News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Asian markets see mixed crypto developments as Metaplanet celebrates Bitcoin profits, Busan innovates supply chain solutions, and Tokyo battles record fraud levels targeting digital assets.

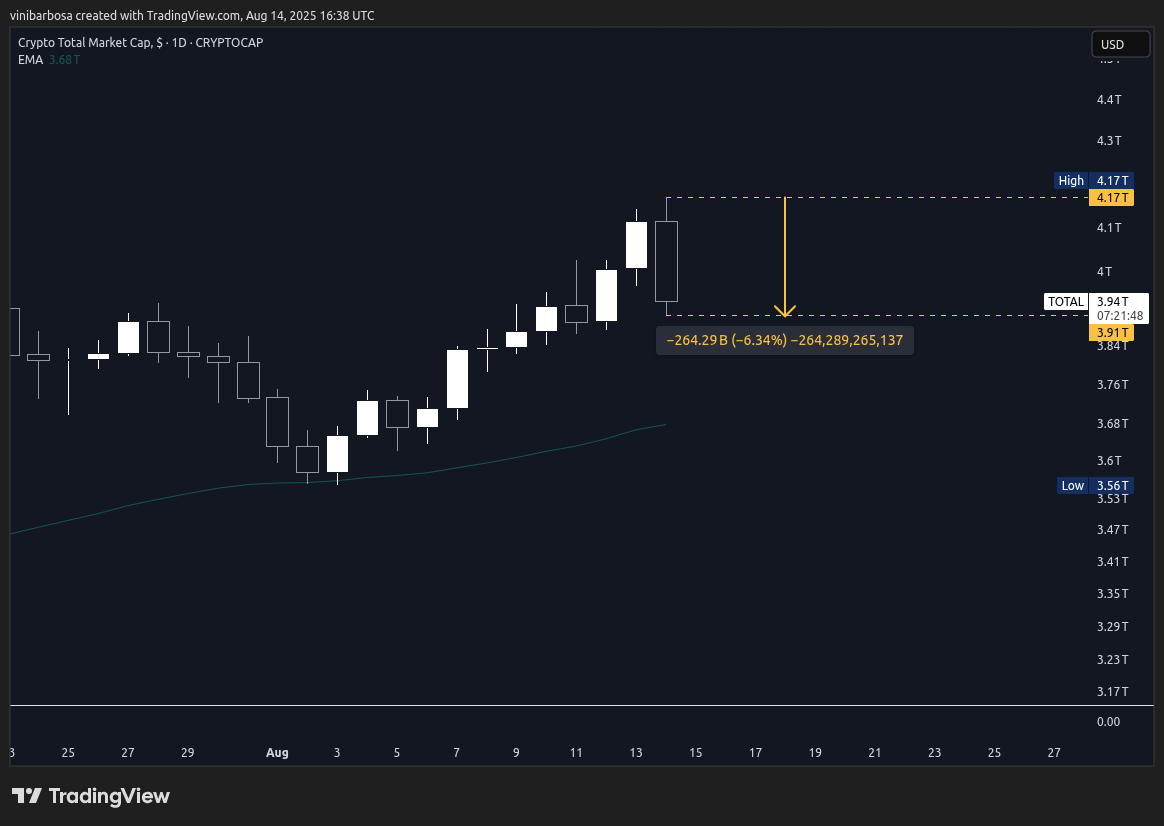

The cryptocurrency market experienced a dramatic reversal on August 14, losing over $264 billion in market cap as $1.03 billion in liquidations struck traders.

TeraWulf secured a massive $3.7 billion high-performance computing agreement with Fluidstack, potentially expanding to $8.7 billion over 20 years with Google backing $1.8 billion of the obligations.

Quick Take Bitcoin holding company Nakamoto and Utah-based KindlyMD have closed their merger to start a Bitcoin treasury strategy. BTC Inc. co-founder David Bailey will act as the company’s CEO.

- 10:02ZEROBASE announces ZBT tokenomics, with 8% allocated for airdrops and early participantsForesight News reported that ZeroBase has released the ZBT tokenomics. The total supply is fixed at 1 billion tokens, allocated as follows: 43.75% for node staking, with linear release starting one month after TGE, and continuous rewards provided to staked nodes to ensure network security and participation; 11.25% allocated to early investors, locked for 1 year and then linearly unlocked over 24 months, supporting early strategic backers for ecosystem and protocol growth; 2% for liquidity, fully unlocked at TGE to facilitate initial liquidity; 8% for airdrops and early participants, incentivizing early contributors to the network launch; 15% for the ecosystem fund, fully unlocked at TGE, to support ecosystem growth, marketing, partnerships, and infrastructure expansion; 20% for the team and advisors, locked for 1 year and then linearly unlocked over 48 months.

- 10:02Duodian Digital Intelligence: Plans Potential Acquisition of 100% Equity in Two Licensed CorporationsForesight News: According to an announcement by the Hong Kong Stock Exchange, the board of directors of Duodian Shuzhi Co., Ltd. has announced that it has submitted a non-legally binding letter of intent regarding the potential acquisition of 100% equity in two licensed corporations under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). One of the target companies for the potential acquisition is licensed to conduct Type 4 (advising on securities), Type 5 (advising on futures contracts), and Type 9 (asset management) regulated activities, while the other company holds a Type 1 (dealing in securities) license. As of the date of the announcement, no binding agreements have been signed by the parties regarding the potential acquisition, and terms are still under negotiation. This potential acquisition is considered a strategic move that will help the company quickly enter the regulated financial services sector and lay the foundation for subsequent upgrades of Type 1, Type 4, and Type 9 licenses to provide virtual asset trading services. The company plans to upgrade the relevant licenses to carry out core virtual asset business after the completion of the potential acquisition. The board of directors stated that the terms and conditions of the potential acquisition are still under negotiation.

- 10:02Ding Shi Capital plans to use approximately HK$5.3 million for a virtual asset trading license application.Foresight News: Hong Kong-listed company Ding Shi Capital Limited has announced that 15,502,949 unsubscribed rights issue shares have been successfully placed at a placement price of HKD 1.66 per share. The total proceeds from the rights issue amount to approximately HKD 60.7 million, with net proceeds of about HKD 57.6 million. The company intends to use approximately 9.2% (about HKD 5.3 million) of the net proceeds for potential application for a virtual asset trading license.