The Fed "successor" reverses course: From "loyal dove" to "reformer"—has the market script changed?

After meeting the last person, Trump’s mind changed yet again.

Just as Wall Street had almost concluded that the new Federal Reserve Chair would be Kevin Hassett, last week, a new meeting at the White House between Trump and former Fed Governor Kevin Warsh threw the outcome into suspense once again.

Unlike previous perfunctory meetings, after this encounter, Trump’s attitude toward Warsh shifted subtly but significantly, clearly giving Warsh more recognition. He even said in an interview with The Wall Street Journal: “I think both Kevins are great,” putting Warsh on par with Hassett as the leading candidates for Fed Chair.

The shift from Hassett to a “two Kevins” contest not only signals a personnel change from a “loyal dove” to a “Fed reformer,” but is essentially a battle over the logic of dollar liquidity for the next four years (see also: Fed Chair Preview: Hassett, Coinbase Holdings, and Trump’s ‘Loyal Dove’).

In short, Trump’s “both are great” means “huge uncertainty” for the market.

I. From Hassett’s “One-Man Show” to the “Two Kevins” Contest

The capital markets are always the most honest. On the prediction market Polymarket, sharp money has already repriced this “succession drama.”

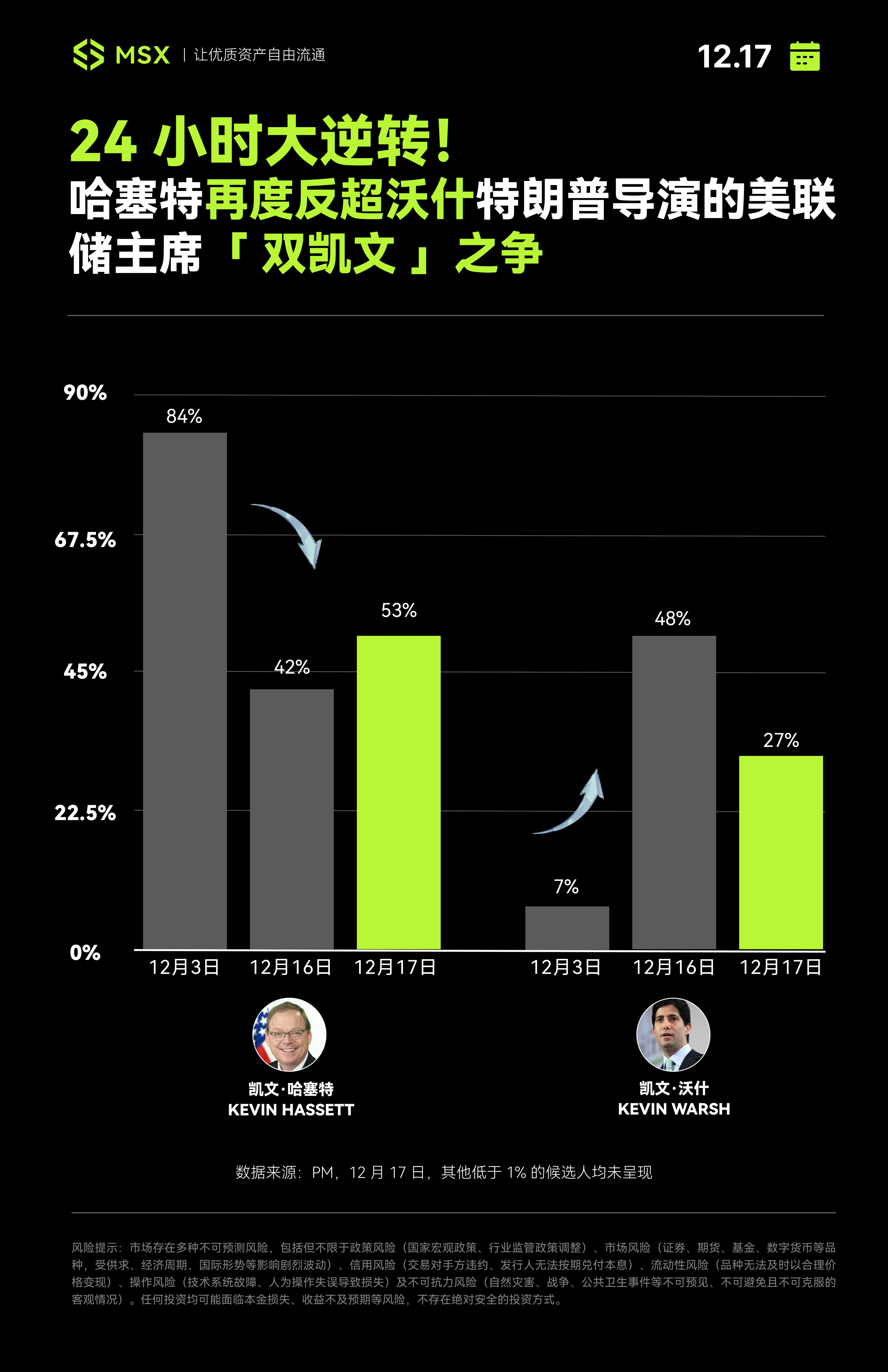

As of December 16, at the time of writing, in the “Who will Trump nominate as Fed Chair?” pool, Warsh’s odds had surpassed 45%, overtaking Hassett (42%) to become the new top “seed.”

Just two weeks earlier, at the beginning of December, Hassett still dominated with an overwhelming 80%+ advantage, while Warsh, like other “also-rans,” had only single-digit odds (Update: as of December 17, Hassett has once again overtaken Warsh, leading 53% to 27%).

So what happened to reverse the previously clear situation so quickly? After reviewing public information, it’s likely that Warsh’s sudden rise and Hassett’s “fall from favor” stem from the details of their respective “advance and retreat.”

First, Warsh’s comeback is primarily due to his “hardcore network” that gives him direct access to Trump’s inner circle.

Compared to Hassett’s “advisor” status, Warsh has a much closer personal relationship with Trump, thanks to his father-in-law—billionaire and Estée Lauder heir Ronald Lauder—who is not only a major Trump donor but also a longtime college classmate and close friend of Trump.

With this connection, Warsh not only advised Trump’s transition team but was naturally seen by Trump as “one of his own.” At the same time, Warsh is also an old friend of Trump’s other key ally, current Treasury Secretary Bessent. As previously reported, Trump once considered Bessent for the next Fed Chair.

Beyond personal ties, Warsh has also won “professional” endorsements. According to the Financial Times, JPMorgan CEO Jamie Dimon recently voiced support for Warsh at a closed-door asset management summit, bluntly stating that Hassett might pursue aggressive rate cuts to please Trump, risking an inflation backlash.

This reflects the preference of Wall Street elites, and their collective support has undoubtedly boosted Warsh’s prospects. In last week’s meeting with Warsh, this trust was validated—Trump revealed that Warsh was his top choice and noted that Warsh’s monetary policy views were “largely aligned” with his own. Trump even unusually said that the next Chair would consult him on rate policy, though not necessarily follow his advice completely.

In contrast, Hassett, who had been the clear frontrunner, seems to have made a tactical error: he tried to demonstrate his “independence” to the market before being officially nominated.

In several public statements last week, to address bond market concerns about his “lack of backbone,” Hassett deliberately distanced himself from Trump. For example, when asked how much Trump’s opinion would matter in Fed decisions, he replied, “No, his opinion won’t carry any weight... Only when his views are reasonable and data-supported will they be considered,” even adding, “If inflation rises from 2.5% to 4%, then we can’t cut rates.”

Objectively, this textbook “central banker’s speech” might reassure bond traders, but it likely irritated Trump, who craves control. Interestingly, it was after these remarks that news of Trump’s meeting with Warsh surfaced.

After all, Trump now wants a “compliant” partner, not another “preacher” like Powell. For future monetary policy control, regardless of Hassett’s intentions, such eagerness to distance himself has likely been marked as a serious “negative” in Trump’s mind.

II. Warsh: The “Insider” Who Once Came Within a Step of the “Fed Throne”

In fact, Warsh is no dark horse. During Trump’s first term, he was the one who “almost had it all, but ultimately missed out.”

Few now remember that Powel, whom Trump now criticizes daily, was actually appointed Fed Chair by Trump himself in 2017.

Even less known is that the final showdown that year was between Powell and Warsh. At the time, Warsh was the youngest Fed Governor in history (age 35) and a key aide to Bernanke during the 2008 financial crisis, but he narrowly lost to Powell, who was strongly backed by then-Treasury Secretary Mnuchin.

Interestingly, four years later, Trump seems to be correcting his “mistake”—last year, The Wall Street Journal reported that after his re-election, Trump considered appointing Warsh as Treasury Secretary.

In short, Warsh has never left Trump’s radar and has always been “close to the emperor’s heart.”

This is thanks to Warsh’s “Stanford undergrad, Harvard Law doctorate, former Morgan Stanley executive, and core economic advisor in the Bush administration”—an almost perfect resume:

- In college, he majored in economics and statistics at Stanford, then attended Harvard Law School focusing on law and economic regulation, and also completed capital markets courses at Harvard Business School and MIT Sloan, making him not only a specialist but a cross-disciplinary talent in law, finance, and regulation;

- After academia, he worked for years in Morgan Stanley’s M&A department, advising multiple companies across industries, until resigning as Vice President and Executive Director in 2002;

- In the Bush administration, he served as Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council, advising the President and senior officials on capital markets, banking, and insurance issues;

Combined with his billionaire family background, it’s no exaggeration to say that for over twenty years, from Morgan Stanley to the Bush administration’s National Economic Council to the Fed Board, Warsh has always been active among the world’s top financiers.

So, understanding Wall Street’s rules and being part of Trump’s core social circle—this dual identity is key to his ability to reverse Hassett’s lead at a critical moment.

III. Two “Kevins,” Two Scenarios

Though both named Kevin, Hassett and Warsh have prepared very different scripts for the market.

If Warsh really takes the helm, we are highly unlikely to see Hassett-style “rate cut liquidity party,” but rather a sophisticated operation targeting the Fed’s QE policy and institutional mission.

For the past fifteen years, as a “anti-QE” flagbearer, Warsh has been one of the Fed’s sharpest critics—he has repeatedly denounced the Fed’s balance sheet expansion and even resigned in 2010 in protest against QE2.

His logic is clear and tough: “If we’re quieter with the printing press, our rates could actually be lower.” This means Warsh aims to suppress inflation expectations by shrinking the money supply (QT), thereby creating room to lower nominal rates—a high-level “trading space for time” maneuver, intended to end the past fifteen years of “monetary dominance.”

On rate cuts, Warsh also published articles this year criticizing the Fed for letting inflation spike, and said that even if Trump’s tariff policies are implemented, he would support further rate cuts. According to Deutsche Bank’s analysis, if Warsh takes over, the Fed may deploy a unique combo: rate cuts to align with Trump, but aggressively shrinking the balance sheet (QT) at the same time.

Moreover, unlike Powell’s attempts at economic fine-tuning, Warsh advocates for the Fed to “do as little as possible.” He believes “forward guidance is almost useless in normal times” and condemns the Fed’s “mission creep” into climate and inclusion issues, insisting the Fed and Treasury must stick to their own roles: the Fed manages rates, the Treasury manages fiscal accounts.

Of course, despite his sharp criticism, Warsh is essentially a “reformer,” not a “revolutionary.” He advocates “Restoration” for the Fed—retaining its core structure but eliminating the policy errors of the past decade. If he takes the helm, the Fed would return to its fundamental mission: defending currency and price stability, rather than taking on fiscal responsibilities.

Overall, a Warsh-led Fed would likely narrow its policy scope and gradually normalize its balance sheet over time.

However, for Crypto and US tech stocks accustomed to “liquidity feeding,” Warsh’s ascension would indeed be a major short-term challenge, as he sees unlimited liquidity not just as poison, but as something to be “destroyed.”

But in the long run, Warsh may be the true “ally”—thanks to his strong support for free markets and deregulation, and his bullish outlook on the US economy, believing that AI and deregulation will bring a productivity boom similar to the 1980s. He is also one of the few high-ranking officials to have invested real money in Crypto (the former stablecoin project Basis and crypto index fund manager Bitwise), making him a true “insider.”

This undoubtedly lays the foundation for healthy long-term gains in financial assets after “de-bubbling.”

Of course, Warsh and Trump are not completely in sync—the biggest risk lies in trade policy. Warsh is a staunch free trader and has publicly criticized Trump’s tariff plans as potentially leading to “economic isolationism.” Although he recently said he would support rate cuts even with tariffs, this thorn remains.

How to walk the tightrope between “maintaining dollar credibility” and “meeting Trump’s tariff/rate cut demands” will be his biggest challenge ahead.

Final Note: There Is Only One Director

In short, the essence of this “two Kevins” contest is a choice between two market paths.

Choosing Hassett means a liquidity party, with a Fed following the White House’s lead likely to become a stock market cheerleader. In the short term, the Nasdaq and BTC could “go to the moon,” but the price would be long-term inflation out of control and further erosion of dollar credibility.

Choosing Warsh would likely bring a surgical reform. In the short term, markets may feel withdrawal symptoms from tighter liquidity, but with “deregulation” and “sound money,” long-term capital and Wall Street bankers would feel more secure.

But regardless of who wins, one fact won’t change: In 2020, Trump could only vent at Powell on Twitter; in 2025, returning with an overwhelming victory, Trump will no longer be content to just watch from the sidelines.

Whether the actor on stage is Hassett or Warsh may determine the plot, but the director of this play is now firmly Trump.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin whales buy the dip: $23 billion purchased in 30 days

Revealing Truth: Changpeng Zhao Confirms No Direct Talks with President Trump

Changpeng Zhao’s Calculated Comeback: Restoring US Influence After Presidential Pardon