One year into the Trump administration: Transformations in the U.S. crypto industry

Written by: Tiger Research

In 2025, the US government is implementing a pro-cryptocurrency policy with a clear goal: to regulate the existing cryptocurrency industry in the same way as the traditional financial sector.

Key Points Summary

-

The US is working to integrate cryptocurrency into its existing financial infrastructure, rather than simply absorbing the entire industry.

-

Over the past year, Congress, the US Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) have gradually incorporated cryptocurrency into this system by introducing and adjusting rules.

-

Despite tensions between regulatory agencies, the US continues to support industry growth while refining its regulatory framework.

1. US Integration of the Cryptocurrency Industry

After President Trump’s re-election, the government launched a series of aggressive pro-cryptocurrency policies. This marks a sharp shift from previous positions—where the cryptocurrency industry was mainly seen as a target for regulation and control. The US has entered a previously unimaginable phase, absorbing the cryptocurrency industry into its existing system at an almost unilateral pace.

The shift in stance by the SEC and CFTC, as well as the entry of traditional financial institutions into cryptocurrency-related businesses, all signal that broad structural changes are underway.

What is particularly noteworthy is that all this has happened just one year since President Trump’s re-election. So far, what specific changes have occurred in US regulation and policy?

2. A Year of Change in US Cryptocurrency Policy

In 2025, with the Trump administration taking office, US cryptocurrency policy reached a major turning point. The executive branch, Congress, and regulatory agencies acted in concert, focusing on reducing market uncertainty and integrating cryptocurrency into the existing financial infrastructure.

2.1. US Securities and Exchange Commission

In the past, the SEC mainly relied on enforcement actions to address cryptocurrency-related activities. In major cases involving Ripple, Coinbase, Binance, and Kraken’s staking services, the SEC filed lawsuits without providing clear standards on the legal status of tokens or which activities were permitted, often basing enforcement on post hoc interpretations. This led cryptocurrency companies to devote more energy to managing regulatory risk rather than business development.

This stance began to shift after the resignation of the conservative crypto-skeptic chairman Gary Gensler. Under the leadership of Paul Atkins, the SEC adopted a more open approach, starting to build foundational rules aimed at bringing the cryptocurrency industry into the regulatory framework, rather than relying solely on litigation for oversight.

A key example is the announcement of the “Crypto Project.” Through this initiative, the SEC signaled its intent to establish clear standards to define which tokens are securities and which are not. This once directionless regulator is beginning to reshape itself into a more inclusive institution.

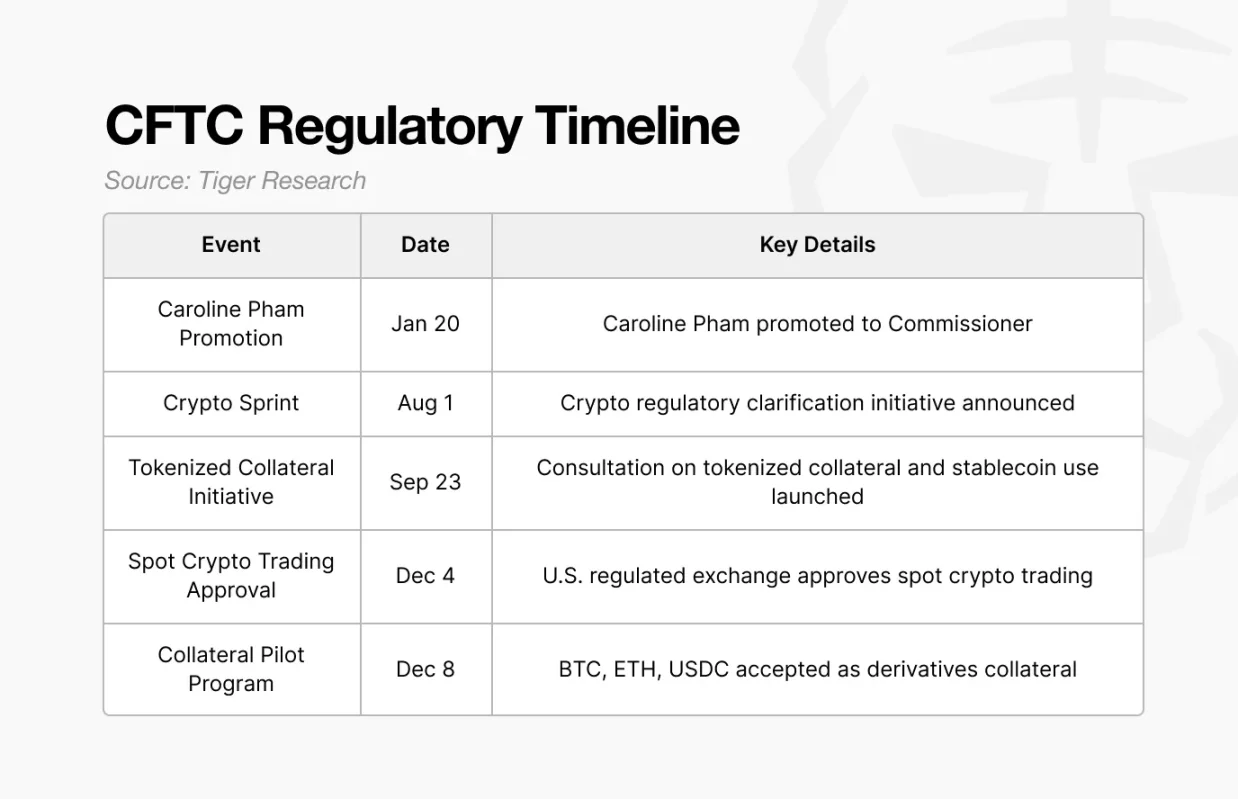

2.2. US Commodity Futures Trading Commission

Source: Tiger Research

Previously, the CFTC’s involvement with cryptocurrency was largely limited to derivatives market regulation. However, this year, it has taken a more proactive stance, officially recognizing bitcoin and ethereum as commodities and supporting their use by traditional institutions.

The “Digital Asset Collateral Pilot Program” is a key initiative. Through this program, bitcoin, ethereum, and USDC are permitted as collateral for derivatives trading. The CFTC applies haircut ratios and risk management standards, treating these assets in the same way as traditional collateral.

This shift shows that the CFTC no longer views crypto assets purely as speculative tools, but is beginning to recognize them as stable collateral assets on par with traditional financial assets.

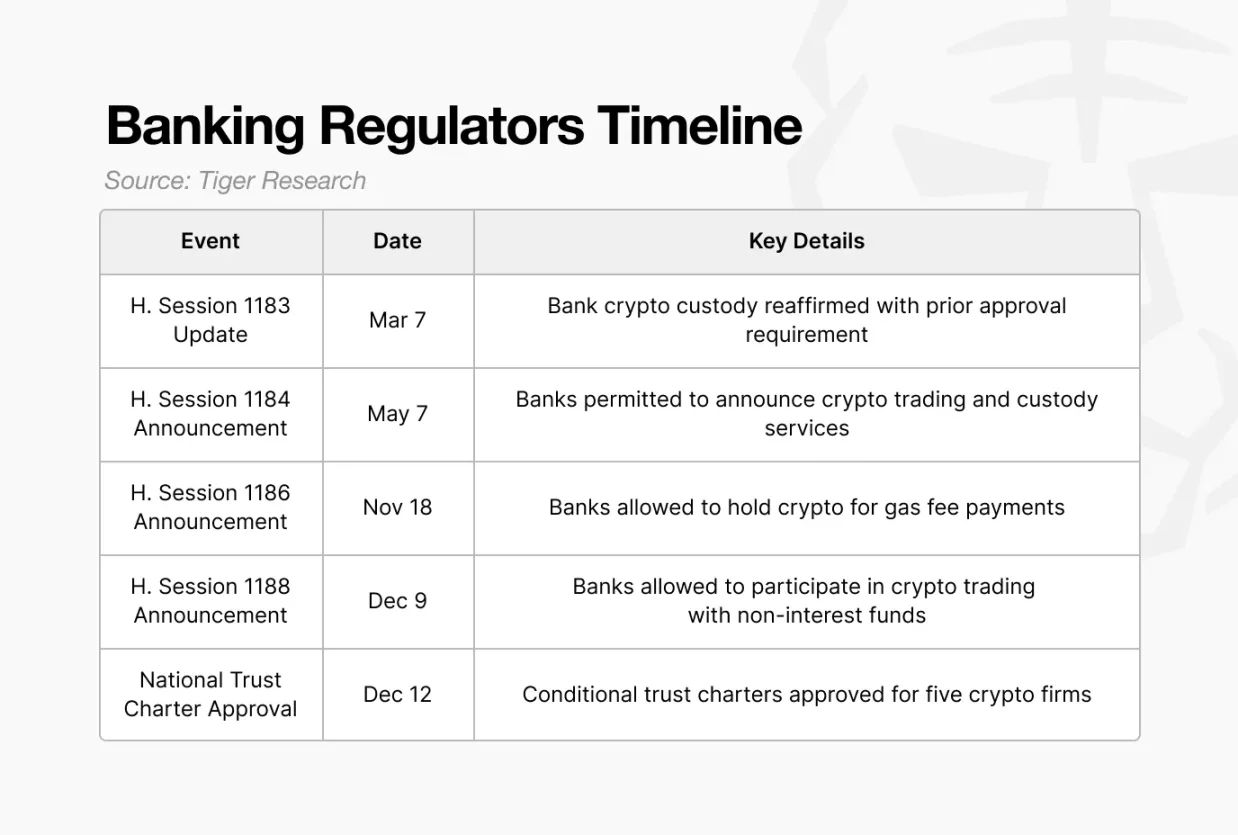

2.3. Office of the Comptroller of the Currency

Source: Tiger Research

In the past, the OCC kept its distance from the cryptocurrency industry. Crypto companies had to apply for licenses state by state, making it difficult to enter the federal banking regulatory system. Business expansion was limited, and structural barriers hindered connections with the traditional financial system, so most operated outside the regulated framework.

Now, this approach has changed. The OCC has chosen to bring cryptocurrency companies into the existing banking regulatory framework rather than exclude them from the financial system. It has issued a series of interpretive letters (formal documents clarifying whether specific financial activities are permitted), gradually expanding the range of allowed activities, including crypto asset custody, trading, and even bank payment chain transaction fees.

This series of changes culminated in December: the OCC conditionally approved national trust bank charters for major companies such as Circle and Ripple. This move is significant because it gives these crypto companies the same status as traditional financial institutions. Under a single federal regulator, they can operate nationwide, and transfers that previously required intermediary banks can now be handled directly like traditional banks.

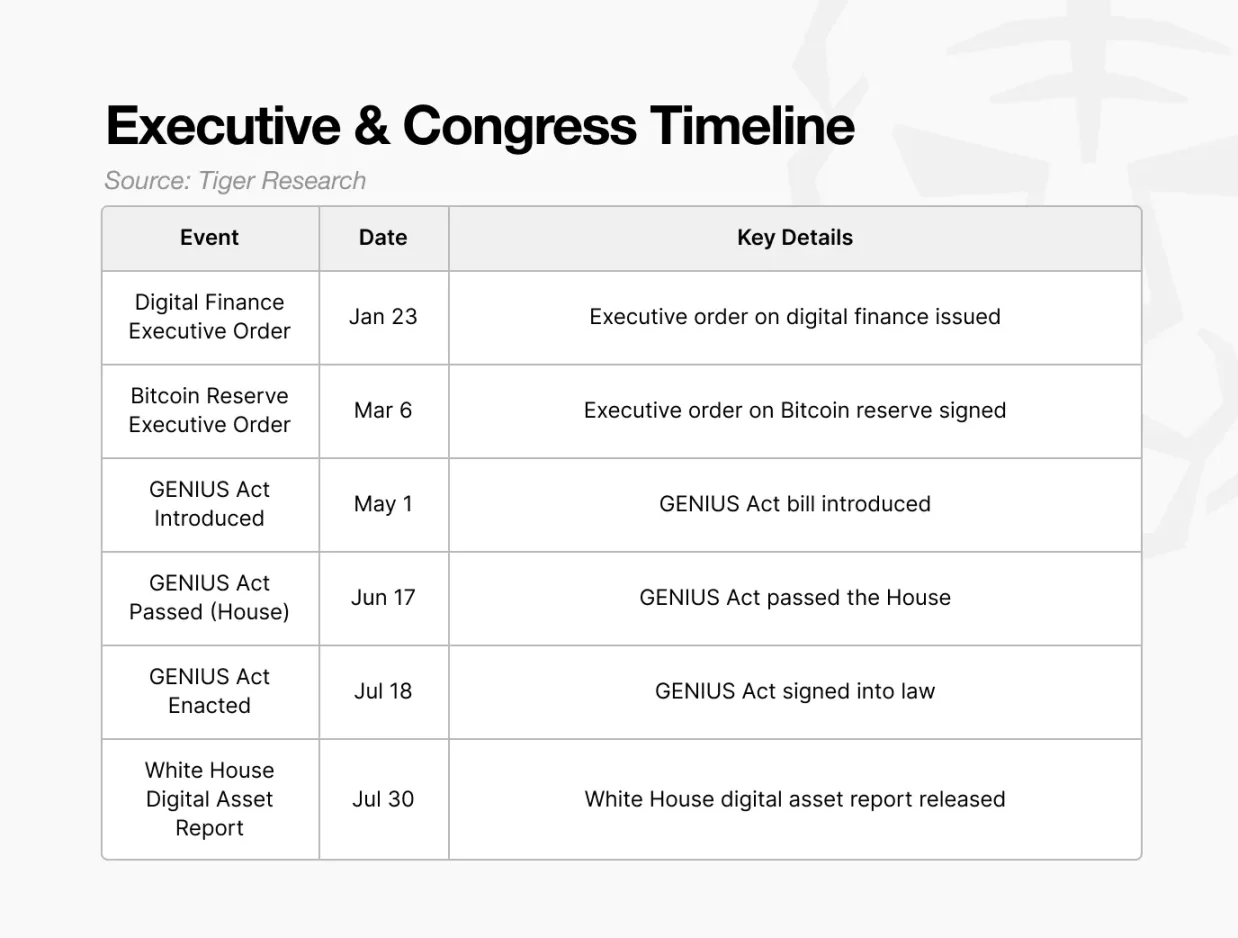

2.4. Legislation and Executive Orders

Source: Tiger Research

In the past, although the US began drafting stablecoin legislation as early as 2022, repeated delays created a regulatory vacuum in the market. There were no clear standards for reserve composition, regulatory authority, or issuance requirements, and investors could not reliably verify whether issuers held sufficient reserves, leading to concerns about the transparency of some issuers’ reserves.

The “GENIUS Act” addresses these issues by clearly defining stablecoin issuance requirements and reserve standards. It requires issuers to hold reserves equal to 100% of the issued amount, prohibits the rehypothecation of reserve assets, and centralizes regulatory authority under federal financial regulators.

As a result, stablecoins have become digital dollars with legal payment capability and legal recognition.

3. Clear Direction, Competition and Checks and Balances Coexist

Over the past year, the direction of US cryptocurrency policy has become clear: to bring the cryptocurrency industry into the formal financial system. However, this process is not uniform or frictionless.

Internal differences of opinion persist in the US. The debate over privacy mixing service Tornado Cash is a typical example: the executive branch actively enforces the law to block illegal fund flows, while the SEC chairman publicly warns against excessive suppression of privacy. This shows that the US government’s understanding of cryptocurrency is not yet fully unified.

But these differences do not equate to policy instability; rather, they are inherent features of the US decision-making system. Agencies with different responsibilities interpret issues from their own perspectives, sometimes expressing dissent publicly, moving forward through mutual checks and persuasion. The tension between strict enforcement and protecting innovation may cause short-term friction, but in the long run, it helps make regulatory standards more specific and precise.

The key is that this tension has not stalled progress. Even amid debate, the US is advancing on multiple fronts: SEC rulemaking, CFTC infrastructure integration, OCC institutional inclusion, and congressional legislation to establish standards. It does not wait for complete consensus, but allows competition and coordination to proceed in parallel, driving the system forward.

Ultimately, the US has neither completely let cryptocurrency run free nor tried to suppress its development, but has instead reshaped regulation, leadership, and market infrastructure. By turning internal debate and tension into momentum, the US has chosen a strategy to attract the global cryptocurrency industry center to itself.

The past year has been crucial precisely because this direction has gone beyond declarations and has been transformed into concrete policies and implementation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock Elevates Bitcoin ETF to Major Theme Despite Market Dip

Crypto Market Sees $250M in Liquidations Ahead of U.S. GDP Release

Gold Silver Rally but Bitcoin Fails to Catch Up: Weak Liquidity or Market Manipulation?

Chainlink Faces Uncertain Times in the Cryptocurrency Market