Date: Thu, Dec 04, 2025 | 05:24 PM GMT

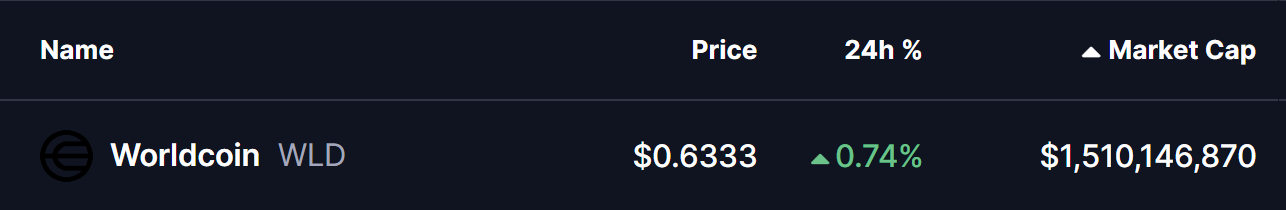

The broader cryptocurrency market is showing renewed upside strength as Ethereum (ETH) rebounds back toward the $3200 region after dipping to $2720 earlier this week. That recovery has helped several altcoins stabilize and shift green — including Worldcoin (WLD), which is beginning to display early breakout signals.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Channel in Play

On the daily chart, WLD continues to drift inside a clean descending channel, defined by two parallel falling trendlines. This structure has dictated price compression for several weeks, keeping bulls largely contained while also preventing deeper breakdowns.

WLD once again retested the channel base near $0.5619, where demand returned and forced a counter-move back toward the midpoint of the structure.

Worldcoin (WLD) Daily Chart/Coinsprobe (Source: Tradingview)

Worldcoin (WLD) Daily Chart/Coinsprobe (Source: Tradingview)

Price is now hovering around $0.6331, sitting just beneath the upper channel barrier and not far below the declining 50-day moving average at $0.7565. That confluence zone forms the immediate breakout region to watch.

What’s Next for WLD?

If buyers manage to lift WLD through the channel ceiling near $0.667 and secure daily strength above the 50-day MA, the pattern would confirm completion of the corrective phase. In that bullish outcome, the next major magnet sits toward $0.9303, the zone aligning with prior structural breakout target.

However, if resistance holds and WLD fails to break out on this attempt, the descending channel will remain active. In that case, the price could continue grinding along the structure, with $0.5558 still standing as the next important support line. As long as that level remains protected, buyers will retain constructive footing.

At the moment, WLD’s positioning leans positive. The descending channel is fully developed, downside momentum has softened, and each test of support continues to show absorption rather than capitulation. A clean breakout above the trendline, coupled with a reclaim of the 50-day moving average, would offer the strongest confirmation that the next phase of upside expansion is ready to begin.