Proposed ‘AfterDark’ Bitcoin ETF Would Skip U.S. Trading Hours

Weary U.S.-based bitcoin BTC$93.110,27 bulls might think it's their imagination that they seem to wake up every morning to BTC doing pretty well only for prices to head lower during the U.S. trading session.

They are, in fact, not imagining things.

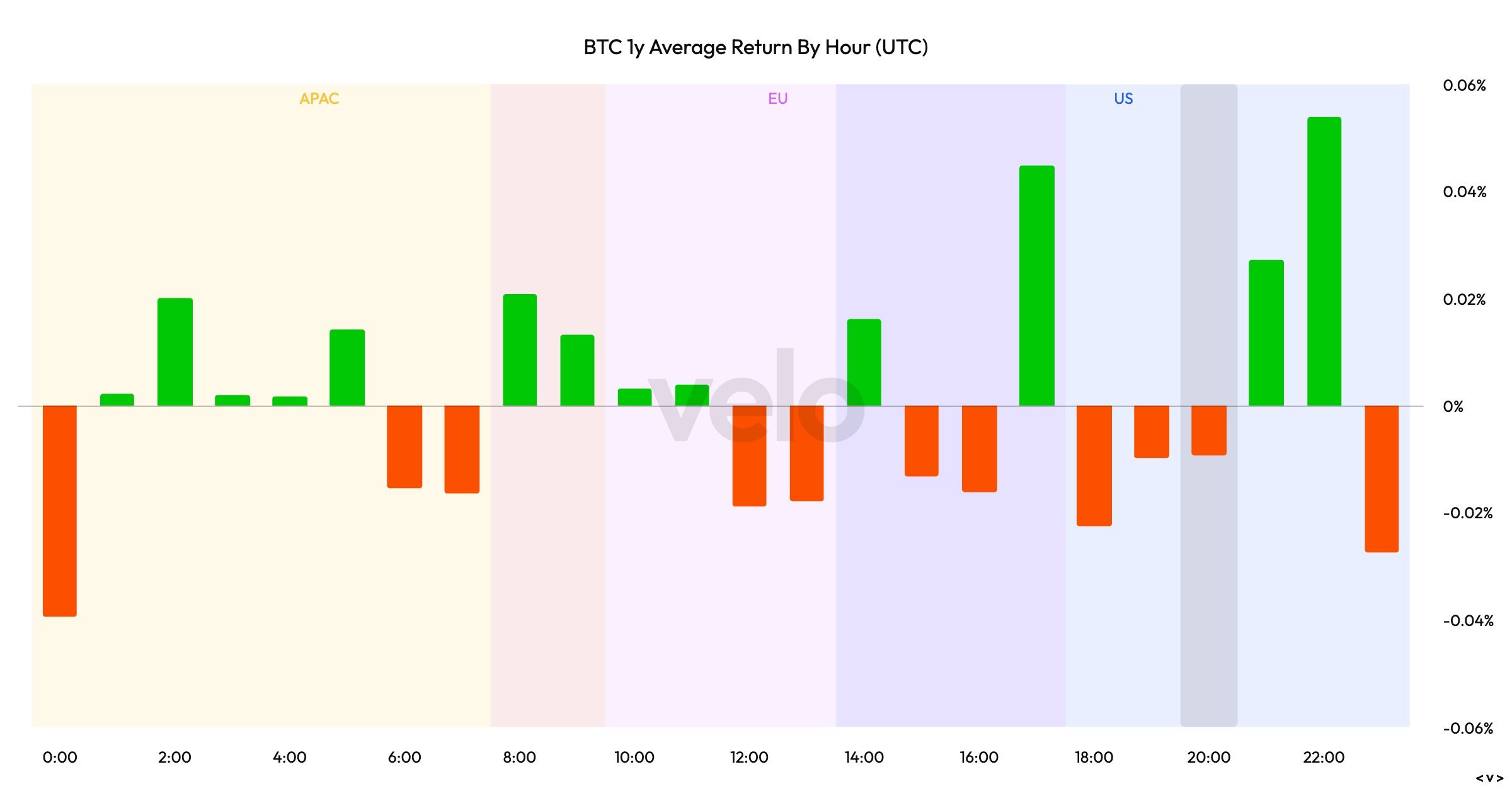

Data from crypto analytics platform Velo.xyz shows that over the past year, bitcoin is more likely to be in the green when traditional U.S. markets are closed and in the red when they're open.

Bloomberg's Eric Balchunas said the data on better performance after U.S. hours was similar for 2024 as well and suggests the spot ETFs or derivatives positioning could be having an impact.

Seeking to take advantage, Nicholas Financial Corporation, a boutique wealth management firm, has filed with the U.S. Securities and Exchange Commission (SEC) to launch a bitcoin BTC$93.110,27 ETF that holds the asset only during overnight hours, opting out of the U.S. trading day entirely.

The fund, called the Nicholas Bitcoin and Treasuries AfterDark ETF (NGTH), would buy bitcoin at 4 p.m. ET—when U.S. markets close—and sell by 9:30 a.m. ET the following day, before the markets reopen. During daytime hours, the fund would rotate into short-term U.S. Treasuries to preserve capital and generate yield.

The firm also submitted paperwork for a second product, the Nicholas Bitcoin Tail ETF (BHGD).

If approved, the ETF would add a novel twist to the growing ecosystem of bitcoin investment products by treating time of day as a key factor in its strategy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating Workforce Changes Through Investment in Educational Technology

- Global workforce transformation driven by AI/automation demands education-industry alignment to bridge skills gaps. - EdTech investments surge in SaaS/corporate upskilling platforms (18.6x EV/Revenue) as STEM/vocational training gains urgency. - Persistent equity gaps (35% female STEM graduates) and 411K unfilled U.S. teaching roles challenge workforce development. - ETFs like KNCT/RSPT (20.98x-22.74x P/E) offer cost-effective exposure to AI-driven productivity tools versus broader tech ETFs. - Investors

Solana Validator Numbers Slide 68% Since 2023, Community Divided

Quick Take Summary is AI generated, newsroom reviewed. Solana's active validator count has seen a sharp decline, falling from over 2,500 in March 2023 to approximately 800, representing a 68% decrease. One perspective argues the decline is a beneficial "healthy pruning" that removes Sybil nodes and improves the genuine decentralization and quality of the network. An opposing view, supported by infrastructure teams, suggests the exits are genuine operators who were forced out by high hardware and bandwidth

A Strong Wave of Institutional Buying Reshapes the XRP Market

Quick Take Summary is AI generated, newsroom reviewed. US XRP spot ETFs purchased $38.04 million worth of XRP recently. Institutional crypto demand rises sharply as funds increase holdings. Strong inflows boost XRP market momentum and attract new investors. ETF activity strengthens confidence and prepares the market for growth.References BREAKING: 🇺🇸 XRP spot ETFs have just bought 38.04 million worth of $XRP.

Ethereum Gas Futures Plan by Vitalik Buterin Gains Attention

Quick Take Summary is AI generated, newsroom reviewed. Vitalik Buterin proposes a trustless on-chain gas futures market for Ethereum. Users could lock transaction fees in advance to avoid unexpected costs. The system is trustless, using smart contracts for fairness and security. Challenges include market liquidity, price swings, and user adoption.References Ethereum co-founder Vitalik Buterin has proposed creating a trustless onchain gas futures market that would allow users to lock in transaction fees for