The leading cryptocurrency is creating significant 15-minute candles again, and with only a few days left until the Fed meeting, anticipation is building. BlackRock’s CEO has made notable statements, ETFs are rebounding, and concerns about the Strategy are diminishing. Enthusiasts now speculate about the timing of an anticipated Ethereum rally, which is crucial for those waiting on an altcoin bull. Recent predictions about ARB Coin’s prospects are also noteworthy.

Altcoin Surge and Ethereum

Ethereum (ETH) $3,149 , the largest altcoin in market value, shows a dominant performance, outperforming Bitcoin (BTC) $92,384 and stimulating interest across altcoins . Although the past altcoin booms may not return due to the plethora of cryptocurrencies, a robust upward trend is expected at least among major cryptocurrencies.

Yesterday, ETH ETFs witnessed a remarkable inflow of $140 million, a trend unseen for weeks. This influx indicates a growing appetite among investors for ETH. Concurrently, the ETHBTC pair is gaining momentum, enhancing market optimism.

DaanCrypto shared a recent chart to emphasize his belief in the upward trajectory.

“ETH remains stable and is now moving at a ratio of 0.032 to BTC. Honestly, everything appears clean considering there’s a clear invalidation below this level. As long as this bounce continues, it’s not surprising to see ETH outperforming. BMNR continues to be a major buyer on a weekly basis, supporting the price somewhat.”

BitMine, targeting 5%, has already acquired 3% of ETH’s supply since June and has shown resilience against strong selling pressures, continuing its purchases.

Analyst Poppe focused on the ETHBTC pair, acknowledging the new records set during the altcoin boom and noting ETH surpassing its moving average for the first time since August. If a higher low and support are seen at the daily 20-MA, Poppe predicts further gains.

ARB Coin Analysis

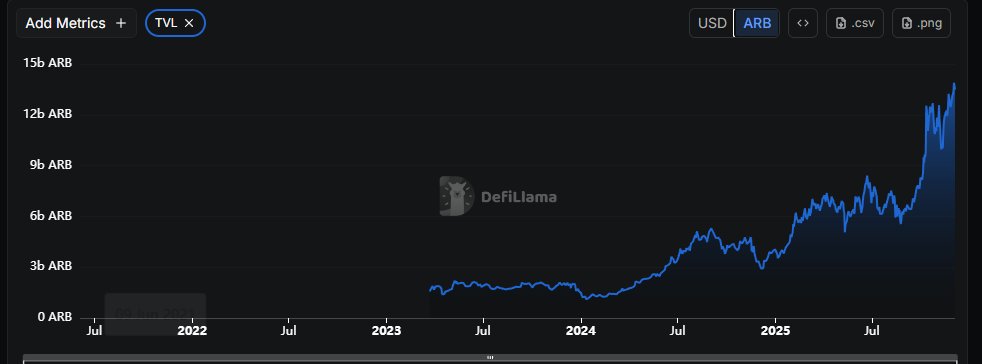

The ARB Coin price graph shows little growth, but the total value locked (TVL) in the network is increasing. Highlighting Arbitrum’s vast potential, Michael Poppe emphasized the possibility for long-term growth. Despite a 70% price drop over three months, the TVL continues to rise steadily, indicating robust network activity.

“As you can see, the network’s TVL is peaking. Despite current market conditions, new ATHs in TVL are set daily. DEX volume is significantly increasing too. The number of applications in the ecosystem rises weekly. While active addresses are fewer than by the end of 2023, given the market downturn, it’s expected. Based on these factors alone, I believe we’re dealing with a market where many fantastic protocols in the ecosystem are undervalued.”