President Trump has steadily amplified his criticism of Powell and has repeatedly hinted that he has “already decided” on the next Fed Chair. He is expected to announce the successor soon.

At the same time, reports indicate that Trump may elevate Treasury Secretary Steven Mnuchin to become his top economic adviser if Hassett is appointed. This highlights the administration’s effort to realign economic leadership around a more aggressive growth agenda.

BREAKING: President Trump is reportedly considering making Treasury Secretary Bessent his top economic adviser if Kevin Hassett becomes the next Fed Chair.This would be in addition to Bessent’s current job as Treasury Secretary.A new era of financial policy is coming. pic.twitter.com/d8ehhItjnY

— The Kobeissi Letter (@KobeissiLetter) December 3, 2025

The political dynamics add to bond-market anxiety. Investors fear a scenario in which the Fed shifts toward rapid easing while inflation remains sticky. Such a move would weaken central-bank credibility just as deficits and issuance remain at historically high levels.

Hassett’s candidacy has crystallized a rare market divergence: crypto is pricing in liquidity-driven upside, while bonds are bracing for policy risk and volatility.

With Powell’s term ending in May 2026 and final interviews underway, the next several weeks will shape expectations for both monetary policy and digital-asset markets.

An official nomination is expected early next year. Until then, investors will continue to trade the growing possibility of a dovish, crypto-aligned Fed and the pushback from traditional finance that comes with it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Increasing Need for Expertise in AI and Computational Fields: Discovering Investment Prospects in Educational and Training Platforms

- Farmingdale State College (FSC) expands computing programs and partners with Tesla/Amazon to address AI/data science demand. - Edtech firms like Century Tech use AI for personalized STEM learning, aligning with FSC’s need to scale enrollment while maintaining rigor. - Global AI education market projected to reach $12.8B by 2028 (33.5% CAGR), driven by corporate/university collaborations like SUNY-NY Creates TII. - Investors face risks in regulatory scrutiny and curriculum obsolescence but gain opportunit

Magic Eden to expand $ME buybacks in 2026 using revenue from Swaps, Lucky Buy, and Packs

The Emergence of Hyperliquid (HYPE): Analyzing the Latest Market Rally

- Hyperliquid (HYPE) dominates 73% of decentralized derivatives market in 2025 via liquidity innovations and hybrid trading structures. - HIP-3 protocol and two-tier architecture drive $3.5B TVL, enabling EVM compatibility and 90% fee cuts to attract DeFi projects. - Platform's 71% perpetual trading share reflects strategic buybacks ($645M in 2025) and 78% user growth amid shifting capital toward on-chain infrastructure. - Hybrid model challenges CEX dominance while facing aggregator risks, but institution

The Emergence of Tokens Supported by MMT and Their Influence on Financial Systems in Developing Markets

- MMT-backed tokens leverage blockchain to tokenize sovereign debt, real estate , and carbon credits, reshaping emerging market fiscal strategies. - Tokenized bonds enable local-currency issuance with smaller denominations, as demonstrated by Hong Kong's 2025 digital green bonds and OCBC's commercial paper program. - Central banks integrate blockchain tools for real-time liquidity adjustments, while programmable features like inflation-linked coupons enhance fiscal flexibility in volatile economies. - Chal