News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Dogecoin price climbed 6% to $0.231, with both on-chain signs and technical patterns hinting at further upside. Traders now eye $0.248 as the next key level.

Hedera’s HBAR token remains range-bound with weakening volatility. Traders await a breakout from the $0.2109–$0.2237 trap for direction.

Retail investors are flocking to Dogecoin in September as ETF approval odds surge and accumulation trends hint at a potential rally. Analysts predict prices could climb toward $1.4 by year’s end.

Share link:In this post: Goldman Sachs is buying a $1 billion, 3.5% stake in T. Rowe Price to push private assets into retirement accounts. The partnership will launch target-date funds, co-branded portfolios, and advice services by mid-2025. Citigroup also announced a deal giving BlackRock $80 billion in client assets to manage starting in Q4.

Share link:In this post: Old Const says Bitmain faked breaches to end their deal and seize mining equipment. The company wants a court order stating that disputes must stay in Texas based on the agreement. Old Const is seeking an injunction, damages, and legal fees from Bitmain.

Share link:In this post: Kevin Hassett accused the Fed of losing independence and overstepping its mandate. He slammed the job data system as broken and called for urgent modernization. Kevin backed a full review of the Fed’s roles in policy, regulation, and research.

Share link:In this post: El Salvador’s central bank bought 13,999 troy ounces of gold worth $50 million. The bank says gold will diversify reserves and provide stability, especially as Bitcoin holdings remain volatile. The move follows the global trend of central banks buying over 1,000 tonnes of gold collectively.

- 13:37US SEC Chairman: The entire US financial market may move on-chain within two yearsChainCatcher news, according to Forbes, Paul Atkins, Chairman of the U.S. Securities and Exchange Commission, stated that it is expected that within the next two years, the entire U.S. financial market may migrate to blockchain technology that supports bitcoin and cryptocurrencies. Paul Atkins, Chairman of the U.S. Securities and Exchange Commission, said in an interview with Fox Business, "This will not only be a trend for the next 10 years, but it may also become a reality within just two years. The next step will come with digital assets, market digitization, and tokenization, which will bring enormous benefits for transparency and risk management." Tokenization refers to representing stocks and assets with tradable blockchain-based tokens, a concept hailed as a potential revolution in financial markets.

- 13:11Glassnode: After bitcoin stabilized, investor panic subsided and funds began flowing into call optionsChainCatcher reports that the latest weekly report from Glassnode points out that the current market conditions are similar to the early stages of the 2022 bear market (also known as the crypto winter). ETF demand continues to weaken, with IBIT experiencing outflows for the sixth consecutive week, marking the longest streak of negative flows since its launch in January 2024. The total redemptions over the past five weeks have exceeded 2.7 billions USD. Derivatives data further confirms the decline in risk appetite. Open interest continues to decrease, indicating a reduced willingness to take on market risk, especially after the flash crash and liquidation event on October 10. Perpetual contract funding rates have remained largely neutral, only briefly turning negative, while the funding premium has also dropped significantly. This suggests a more balanced market environment with reduced speculation. Sentiment in the options market remains cautious, with investors preferring to sell rather than chase upside potential. Earlier this week, as the bitcoin price approached 80,000 USD, put option buying dominated. However, as the price later stabilized, investor panic subsided and capital flowed into call options.

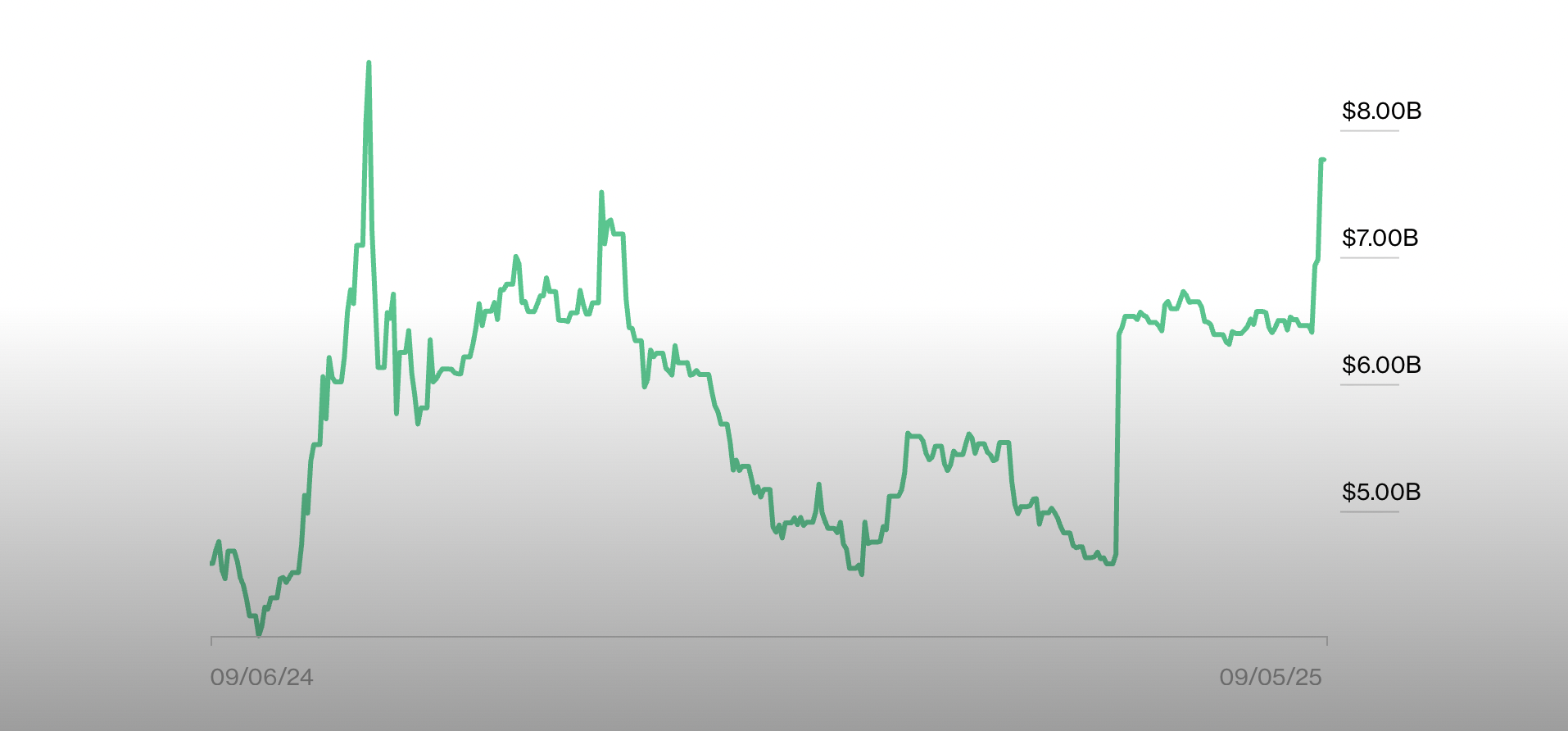

- 12:51Total USDT supply surpasses 190 billions, market capitalization exceeds $185 billions, reaching a new all-time highAccording to a report by Jinse Finance, the latest data from Coingecko shows that the total supply of the US dollar stablecoin USDT, issued by Tether, has surpassed 190 billions, currently reaching 191,099,037,578 tokens (with a circulating supply of 185,632,100,913 tokens), and a market capitalization of $185,680,551,074, setting a new all-time high.