Hour Loop Rallies 17% in 6 Months: Should You Buy the Stock?

Hour Loop, Inc. HOUR shares have gained 16.8% in the past six months against the industry’s 10.7% decline. The company has outperformed other industry players, including Carvana Co. CVNA and Bed Bath & Beyond, Inc. BBBY. Shares of CVNA have rallied 6.7%, while BBBY stock has plunged 43.4% in the same time frame. HOUR benefits from rising e-commerce penetration, scalable wholesale operations, data-driven inventory management, improved efficiency and proactive supply chain initiatives.

Image Source: Zacks Investment Research

A Key Look Into HOUR’s Business Operations

Hour Loop is a U.S.-based online retailer founded in 2013 that primarily operates as a wholesale third-party seller on Amazon, generating a majority of its revenue through the platform. The company also sells on Walmart, eBay, Etsy and its own website, though these channels contribute minimally. Managing over 100,000 SKUs across categories such as home décor, toys, kitchenware, apparel and electronics, Hour Loop leverages proprietary software to identify product gaps, optimize pricing, and maintain year-round inventory.

Its wholesale model involves buying in bulk from brands and reselling via Fulfillment by Amazon, balancing competitive pricing and profitability. The company competes for Amazon’s Buy Box using automated repricing tools and strategic pricing policies, including competition-based, promotional, and value-based approaches to maximize ROI and margins.

Hour Loop’s Key Tailwinds

Hour Loop benefits from the continued structural shift toward online shopping and the growing consumer preference for digital marketplaces. As a long-standing third-party seller primarily operating on Amazon, the company is well-positioned to capture incremental demand as e-commerce penetration deepens. Its established presence, marketplace familiarity, and operational integration allow it to leverage platform traffic growth without bearing the infrastructure costs of building a standalone retail ecosystem.

Another significant tailwind is the company’s scalable wholesale model combined with operational expertise. The business emphasizes broad SKU availability and efficient fulfillment through Amazon, supported by experienced teams in listing, shipment, advertising and reconciliation. This structure enables relatively lower complexity compared to private label models and supports scaling across more than 100,000 SKUs, allowing the company to respond quickly to shifts in demand.

The company’s proprietary software platform provides a further competitive advantage. Management highlights that its customized system collects and processes large volumes of data daily to identify product gaps and maintain year-round inventory availability. This data-driven inventory planning enhances in-stock rates, reduces missed sales opportunities and supports more disciplined advertising allocation toward higher-return products.

Financial performance trends also represent an operational tailwind. For the nine months ended Sept. 30, 2025, revenues increased to $86.4 million from $83.8 million in the prior-year period, while net income rose to $2.4 million. Improved operating efficiency and disciplined expense management contributed to higher comprehensive income, reinforcing the company’s ability to grow profitably even amid competitive pricing pressure.

Finally, proactive supply chain and tariff management initiatives strengthen near-term resilience. The company expanded inventory coverage to mitigate tariff volatility and strategically front-loaded imports during temporary relief windows. These actions, combined with selective price adjustments, help protect margins and product availability, positioning the company to navigate trade uncertainty while sustaining projected sales growth.

Challenges Persist for HOUR’s Business

Hour Loop faces several material headwinds, including heavy reliance on Amazon, exposing the company to platform fee changes, policy shifts and Buy Box competition. The business also operates in an intensely competitive e-commerce environment marked by pricing pressure and discounting that can limit revenue growth despite higher order volumes.

Ongoing U.S.-China tariff uncertainty and tighter export regulations increase procurement costs and inventory carrying requirements. The company has also experienced cash outflows from operations, elevated inventory levels and significant working capital needs, while remaining exposed to foreign currency risk through its Taiwan subsidiary and potential margin pressure from rising shipping, advertising and fulfillment expenses.

Hour Loop’s Valuation

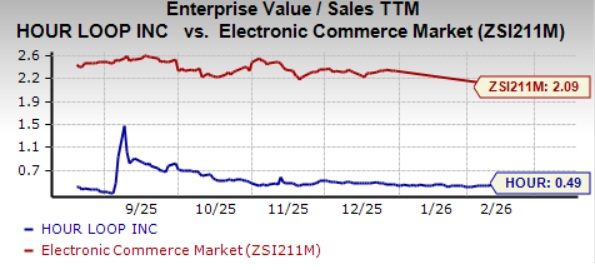

The company is cheaply priced compared with the industry average. Currently, HOUR is trading at 0.49X trailing 12-month price/earnings value, below the industry’s average of 2.09X. The metric also remains lower than that of one of the company’s peers, Carvana (4.45X), but remains higher than that of Bed Bath & Beyond (0.14X).

Image Source: Zacks Investment Research

Conclusion

Given Hour Loop’s positioning to benefit from sustained e-commerce penetration, its scalable wholesale model, proprietary data-driven platform and improving operating efficiency, the company appears well placed to capitalize on long-term online marketplace growth. Despite heavy reliance on Amazon, intense pricing competition, tariff and regulatory uncertainty, and elevated working capital and cost pressures, the company’s scalable operations, data-driven inventory management and proactive supply chain initiatives should help it navigate these challenges, supporting its ability to sustain margin expansion and deliver stable cash flow growth over time.

Strong fundamentals, coupled with HOUR’s undervaluation, present a lucrative opportunity for investors to add the stock to their portfolio.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ASTER Price Falls 70% as Users Vanish — Here’s Why Charts Still Point to 85% Rally

Silent XRP Footprint In SWIFT’s New Payment Stack

Popular Retail Stock Pulling Back Before Earnings

Bitcoin Moves While You Sleep: Here’s How to Never Miss a Pump Again