News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

BTC Volatility Weekly Report (September 1 - September 8) Key Metrics (Hong Kong Time: 16:00 on September 1 to 16:00 on September 8) B...

Forward Industries, Inc. (NASDAQ: FORD) announced a $1.65 billion private placement in cash and stablecoin commitments led by Galaxy Digital, Jump Crypto, and Multicoin Capital to launch a Solana-focused treasury strategy. The deal marks the largest Solana-centered raise by a public company and underscores institutional confidence in the blockchain’s growth trajectory. Strategic Backing From Galaxy,

The altcoin season of 2021 erupted under a unique macro environment and market structure, but now, the market environment has changed significantly.

a16z points out that a well-designed fee structure is not at odds with decentralization—in fact, it is key to creating a functional decentralized market.

An ETF analyst claimed a Dogecoin ETF could launch this week, but with no SEC confirmation, markets remain cautious despite initial hype.

Somnia’s SOMI token is under pressure after a 17% drop from its peak, with weakening momentum and falling open interest signaling more downside risk.

- 02:35Aave announces three major strategic pillars for 2026: Aave V4, the institution-focused RWA market Horizon, and the mobile Aave App.BlockBeats News, December 17, Aave founder and CEO Stani.eth posted on social media that Aave protocol's vision for the coming decades is to bring trillions of dollars in assets into Aave and onboard millions of new users on-chain. Stani.eth stated that this year has been the most successful year for Aave so far, with peak net deposits reaching $75 billion, generating $885 million in fees, accounting for 52% of all lending protocol fees, surpassing the combined total of the next five competitors. In addition, the current scale of the Aave protocol is comparable to the top 50 banks in the global financial center of the United States, occupying 59% of the DeFi lending market and 61% of all active loans in DeFi. Aave's strategy for next year is mainly based on three pillars: Aave V4, Horizon, and Aave App. Among them, Aave V4 will make Aave the infrastructure for all financial activities. It is a complete redesign of the Aave protocol and will enable Aave to handle assets at the trillion-dollar level. In 2026, Aave will continue to engage with fintech companies and work closely with DAOs and partners to gradually expand the total value locked throughout the year. Horizon is the bridge prepared for the next trillion-dollar assets. As a market established by Aave specifically for institutional-grade RWA, it allows eligible institutions to use tokenized assets such as US Treasuries and other credit instruments as collateral to borrow stablecoins. The Aave App is the flagship mobile application of the protocol, designed to bring DeFi to everyone. This app aims to abstract away all complexities and provide a user experience that addresses real needs in the current economy. The Aave App will offer the best cash-to-DeFi experience on the market.

- 02:33Over $258 million in liquidations occurred in the crypto market within 24 hours, with long positions accounting for $152 million.According to Odaily, citing Coinglass data, in the past 24 hours, a total of 101,827 people were liquidated globally, with the total liquidation amount reaching 258 million US dollars. Among them, the amount of long position liquidations was 152 million US dollars, while short position liquidations amounted to 106 million US dollars. The largest single liquidation occurred on the Hyperliquid platform's ETH-USD trading pair, valued at 6.9124 million US dollars.

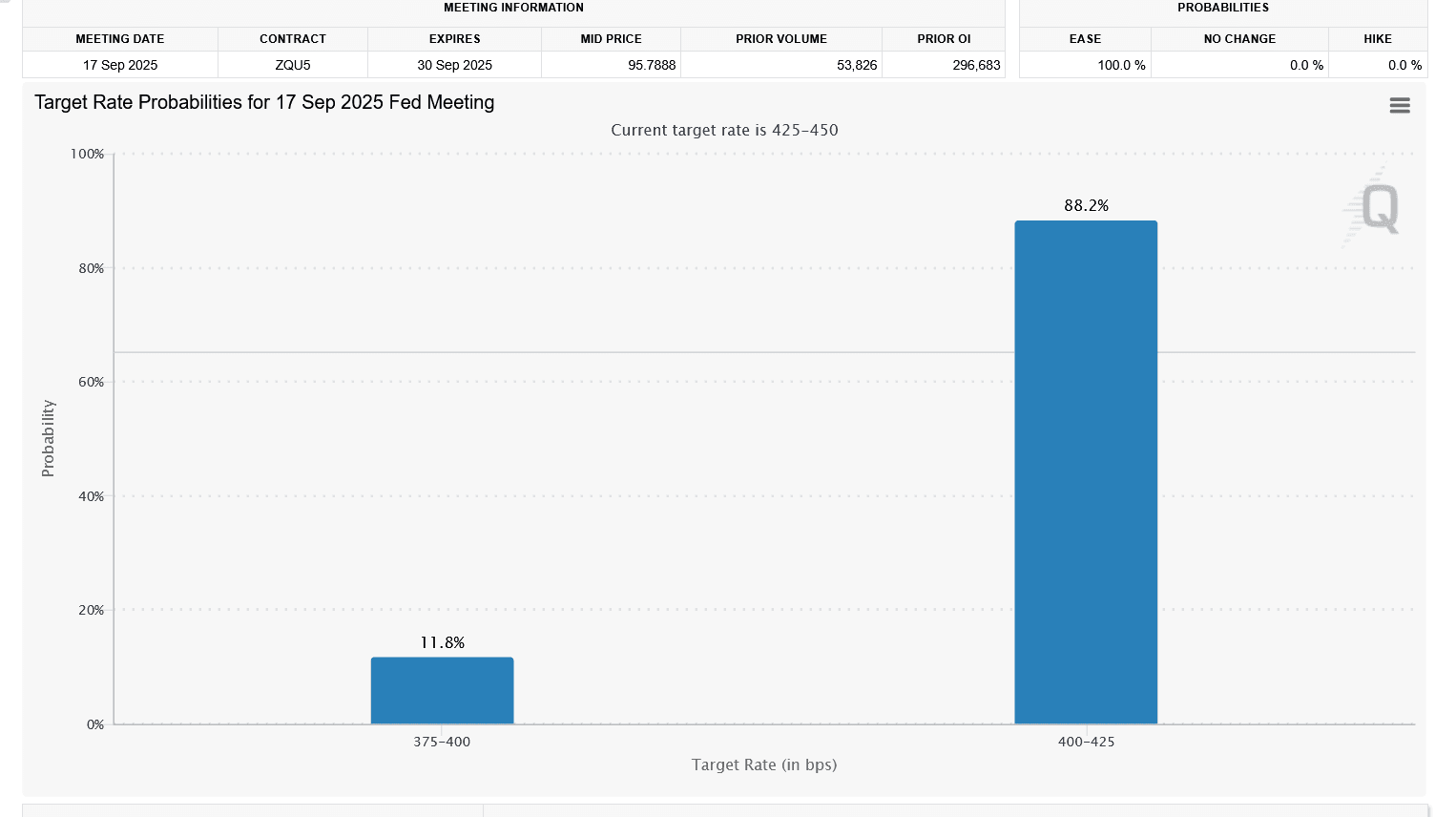

- 02:32Report: Prediction Markets Have Become Leading Indicators for Key Economic DataAccording to ChainCatcher, as reported by DLnews, the latest report from crypto market maker Keyrock points out that prediction markets such as Polymarket and Kalshi have become leading indicators for key economic data, and traders are incorporating them into their models to gain an edge.