- The live price of the LINK token is $ 14.41920720.

- Price prediction for 2025 suggests a potential high of $32.

- Long-term forecasts indicate LINK could reach $195 by 2030.

Chainlink has emerged as a game-changing decentralized oracle network, enabling smart contracts to connect seamlessly with real-world data, APIs, and traditional financial systems. As the crypto market evolves, Chainlink’s role continues to expand, especially with its Cross-Chain Interoperability Protocol (CCIP) gaining traction. Its native token, LINK, not only powers the ecosystem but has also caught the attention of investors and analysts. As a result, institutional interest surged, leading to the launch of the LINK ETF by Grayscale in early December 2025.

With LINK price showing signs of a potential breakout and strong on-chain fundamentals backing its rise, the big question remains: Can LINK coin price hit $50 in December 2025? Let’s dive into this detailed Chainlink price prediction 2025–2030 to find out.

Table of Contents

- Chainlink Price Prediction December 2025

- Chainlink Price Analysis 2025

- Chainlink Price Forecast 2025

- Chainlink Price Targets 2026 – 2030

- Market Analysis

- CoinPedia’s Chainlink Price Prediction

- FAQs

| Cryptocurrency | Chainlink |

| Token | LINK |

| Price | $14.4192 |

| Market Cap | $ 10,048,024,110.09 |

| 24h Volume | $ 942,308,434.2911 |

| Circulating Supply | 696,849,970.4526 |

| Total Supply | 1,000,000,000.00 |

| All-Time High | $ 52.8761 on 10 May 2021 |

| All-Time Low | $ 0.1263 on 23 September 2017 |

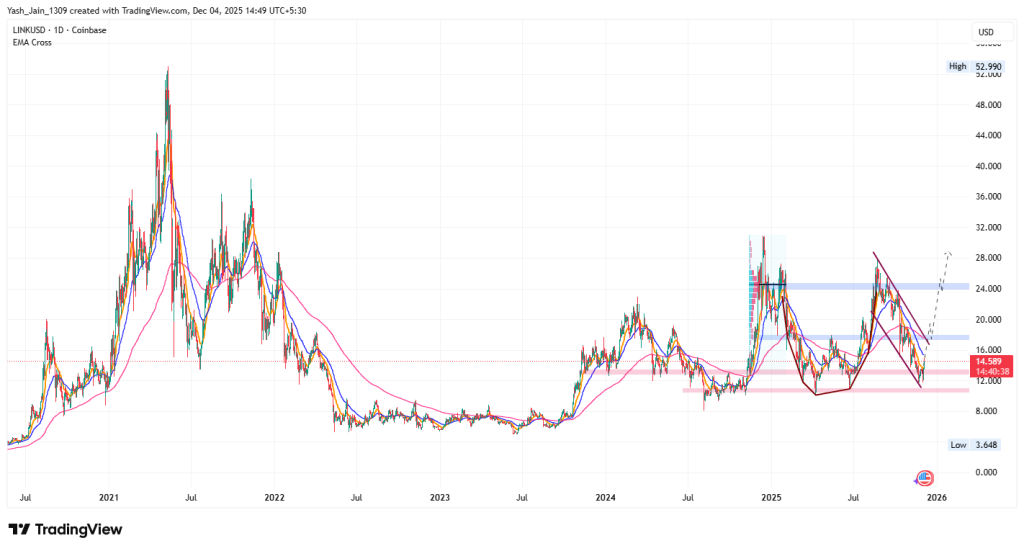

The wedge formed from the cup and handle pattern appears to be entering its final completion phase. In late November, the lower border of the handle provided support, which was further strengthened by the LINK ETF announcement on December 3rd.

It appears that the price is heading towards the upper boundary of this handle pattern. A significant jump could be imminent, aiming to test the $18 upper border of this wedge soon. Beyond that, a breakout may be on the horizon, as widespread accumulation might be occurring.

This suggests that December 2025 has the potential to be either a month of significant gains if the price rallies or a month of continued losses if it remains flat. If the price rises, the $18 resistance could become a critical target, potentially leading to a surge towards $24. Conversely, if the price falls below the $13 support level, the decline might continue down to $10.

| Month | Potential Low ($) | Potential Average ($) | Potential High ($) |

| LINK Crypto Price Forecast November 2025 | 10 | 18 | 30 |

In 2025, Chainlink price (LINK) started the year on a downward path, but by April, the tide began to turn. Early in April, LINK began its recovery from a low of $10.067.

By May, it had formed a bullish rounded bottom pattern, with a crucial neckline set at $18. However, since mid-May, LINK faced challenges in maintaining its position near this neckline.

By the third week of June, it pulled back toward the support level of the rounded bottom, which coincides with a multi-year support zone around $11.

In the final week of June onwards, the LINK price began to rise higher following the Bitcoin rally.

The Chainlink price (LINK) saw significant growth in the second half of 2025, rising from $11 to $28 between July and August. This surge was primarily triggered by the successful launch of the Chainlink Reserve.

However, after reaching its peak, profit-taking in late August led to a decline in the LINK/USD price, which dropped to $11.75 by November 21st. This price point coincided with the lower border support of a declining wedge, which is part of a cup-and-handle pattern where the handle is represented by the declining wedge.

By late November, the price began to rise again, facing some challenges around the $13.30 mark. On December 3rd, momentum shifted positively when Grayscale launched its LINK ETF , GLNK, resulting in a 25% increase and enabling the price to clear the 20-day EMA band on the daily chart. It now appears that LINK price is headed to retest the upper boundary of the handle as well as the falling wedge.

The immediate bullish outlook for LINK/USD as of late December 2025 depends on increased demand. A sustained close above the $18 resistance level would confirm a cup-and-handle breakout for Chainlink price. However, before reaching this point, LINK must first surpass the $15 level. Confirming this breakout could lead to a rally that revisits the $24 and $28 levels by December or the end of the year.

Also, if it breaks through $28, a strong long-term upward trend could be established in the first half of 2026, with forecasts suggesting a potential target of $52.

Conversely, if the LINK price fails to break through the $20 resistance, it may continue to follow its current pattern and potentially extend its downtrend to $10 or lower by the end of the year. In this scenario, any chances for a bullish rally would rest entirely on the shoulders of 2026.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2025 | 13 | 35 | 52 |

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 35 | 50 | 55 |

| 2027 | 48 | 64 | 80 |

| 2028 | 58 | 85 | 104 |

| 2029 | 70 | 108 | 141 |

| 2030 | 85 | 147 | 195 |

This table, based on historical movements, shows Chainlink price to reach $195 by 2030 based on compounding market cap each year. This table provides a framework for understanding the potential LINK price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $15.32 | $25.83 | $140.70 |

| coincodex | $10.66 | $6.44 | $14.79 |

| Binance | $17.55 | $18.43 | $22.40 |

| Mitrade | $22.64 | $32.22 | $139.2 |

| Investing Haven | $39.20 | $54.10 | $80 |

| Flitpay | $40.6 | $62.6 | $110 |

*The aforementioned targets are the average targets set by the respective firms.

Chainlink has the inherent capability to expand smart contracts, allowing data accessibility for events and transactions. Optimism is catching up with the heat on a long-term price forecast for the platform.

According to Coinpedia’s formulated prediction, if the network updates in cryptography and starts new partnerships. LINK price might reach a maximum of $47.

On the flip side, the LINK price can dump to $31. This gives us the average trading price of the token at $39.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $31 | $39 | $47 |