Monero bucks the market trend and continues to strengthen: What are the reasons?

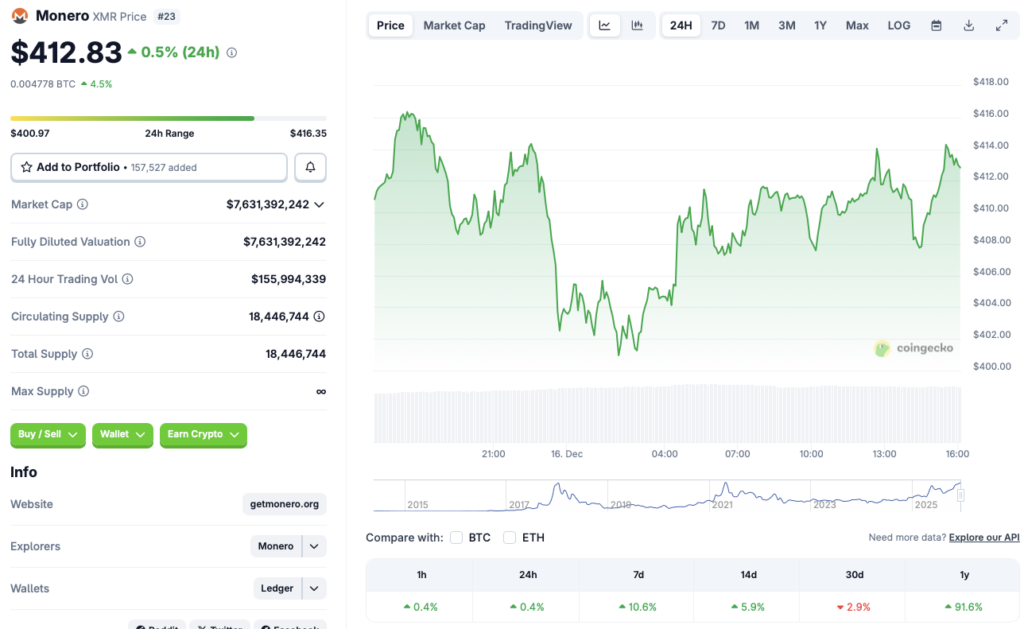

While the major cryptocurrency market faces yet another price correction, Monero (XMR) is bucking the trend and rising. According to CoinGecko's Monero data, this privacy-focused crypto asset has risen 0.4% in the past 24 hours, 10.8% in the past week, 5.9% over 14 days, and has soared 91.6% since December 2024. Nevertheless, Monero (XMR) has still experienced a 2.9% pullback over the past month. Let’s explore why Monero (XMR) is able to rise while other assets are plummeting.

Source: CoinGecko

Source: CoinGecko Why is Monero (XMR) rising while the market is falling?

Source: FinanceMagnate

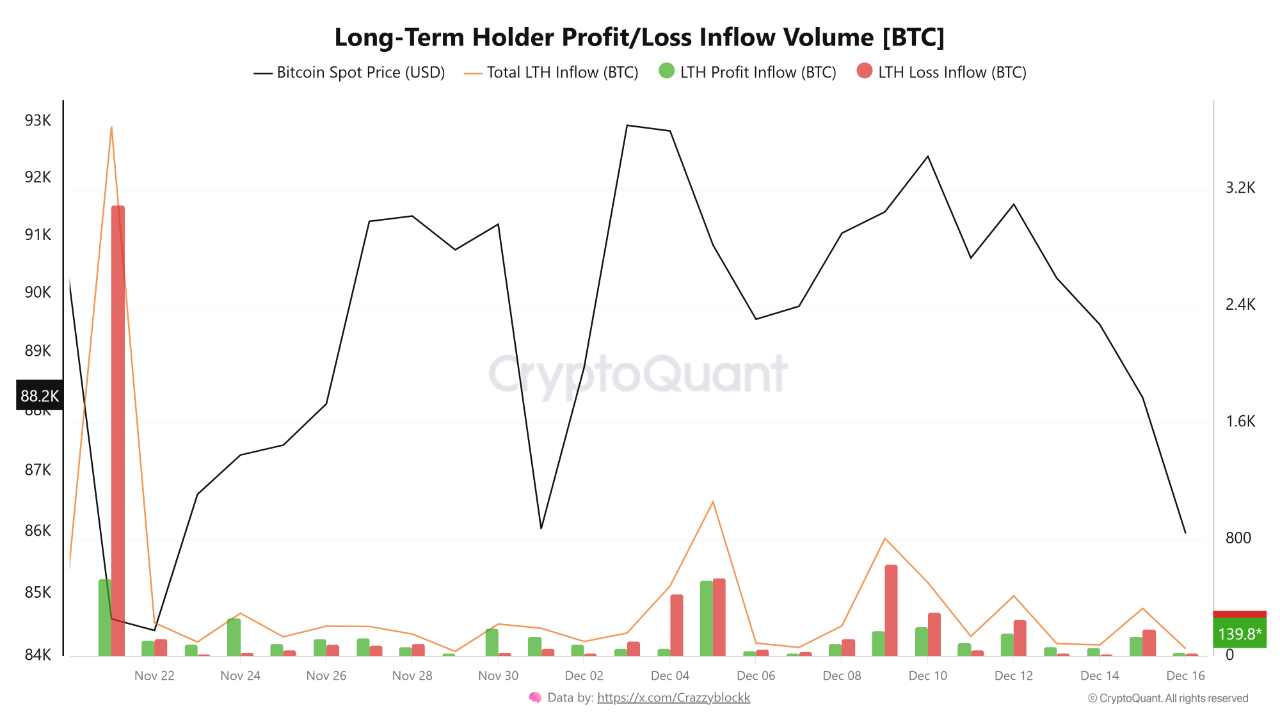

Source: FinanceMagnate Given that the cryptocurrency market is undergoing a significant price correction, the surge in Monero (XMR) is surprising. According to... CoinGlass data shows that over $660 millions worth of cryptocurrencies have been liquidated from the crypto market. In the past 24 hours, the market has seen a broad-based crash, most likely due to ongoing macroeconomic concerns and investors seeking safe-haven strategies. Market participants are likely moving funds into safe-haven assets such as silver and gold.

Monero (XMR)'s current upward momentum may stem from increased interest in privacy coins. Investors may be spooked by ongoing market turmoil and are turning to privacy cryptocurrencies. The shift to privacy coins is nothing new. This trend was already evident back in October when cracks began to appear in the crypto market. In addition to Monero (XMR), ZCash (ZEC) also experienced a surge, but later underwent a significant pullback.

Also read: SEC Chairman calls cryptocurrency a "financial surveillance architecture"

If demand for privacy coins remains strong, Monero (XMR)'s rally could continue. However, given the current market conditions, the asset could face a pullback at any time. Macroeconomic conditions have not improved, and the global economy remains quite unstable. For now, silver and gold seem to be getting more attention. If the status quo remains, privacy coins may continue to grow in the coming months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Treasury KindlyMD faces Nasdaq delisting, stock price drops 99%.

Who are the real dip sellers? On-chain data reveals the true sellers of bitcoin

Ethereum Faces Pressure After Failing to Hold $3,400—What Happens Next?