2026 Layer 2 Outlook

2025 has been the year that the Layer 2 narrative bifurcated: most new launches have become ghost towns shortly after airdrop farming cycles, while only a small handful of L2s have managed to escape this phenomenon.

Rollup ecosystems have matured from pure scaling experiments into distribution networks, while the key to growth is no longer technical superiority, but the ability to get their infrastructure embedded in as many channels, partners and external platforms as possible.

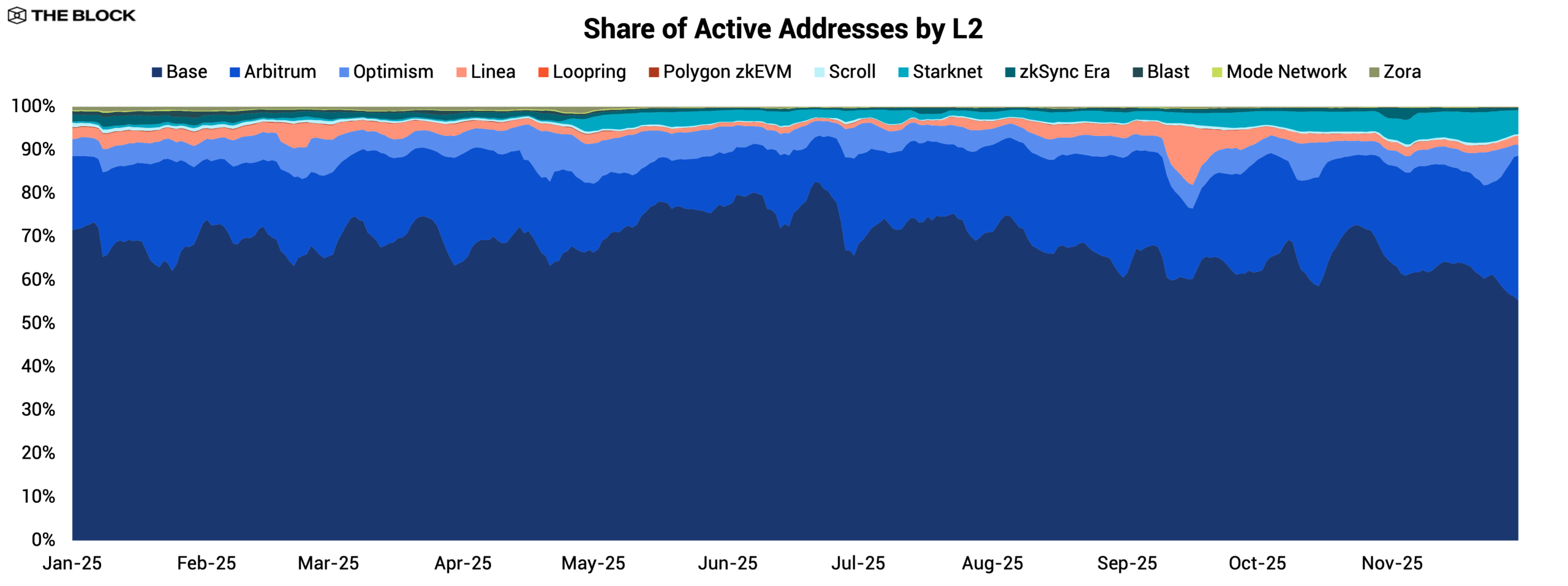

With major institutions launching or adopting their own L2 solutions this year, many of them have chosen to build on existing infrastructure rather than develop bespoke systems. The standout winner has been Coinbase’s Base, built on the OP Stack, having dominated across users, transactions, and overall activity throughout the year.

TVL & Liquidity Concentration

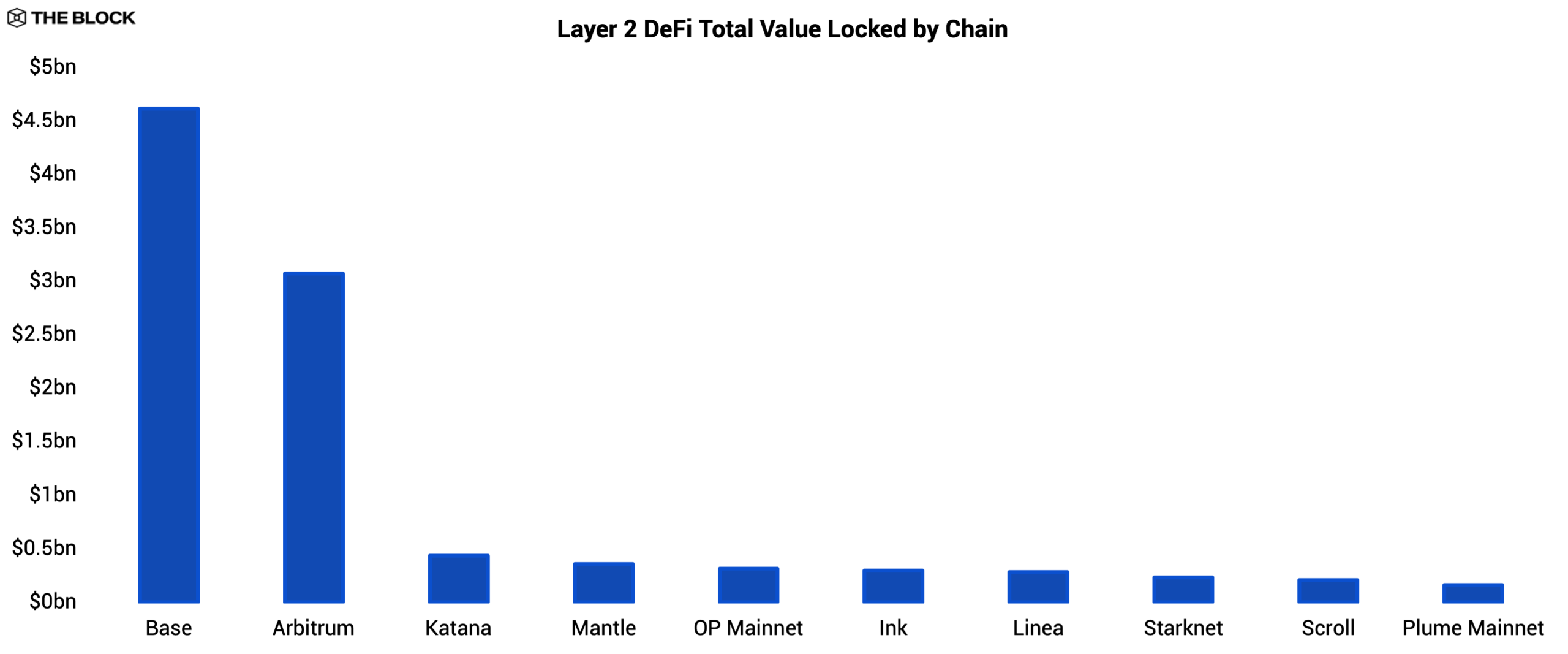

Layer 2 TVL expanded in 2025, but the growth was highly uneven. A clear power-law distribution has formed, with Base capturing the majority of new liquidity while most other L2s saw their TVLs stagnate or decline once incentive programs faded.

Source: The Block, DeFiLlama

TVL on Base rose from $3.1B in January to a peak above $5.6B in October, accounting for roughly 46.6% of all L2 DeFi TVL and extending what has essentially been uninterrupted exponential growth since launch.

On the other hand, TVL on Arbitrum has remained largely stable YoY, edging down slightly from approximately $2.9 billion to $2.8 billion, which still represents over 31% of L2 DeFi TVL. OP Mainnet benefited from new Superchain partners, but it continues to lag in retail usage as consumer attention has shifted almost entirely toward Base.

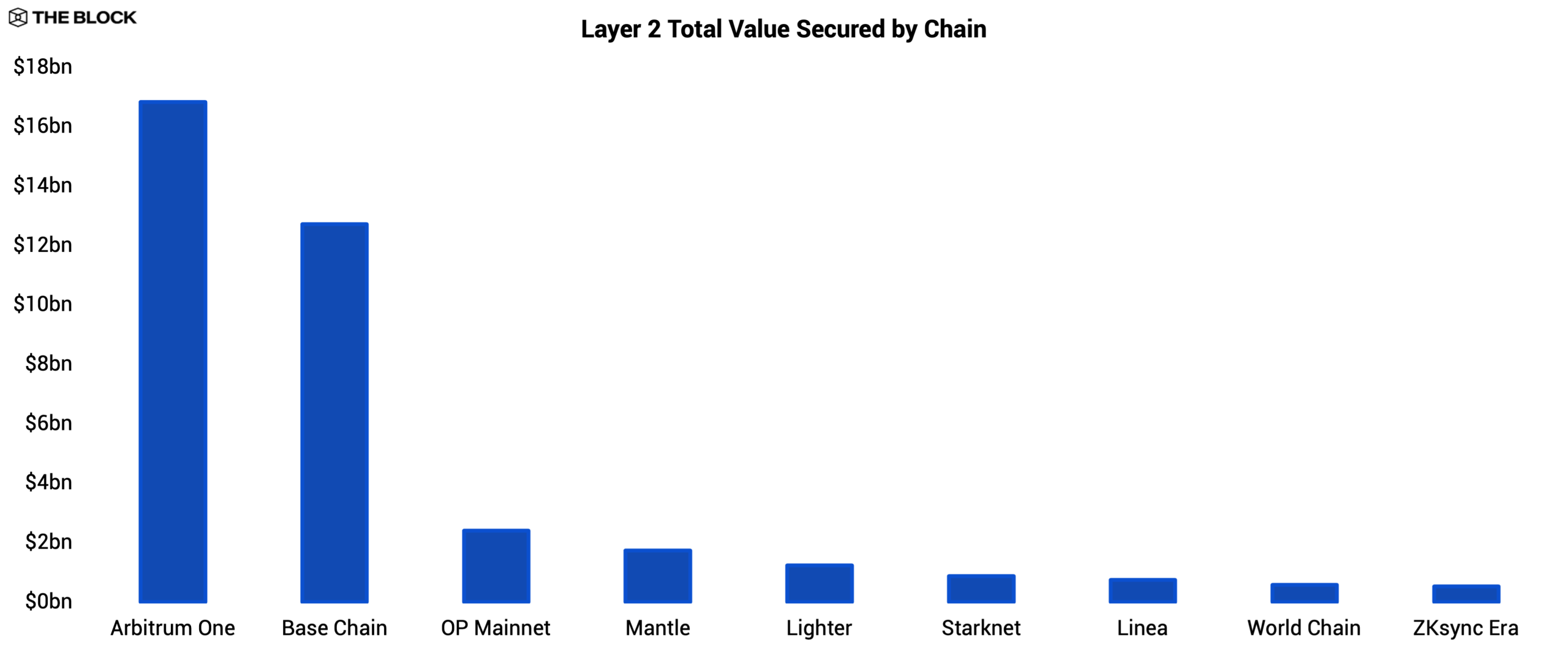

The data illustrates this divergence clearly. Base (46.58%) and Arbitrum (30.86%) dominate DeFi TVL for Layer 2s. Total value secured shows a similar hierarchy, with Arbitrum and Base together representing over 75 percent of the category. TVS measures all assets bridged to or held on a network, which provides a broader view than TVL that measures only assets actively used in DeFi.

User Activity & Ecosystem Health

Across all major activity metrics, Base showed the strongest sustained, organic growth in 2025. DEX volume, active wallets, and onchain interactions all point in the same direction. Over the course of the year, Base consistently captured around half of all DEX volume among L2s, benefiting from Coinbase’s mainstream funnel, a growing mix of consumer-facing apps, and real usage from products like Aero, Echo and Morpho.

Morpho has quickly become a key driver of Base’s growth, with deposits rising from $354 million in January to more than $2 billion at the time of this report. This growth is driven in large part by Morpho’s integration into the Coinbase app, which significantly simplified access to onchain lending.

Meanwhile, the broader Superchain ecosystem shows strength through distribution, with Base, World Chain, Soneium, INK, and Unichain rollups expanding the OP Stack footprint.

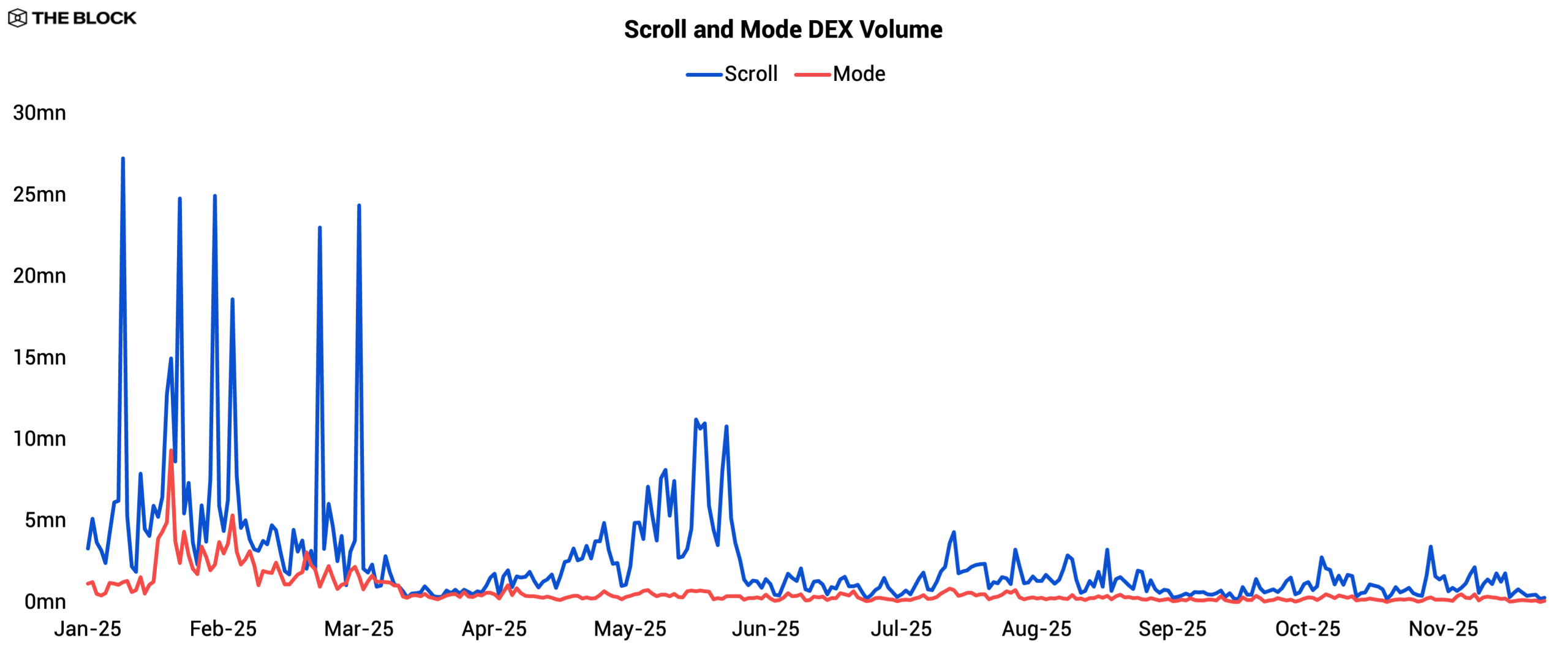

Many emerging L2s have followed similar trajectories with heavy, incentive-driven activity ahead of a token generation event, resulting in a points-fueled surge in usage, followed by a rapid post-TGE decline as liquidity and users migrate elsewhere, highlighting the mercenary nature of on-chain participation and the challenge of establishing a true flagship application.

L2 Landscape: Centralization, Fragmentation, and Enterprise L2s

2025 marked the rise of the “enterprise rollup.” Major institutions began launching or adopting L2 infrastructure, often standardizing on OP Stack deployments. Kraken introduced INK, Uniswap launched UniChain, Sony launched Soneium for gaming and media distribution, and Robinhood integrated Arbitrum for quasi-L2 settlement rails for brokerage clients.

The strategic insight is becoming clear: L2s win by distributing their infrastructure outward and partnering with large platforms rather than operating in isolation.

At the same time, the L1-to-L2 migration trend accelerated, with a notable portion of the industry having largely accepted that it is better to join Ethereum’s shared network effects than attempt to rival them. For example, Celo and Lisk transitioned to OP Stack L2s, with the former secured by EigenLayer, while World Chain evolved from an application layer into a full OP Stack L2.

This has led to an increasingly fragmented L2 landscape where the number of chains continues to grow, but only a small subset matters.

Data Availability

In early 2025, Celestia briefly appeared to dominate total data posted, but this was largely the result of short-lived activity from small sovereign rollups, test deployments, and airdrop-driven networks. These systems generated disproportionately high data volumes during their bootstrapping phases despite having minimal real economic activity. As incentives wound down and many of these chains either stabilized or became inactive, the volume of data posted to Celestia declined sharply.

At the same time, Ethereum has reasserted itself as the primary data-availability layer for rollups with strong user bases. The effects of EIP-4844, which launched in March 2024, became fully visible throughout 2025 as major rollups optimized their batching systems to take full advantage of blob-based data posting. Optimism, for example, upgraded its batcher to rely primarily on blobs rather than call data, cutting DA costs by more than half. zkSync reworked its proof-submission pipeline to compress state updates into fewer, larger blobs, reducing posting frequency and improving fee efficiency.

Linea followed a similar path, shifting its sequencer to a blob-first submission strategy that meaningfully lowered its L1 data footprint. Enterprise-focused L2s also contributed to this shift, with several operating using centralized or hybrid DA setups. For example, Immutable zkEVM runs in validium mode with off-chain data availability, and Mantle uses a hybrid EigenDA-based approach. These designs lower costs but introduce additional trust assumptions, which raises security concerns compared to Ethereum’s blob-based DA.

Overall, DA markets are fragmenting, but Ethereum remains the premium option.

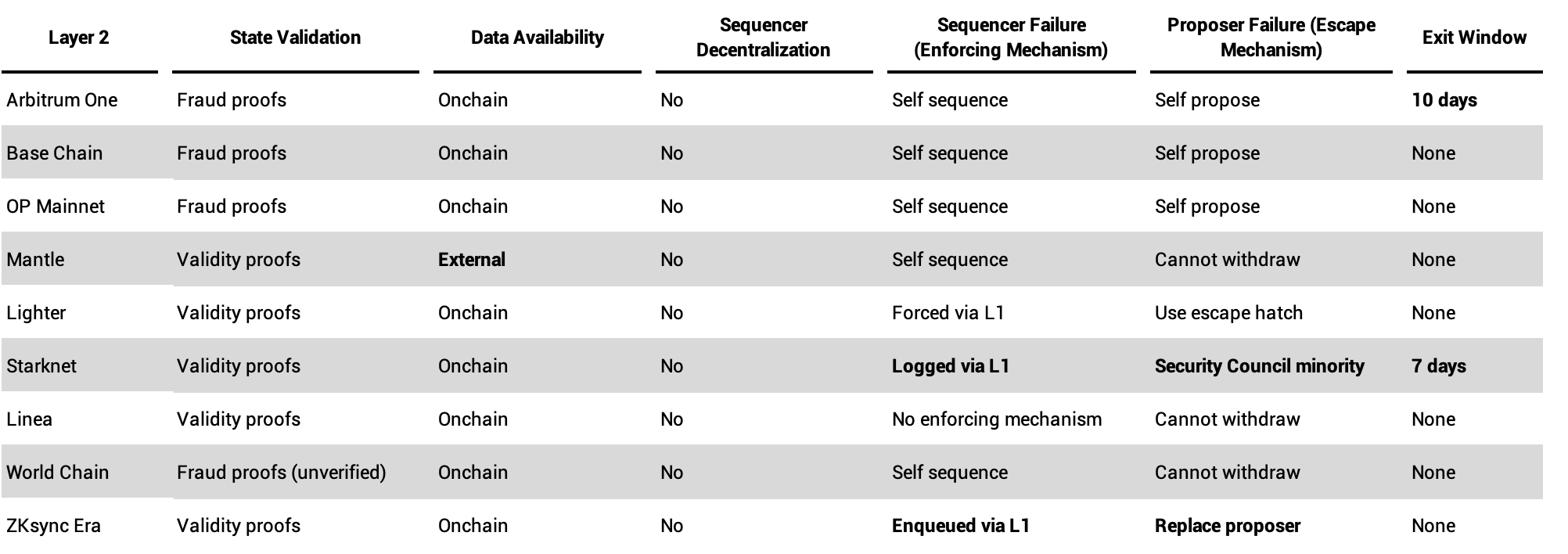

L2 Security & Centralization: Little Decentralization After Years of Promises

Even though the rollup ecosystem has made progress in their decentralization efforts over the past year, most L2 networks are still far more centralized than they appear. Many L2s continue to rely on trusted operators, upgrade keys, and closed infrastructure, as 2025 has shown that decentralization is still treated as a long-term goal rather than an immediate priority.

Sequencers are responsible for transaction verification on L2s and submitting state reconstruction data to the L1.

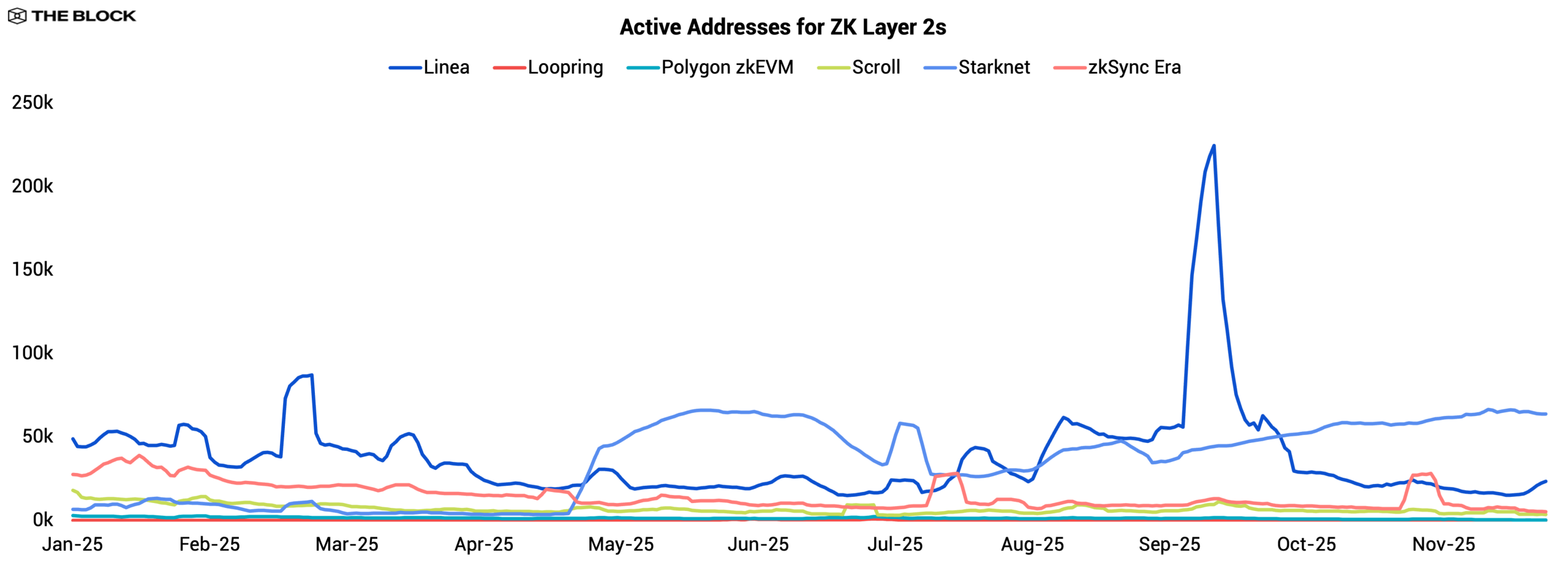

Most L2s still use a permissioned sequencer run by a single operator, which means censorship resistance and neutrality depend on the integrity of a single entity. Shared-sequencer networks like Espresso have continued to develop, but adoption remains limited. Astria, once a leading shared-sequencer effort, shut down entirely in 2025, underscoring how early and fragile this category still is.

The pattern is even more common among smaller, low-activity rollups, which often launch with a fully centralized sequencer, no clear plan for fraud proofs, a centralized DA committee, and emergency upgrade keys controlled entirely by the team. In these networks, the entire architecture still depends on trusting the operator.

While some L2s, such as Base, have improved their governance with longer timelocks or larger security councils, many chains can still be upgraded quickly by a small multisig. This leaves the door open to governance capture, insider mistakes, or key compromise.

The exit window refers to the period during which users can withdraw their funds before an L2 executes an upgrade. However, several L2s lack reliable, trustless exit windows, meaning that if a sequencer goes offline or upgrade keys are compromised, users may not have a guaranteed or timely way to withdraw their assets safely.

State validation refers to the type of proof system that L2s use for ensuring the correctness of their state.

The largest optimistic rollups have made progress. Arbitrum, OP Mainnet, and Base all have live, permissionless fraud proof systems and are now classified as Stage 1. However, many smaller optimistic rollups still do not have working fraud proofs. These chains remain at Stage 0, which means users must rely entirely on the operator to act honestly.

ZK rollups still depend on centralized proving circuits and centralized prover infrastructure. Generating proofs is technically demanding, so most networks rely on a single prover or a small, controlled set of circuits. A few teams, such as zkSync, have begun experimenting with external or distributed prover networks, but practical prover decentralization is still in the very early stages. Most ZK rollups continue to rely on trusted parties to validate state transitions.

Despite years of promises, the average L2 still operates far closer to a sidechain than a trust-minimized rollup.

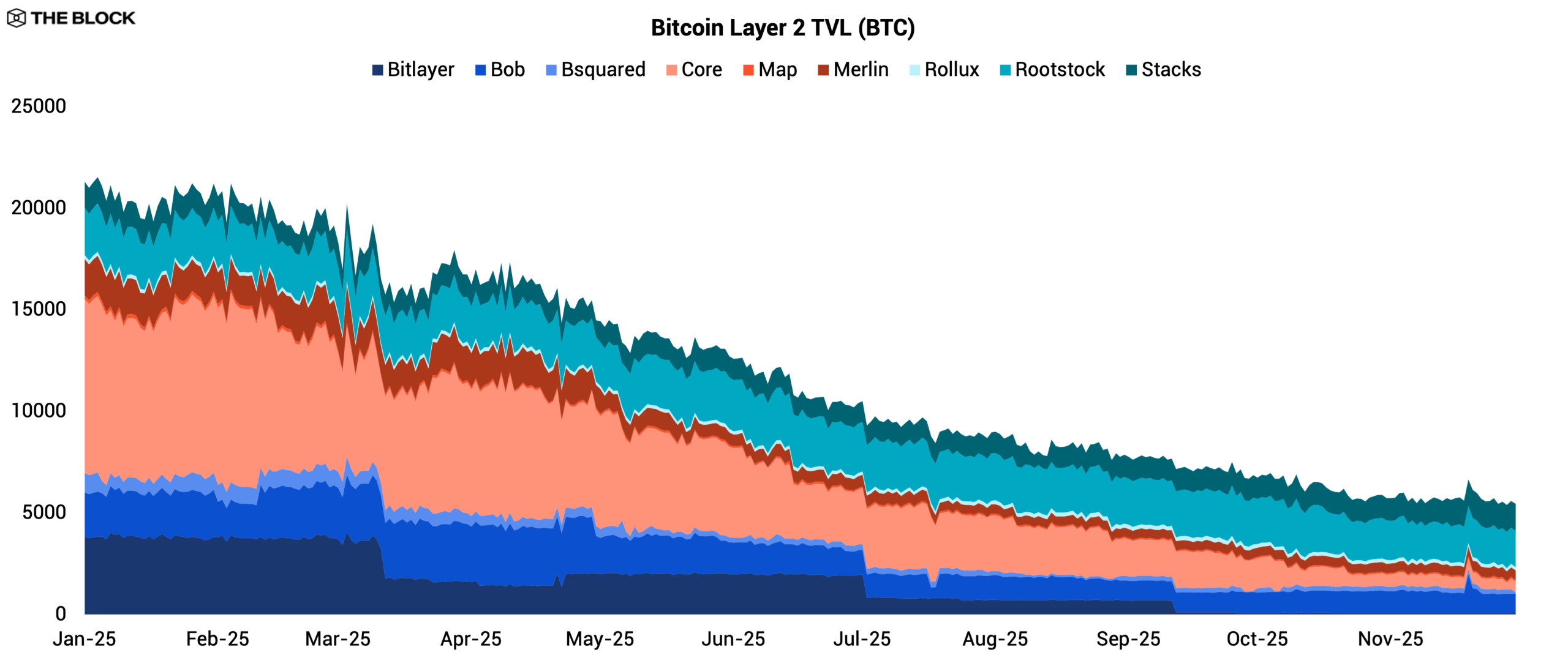

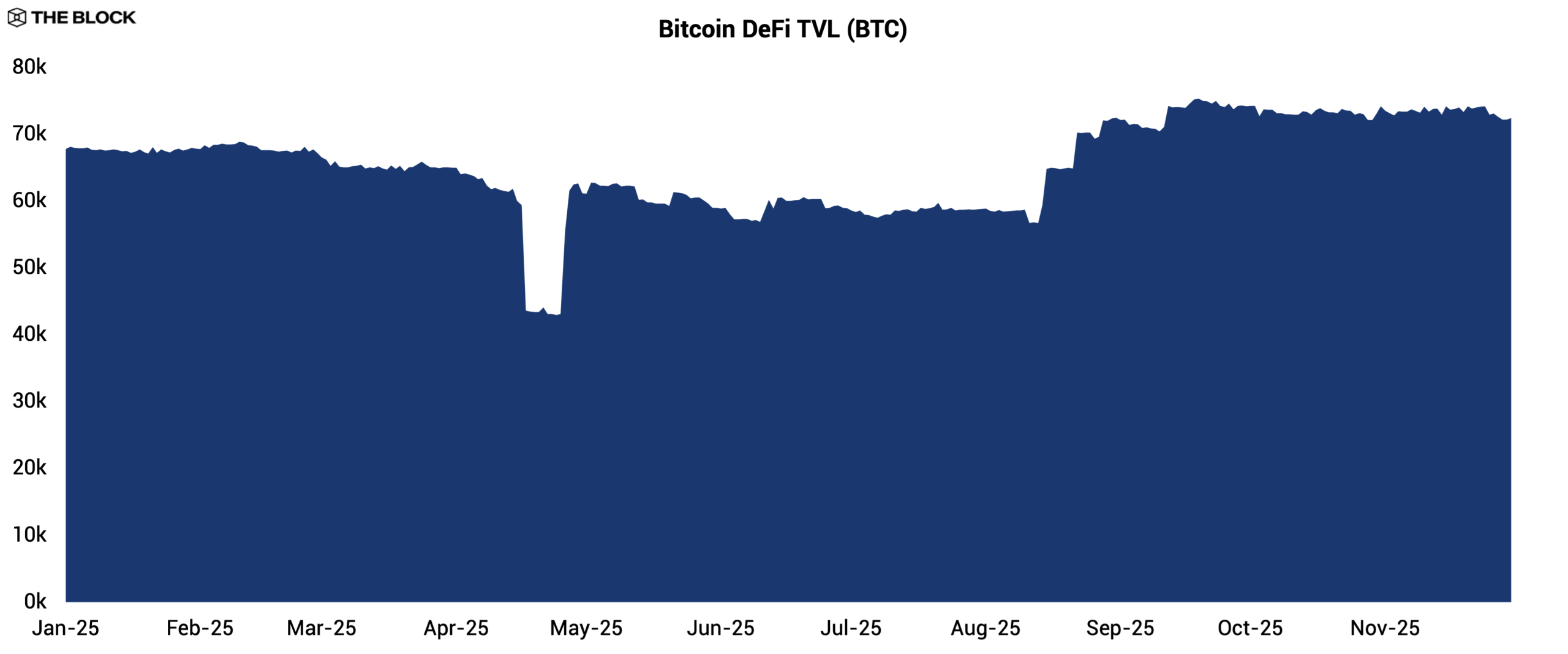

Bitcoin L2: Another year of noise over substance

Bitcoin L2 TVL has shrunk by over 74% this year, while TVL in BTCFi has declined by 10%, from a cumulative TVL of 101,721 BTC to 91,332 BTC, representing just 0.46% of all Bitcoin in circulation.

This year saw yet another wave of raises for projects attempting to compete for the Bitcoin DeFi dream, with Build on Bitcoin (BB) raising an additional $9.5 million, totalling up to $21 Million with their previous raises from last year; Lombard raising another $6.75 million through their token sale in September, to add to their $16 million raised in 2024.

Despite these additional raises, the ecosystem has not grown since last year’s explosion in TVL, and still remains dwarfed by the EVM ecosystem,with the two largest projects being Bitcoin restaking projects, Babylon Protocol and Lombard, with respective TVLs of $4.95 billion and ~$1 billion.

Launching the same existing primitives seen on EVM-based L2s on a BTC chain is not enough to attract liquidity or developers.With the Ordinals narrative fully played out, BTCFi is in desperate need of a novel catalyst and while “DeFi but Bitcoin” may still be able to attract VC money, the same cannot be said for builders.

Starknet, meanwhile, has benefited from the broader Q4 resurgence in ZK-driven narratives. Its pivot toward BTC-aligned functionality, combined with renewed market interest in quantum-resistant chains like Zcash, has helped reposition it as one of the few ecosystems gaining traction late in the year. The past two months have shown that user interest is returning to ZK rollups that offer new cryptographic capabilities, in sharp contrast to BTCFi’s stagnation and its repeated attempts to repackage existing Ethereum primitives.

Layer 2 Outlook for 2026

With this year ending, the L2 landscape could be shaken up by the rise of MegaETH, which has become one of the year’s most-watched projects. With a goal to offer parallel, high-throughput execution on an Ethereum-aligned L2, using a runtime where independent transactions can be processed concurrently rather than through a single global queue. This would enable developers to build computation-heavy, and more responsive on-chain applications that feel closer to real-time for users. This has raised expectations for what L2 performance should look like, though the real test will be whether its apps attract meaningful usage after launch.

Looking ahead, distribution is set to play an even larger role as more major consumer platforms explore launching their own L2s. Competition between ecosystems will intensify as liquidity concentrates around a few leading networks, and many smaller chains will continue to struggle to find a clear purpose.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gold Price Keeps Breaking Records – So How Much Would Bitcoin Need to Be Worth to Surpass Gold?

Shiba Inu Holds $0.057402 Key Support as Tight Trading Range Defines Short-Term Price Action

Chinese Groups Have Transformed Telegram into the Dark Web of Crypto Scams