Crypto markets are entering another uncertain stretch as US lawmakers continue to debate digital asset rules. When clarity is missing, price swings tend to widen across major tokens, including Cardano.

The Cardano price prediction is weighing regulatory delays alongside project-specific updates. Interest is also growing in tools that help sort useful signals from daily noise.

US crypto rules remain unresolved as Senate delays decision into 2026

US crypto policy remains unsettled after industry leaders met with key senators to restart talks on a long-delayed market structure bill. The meetings kept dialogue open, but no timeline or clear agreement followed.

Separate reporting confirmed the bill will not move forward before year-end and is now expected to return in early 2026, extending the period of uncertainty. For traders, it’s an environment that puts a premium on speed, context, and tools that can surface signals early.

DeepSnitch AI (DSNT)

DeepSnitch AI is built for periods when news flow matters more than long-range forecasts. Its AI system is designed to give users an immediate edge.

Five AI agents handle narrow, repeatable jobs. Three are already live, feeding a single dashboard that tracks whale behavior, token risk, sentiment shifts, and breaking market narratives in real time. SnitchFeed flags unusual whale wallet movements and sudden sentiment flips.

SnitchScan checks token contracts, liquidity locks, and wallet behavior for rug and risk signals. SnitchGPT translates raw on-chain data and market noise into plain-language answers that traders can act on quickly. DeepSnitch AI is already usable.

Cardano price prediction and Midnight sidechain launch

Cardano price prediction returned to focus following the launch of the Midnight sidechain with its NIGHT token, which adds optional privacy features while keeping parts of activity visible on-chain. The upgrade expands what developers can build and adds another layer to Cardano network fundamentals and improves the ADA long-term outlook.

A TradingView analysis makes the case that Cardano price prediction is at a crossroads, pointing out that the 2022 collapse was driven by weak on-chain activity, stalled adoption, and limited real usage. Today’s setup is very different from 2022, with the Cardano ecosystem boasting more mature governance tools, major upgrades like Midnight, and steadier developer participation.

Bitcoin price prediction

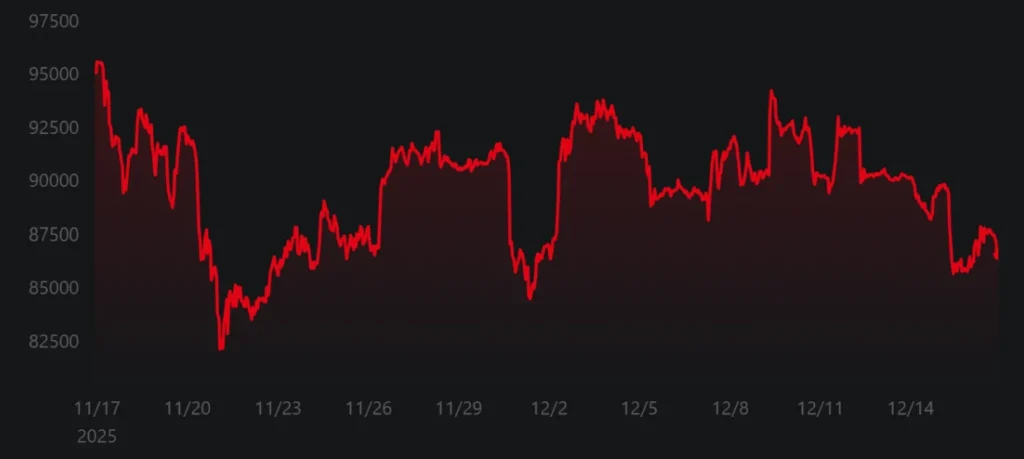

In mid-December, BTC slipped below the $89,000 area, extending a pullback after failing to hold recent support. What stands out is who was buying into that weakness.

Strategy disclosed another week of heavy accumulation, adding roughly $1 billion in BTC for a second straight week. Historically, sustained corporate buying at this scale has tended to stabilize price ranges. If Bitcoin holds near its recent range, traders usually rotate attention toward higher-beta setups and early-stage opportunities.

Bottom line

Regulatory delays tend to stretch uncertainty, which can reward projects with utility over speculation. That is where DeepSnitch AI separates itself from coins like BTC or ADA. It is a tool focused on real trading signals.

In markets driven by noise and timing, utility often wins attention.

FAQ

What is the Cardano price prediction for 2026?

Many models suggest ADA’s outlook depends on whether privacy features and network usage translate into sustained demand. If adoption stays steady, traders often look for tools like DeepSnitch AI to track real demand.

What is the latest Cardano price prediction after Midnight’s NIGHT launch?

After the NIGHT launch, the market looked toward execution and utility from the big update rather than speculation about it. DeepSnitch AI can be used to track sentiment shifts like these in real time.