Crypto Game under Hawkish Rate Cuts: How FOMC Night Reshapes Asset Pricing Logic

Author: ChandlerZ, Foresight News

Original Title: On the Eve of the Rate Decision: Hawkish Rate Cuts Loom, the Liquidity Gate and the Year-End Test for the Crypto Market

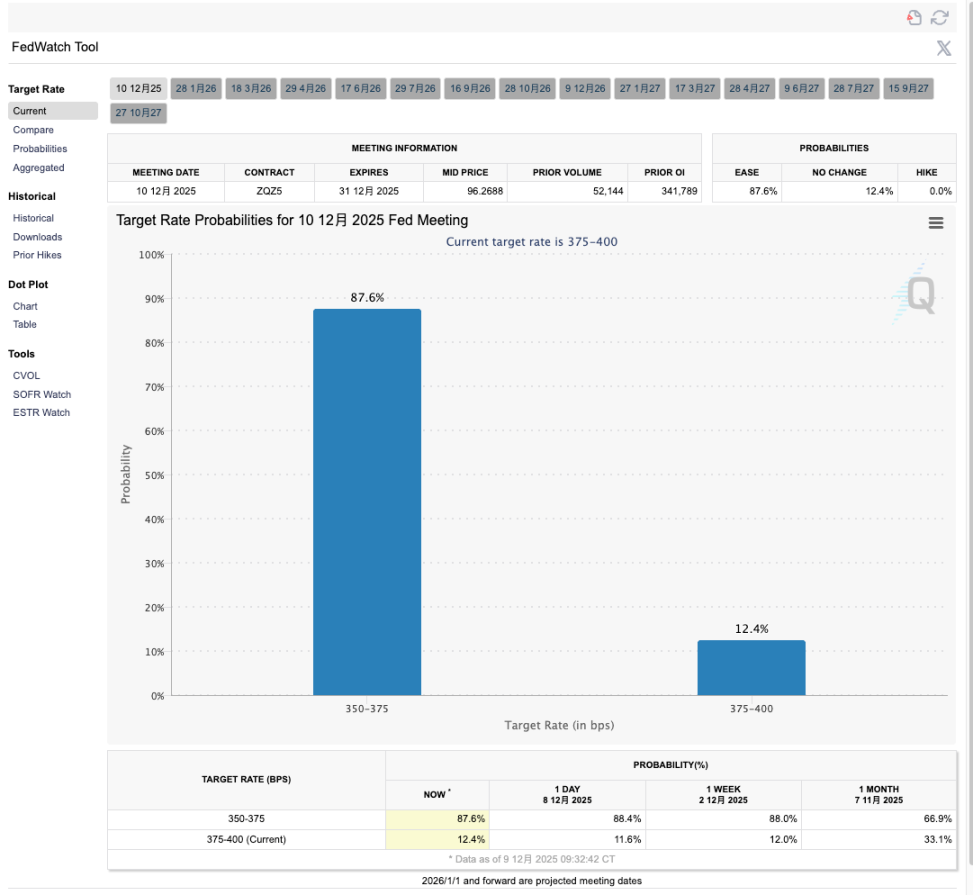

In the early hours of December 11, Eastern Eight District time, the Federal Reserve will announce its final interest rate decision of the year. The market has almost reached a consensus that the federal funds target range is highly likely to be cut by another 25 basis points, from 3.75%–4.00% down to 3.50%–3.75%, marking the third rate cut since September.

But rather than waiting to see if there will be a rate cut, the market is more concerned about whether this will be a standard "hawkish rate cut."

Behind this subtle sentiment is a highly divided Federal Open Market Committee. Some members worry that the job market is already showing signs of weakness amid government shutdowns and proactive corporate downsizing, and that keeping rates high will only amplify recession risks; other members focus on core inflation, which remains above the 2% target, believing that current rates are already restrictive enough and that turning dovish too soon would sow greater inflation risks for the future.

What makes things trickier is that this debate is happening during a data vacuum. The U.S. government shutdown has delayed the release of some key macro data, forcing the FOMC to make decisions with incomplete information, which also makes policy communication for this meeting significantly more challenging than usual.

A Divided FOMC and a Reprise of the Hawkish Rate Cut

If this rate decision is seen as a major drama, then the hawkish rate cut in October serves as the prelude. At that time, the Federal Reserve both lowered the federal funds rate target range by 25 basis points and announced the official end of its three-year quantitative tightening process as of December 1, halting further balance sheet reduction. Operationally, this was a clearly dovish combination—rate cuts plus ending QT—which should, in theory, provide sustained support for risk assets.

However, Powell repeatedly poured cold water on expectations at the press conference. He emphasized that another rate cut in December was by no means a foregone conclusion and, unusually, publicly mentioned strong disagreements within the committee. As a result, while rates did fall and the Fed signaled marginal monetary easing, the dollar and U.S. Treasury yields climbed, and both the stock and crypto markets quickly gave back their brief gains.

New York Fed President Williams stated at the end of November that there was still room for further adjustments to the federal funds rate target range in the short term, which was seen as a public endorsement of this rate cut; in contrast, several officials from the Boston Fed, Kansas City Fed, and others repeatedly reminded that inflation remains above the 2% target and that service prices are particularly sticky, arguing that there is no strong need to continue easing in this environment. In their view, even if there is another cut this time, it is more like a minor policy adjustment rather than the start of a new easing cycle.

External institutions' forecasts reflect this same ambivalence. Investment banks like Goldman Sachs generally expect the dot plot to slightly raise the path of rate cuts after 2026, meaning that while acknowledging current economic and employment pressures, the Fed will still deliberately signal to the market not to interpret this cut as a return to a continuous easing mode.

Three Scenarios: How Bitcoin Prices Itself in Macro Gaps

On the eve of the rate decision, bitcoin's position is quite delicate. Since its surge in October, the price has undergone a roughly 30% pullback and is currently consolidating above $90,000; meanwhile, ETF net inflows have slowed significantly compared to the peak at the start of the year, some institutions have begun to lower their medium- and long-term price targets, and concerns about persistently high risk-free rates are slowly seeping into pricing models. The signals from this rate decision could push the market onto three completely different trajectories.

The first is the most likely baseline scenario: rates are cut by another 25 basis points as expected, but the dot plot is conservative about the number of cuts after 2026, and Powell continues to stress at the press conference that there is no preset path for continuous rate cuts and that everything depends on the data. In this scenario, the market still has reason to buy the rate cut itself in the short term, and bitcoin may attempt to test resistance near its previous highs that night. However, as long-term U.S. Treasury yields stabilize or even rise slightly, real rates will increase, and the sustainability of the sentiment recovery will be tested. Prices are more likely to see repeated tug-of-war at high levels rather than a strong, sustained upward trend.

The second is a relatively dovish but less likely surprise scenario: in addition to the rate cut, the dot plot significantly lowers the medium-term rate center, implying more than two additional cuts in 2026, and the post-meeting statement positions the end of QT more as a reserve management-style bond purchase, with a clearer commitment to maintaining ample reserves. This scenario essentially means another rate cut plus a reversal in liquidity expectations, which would be a substantial positive for all long-duration assets.

For the crypto market, as long as bitcoin can hold its ground near $90,000, it will have a chance to challenge the psychological barrier of $100,000 again. On-chain assets represented by ETH and mainstream DeFi and L2 protocols may see significant excess returns driven by a return of on-chain liquidity.

The third is an unexpected scenario that would significantly suppress market risk appetite: the Federal Reserve chooses to hold steady, or, although it cuts rates, the dot plot sharply raises long-term rates and significantly reduces the number of future cuts, signaling to the market that October and December were merely insurance tweaks and that high rates will remain the main theme for longer. In this scenario, the dollar and U.S. Treasury yields are likely to strengthen, and all non-cash-flow assets that rely on valuation support will come under pressure.

Given that bitcoin has already experienced a significant pullback, ETF inflows are slowing, and some institutions are adjusting their expectations, the addition of a negative macro narrative could technically lead to a search for new support levels. High-leverage and pure narrative altcoins are even more likely to become priority targets for liquidation in this environment.

For crypto market participants, this rate decision night is more like a macro-level options expiration date.

Whether in U.S. stocks or in bitcoin's history, most FOMC rate decision nights follow a similar pattern. The hour after the decision is announced is the battlefield for emotions, algorithms, and liquidity, with wild swings in the candlesticks but no stable directional signal; the real trend usually only becomes clear in the following 12–24 hours, after the press conference ends and investors have digested the dot plot and economic forecasts.

The rate decision determines the current rhythm, but the direction of liquidity is likely to decide the second half of this cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Elon Musk at the Center of an Unprecedented Showdown with the EU

Stablecoin Payments: Stripe’s Tempo Blockchain Launches Public Testnet

Trump Launches Fed Auditions: Who Will Replace Powell?

Whales Wait for Powell: Why Bitcoin Could Slip Tonight