Base Creator Jesse Pollak Sparks Backlash by Endorsing Soulja Boy–Linked Meme Token

Base creator Jesse Pollak is facing growing criticism after publicly promoting what appeared to be a meme token linked to rapper Soulja Boy. This case reignites long-standing concerns about celebrity involvement in speculative crypto projects. Base Exec Jesse Pollak Faces Backlash After Promoting Soulja Boy–Linked Meme Token The controversy unfolded over a series of posts

Base creator Jesse Pollak is facing growing criticism after publicly promoting what appeared to be a meme token linked to rapper Soulja Boy.

This case reignites long-standing concerns about celebrity involvement in speculative crypto projects.

Base Exec Jesse Pollak Faces Backlash After Promoting Soulja Boy–Linked Meme Token

The controversy unfolded over a series of posts on X (Twitter) in mid-December. On December 13, Soulja Boy shared a comparison of creator payout schedules across major platforms, arguing that newer apps offered faster monetization.

“Twitch pays you once a month. TikTok pays you once a week. Favorited pays you once a day. Choose your poison wisely,” the rapper wrote.

A day later, Pollak appeared to amplify the message while positioning Base, Coinbase’s Ethereum Layer‑2 network, as a new creator-focused monetization layer.

. @baseapp pays you instantly

— jesse.base.eth (@jessepollak) December 13, 2025

With this remark, Jesse Pollak framed on-chain tools as a superior alternative to traditional social platforms.

The situation escalated when Pollak directly replied to Soulja Boy. The crypto executive stated that he had just backed Soulja Boy on Base and had “instantly earned,” describing the dynamic as “new internet” behavior.

@souljaboy just backed you on @base and you instantly earned. new internet shit

— jesse.base.eth (@jessepollak) December 13, 2025

Notably, Pollak did not explicitly promote a specific token by name. Nonetheless, many users interpreted the exchange as an endorsement of a Soulja Boy–linked meme token and, more broadly, of the rapper’s crypto activity.

ZachXBT Calls Out Soulja Boy’s Crypto History

That perception triggered a swift response from blockchain investigator ZachXBT. The sleuth publicly questioned Pollak’s decision to engage with Soulja Boy at all.

“Why give SouljaBoy the platform to scam new people?” ZachXBT posed, referencing his prior investigations into the rapper’s crypto history.

ZachXBT pointed to research he published in April 2023 documenting what he described as a pattern of exploitative behavior.

According to that investigation, Soulja Boy was involved in 73 crypto promotions and 16 NFT launches. Many allegedly ended in collapses, abandoned projects, or rug pulls.

1/ In recent weeks influencers have given @souljaboy praise for new NFT projects in hopes of clout.In reality he has been one of the most shameless promoters in the crypto space.In my research I observed 73 promotions & 16 NFT drops done by him. Many of these were scams.

— ZachXBT (@zachxbt) April 19, 2023

The research detailed repeated instances in which promoted tokens lost value shortly after heavy marketing, followed by the deletion of promotional posts.

The investigator also highlighted alleged regulatory and legal issues surrounding the rapper’s past activity. Among them are past SEC charges related to Tron promotions and a lawsuit connected to SafeMoon.

Beyond tokens, the research described numerous NFT drops that advertised future utility but were later abandoned, with some collections reportedly removed from marketplaces due to concerns over intellectual property.

For critics, the issue extends beyond any single token. They argue that when prominent builders like Pollak, who plays a key role in shaping Base’s public image, engage with controversial figures, it risks undermining trust in the broader ecosystem.

Base has positioned itself as a mainstream-friendly, compliant Layer‑2 network backed by Coinbase, making reputational risk particularly sensitive.

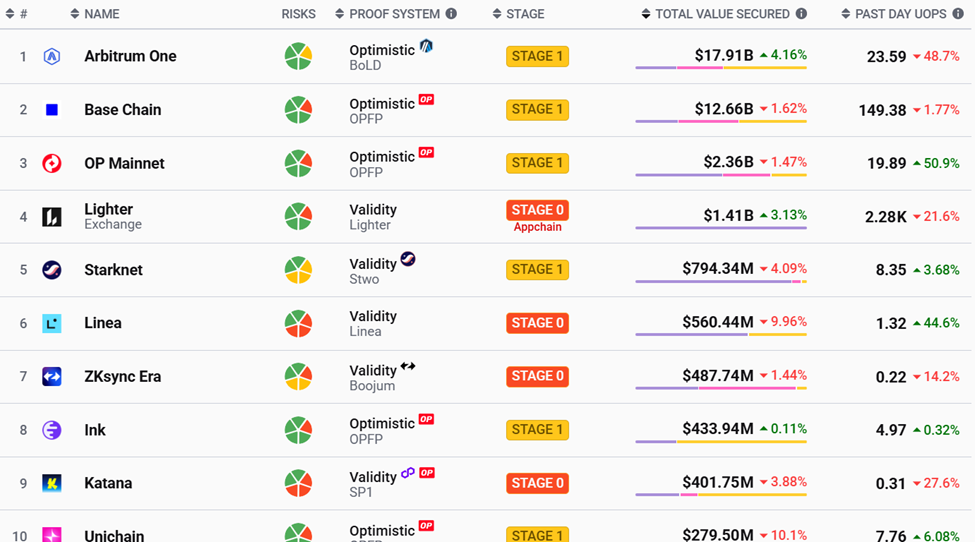

Ethereum Layer-2 Networks by TVS. Source:

L2Beat

Ethereum Layer-2 Networks by TVS. Source:

L2Beat

The episode has reignited a familiar debate in crypto. Responsibility lies when influential developers amplify celebrity-driven projects with troubled track records.

“Even if intentions were lighthearted, credibility risk compounds fast when serious builders mingle with serial promoters. Markets judge alignment, not tone. Signal erodes when attention shifts from innovation to spectacle, and liquidity follows perception,” one user expressed.

Supporters of open networks argue that permissionless systems should not police who can build or promote on‑chain.

Critics counter that visibility from senior ecosystem leaders functions as implicit validation, especially for newcomers.

The backlash facing Pollak highlights the growing scrutiny on how major platforms balance openness with due diligence. It also shows how quickly past controversies resurface when trust is at stake. This is as crypto once again experiments with creator monetization and meme-driven distribution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of a Vibrant Clean Energy Market: How REsurety's CleanTrade Platform is Transforming Institutional Investments and ESG Approaches

- REsurety's CleanTrade platform, CFTC-approved for clean energy swaps, is transforming the market by enabling institutional trading of renewable assets with liquidity and transparency. - It addresses historical illiquidity in VPPAs/RECs through standardized contracts and real-time pricing, reducing transaction times and enabling $16B in notional value within two months. - The platform integrates ESG metrics with financial analysis, supporting 84% of institutional investors' growing demand for decarbonizat

COAI's Significant Recent Drop: Should Investors See This as a Chance to Buy or a Cautionary Signal?

- COAI's sharp stock decline sparks debate over short-term volatility vs. structural risks in South Africa's coal sector. - Weak domestic coal supply chains, US tariffs, and governance gaps amplify operational risks for export-dependent COAI. - Unclear AI policy implementation and media credibility issues deepen investor skepticism about COAI's transparency and adaptability. - Structural challenges including infrastructure bottlenecks and low AI adoption rates suggest the decline may reflect systemic indus

3 Future-Proof Cryptos to Add to Your Portfolio for 2026 — LINK, AVAX, and ALGO

Smart Money Bets on These 3 Altcoins for Big Gains