News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 11)|The Federal Reserve announced a 25 bps cut to the benchmark rate; Bitmine purchased 33,504 ETH; CBOE has approved the listing and registration of the 21Shares XRP ETF2Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K3Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

Ethereum Devs Introduce Virtual Machine for Future Network Scaling

Coinspaidmedia·2025/09/08 13:18

USDD natively deployed on Ethereum! Embarking on a new journey of global ecosystem expansion

USDD has completed its native deployment on Ethereum, joining the world’s largest Layer 1 ecosystem. It offers a decentralized, over-collateralized, and high-yield stablecoin option, promoting the development of an open and transparent industry ecosystem.

MarsBit·2025/09/08 13:08

SwissBorg loses $41M in SOL after partner API compromise affects earn program

CryptoSlate·2025/09/08 13:05

Strategy stacks 1,955 Bitcoin for $217 million in week eight of nonstop buys

Cryptobriefing·2025/09/08 12:33

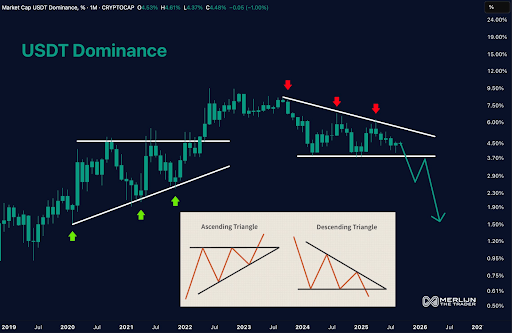

Altcoins May Outperform Bitcoin in 2025 Cycle, Analyst Says

Coinotag·2025/09/08 11:57

CoinShares Plans $1.2 Billion SPAC Merger To Enter US Public Markets

BTCPEERS·2025/09/08 11:30

Crypto Enthusiasts Witness Bitcoin’s Surge as Altcoins Gain Momentum

In Brief Bitcoin stabilizes, boosting the altcoin market's momentum. Experts foresee significant price increases for Bitcoin and Ethereum. Institutional interest grows in diverse altcoins, leading to a balanced market.

Cointurk·2025/09/08 11:14

Flash

- 20:13dYdX launches spot trading on Solana and opens access to US usersForesight News reported, according to CoinDesk, that the dYdX team is launching its first spot trading product on Solana, which will also be available to U.S. traders for the first time. Previously, the exchange was almost exclusively known for its derivatives market. To attract new users, especially those from the United States, dYdX announced that trading fees will be waived in December.

- 20:12Crypto journalist: US officials will continue key negotiations today on the "Crypto Market Structure Bill"Foresight News reported that, according to crypto journalist Eleanor Terrett, U.S. senators will continue discussions on the "Cryptocurrency Market Structure Bill" today. This afternoon, representatives from several leading industry companies will head to the White House to attend another meeting on market structure. Afterwards, the CEOs of Bank of America, Citibank, and Wells Fargo will meet with senators to discuss the issue of restricting stablecoin issuers' affiliated companies from paying interest, as well as other outstanding issues.

- 20:12Machi Big Brother's 25x long position on ETH was partially liquidatedForesight News reported, according to Onchain Lens monitoring, as the market declined, Machi Big Brother (@machibigbrother) had part of his 25x long position on ETH liquidated, and closed part of his position at a loss 11 hours ago. The remaining positions currently have an unrealized loss of about $480,000. Overall, Machi has now lost more than $21.6 million.

News